According to a side-by-side comparison of the two NFT marketplaces using Nansen data, Blur continues to lag behind OpenSea in terms of transactions and active wallets, despite experiencing remarkable volume growth.

In 2023, the non-fungible token (NFT) sector has become more competitive as numerous platforms vie for creators and collectors.

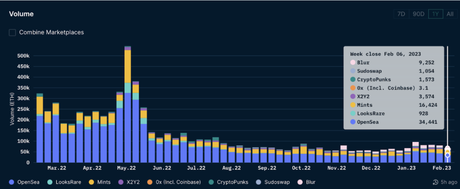

Since its launch in December 2017, OpenSea has dominated the NFT market. According to the blockchain data analytics platform Nansen, it had a trade volume of over $56 million value of over 34,000 ETH last week, maintaining its supremacy in the NFT industry. However, since its inception in October, Blur’s market share among JPEG users has increased significantly.

Blur, which is renowned for its $0 trading fees and “floor sweeping” of the market, has rapidly become the second-largest NFT marketplace by volume. According to Nansen, Blur’s NFT volumes for the week ending February 6 were more than 9,200 ETH worth more than $15,2 million, or more than 25% of OpenSea’s volume.

Review of the market

The top five NFT projects on OpenSea based on volume over the past 30 days are Sewer Pass, Memes by 6529, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Checks – VV Edition.

In comparison, the top five NFT projects by volume for Blur for the preceding 30 days were the high-volume collections MAYC, Azuki, BoredApeKennelClub, BAYC, and Otherdeed for Otherside.

While both Blur and OpenSea have overlapping NFT projects named BAYC and MAYC, as of publication on Tuesday, Blur’s top five coins have a medium market cap of 270,109 ETH while OpenSea’s top five coins have a medium market cap of 94,400 ETH. Given that Blur’s top five NFT collections have a greater medium market cap than OpenSea’s, it seems likely that professional NFT traders will select Blur over OpenSea.

Andrew Thurman, a “Simian Psychometric Enhancement Technician” for Nansen, informed CoinDesk over Telegram that Blur dominated with Azukis and won some high-volume collections, such as Apes and derivatives. With the addition of new collections and initiatives such as Sewer Passes, OpenSea has expanded its audience.

Sales and wallets

The fact that NFT sales and wallets on Blur’s marketplace are decreasing relative to OpenSea despite Blur having more than 25% of OpenSea’s volume implies that NFT traders with large holdings prefer Blur’s no-fee marketplace.

According to Nansen data, there were 20,603 sales on Blur over the seven-day period ending on February 6. This represents 9 percent of the more than 228,000 total transactions on OpenSea. Comparing the quantity of wallets participating in the two NFT markets reveals a similar pattern: OpenSea trumps Blur, as indicated by the 11-fold increase in wallets connected to OpenSea compared to Blur.

Thurman said that, based on the data as a whole, OpenSea continues to lead in terms of volume and retail traders, while whales with large budgets seeking to flip more expensive products are switching to Blur.

After handing away BLUR tokens to users for months in exchange for varied degrees of participation, Blur announced on February 14 the launch of its BLUR governance token.

Content Source: coindesk.com