Beer enthusiasts from coast-to-coast spent a lot of time in 2015 talking about the hottest news topic of last year: mergers and acquisitions.

But when we weren't talking about who was being bought, it seemed like the geekiest conversations about the future of the beer industry centered around the fight for distribution. Whether it was breweries trying to get the right to deliver their own beer ( and deliver more of it) or Big Beer trying to take on larger roles within the space, the way beer arrives to our local stores seemed to be almost as contentious as the fight for who owns and ultimately makes what were drinking.

As Michael Kiser pointed out, "smart craft people need to get into the distro game. It's the next frontier to be redefined."

With buyouts and investments becoming more commonplace - and by extent becoming more commonly accepted, if only in understanding - turning our attention to this new space seems inevitable. We started toward the end of last year when AB InBev's incentive program to encourage distributors to sell AB brands became a public talking point.

Now, as we eye what's to come for 2016, it's worth crunching the numbers to see what kind of impact distribution can have on the industry.

In a general sense, I imagine we've all heard the motivating factor behind the combative nature of beer's middle tier of its three-tier system is also what makes the world go 'round. It's the reason why the National Beer Wholesalers Association has spent nearly $1 million (so far) in the 2016 election cycle and why Anheuser-Busch, with the largest distribution network in the U.S., has spent just over $200,000.

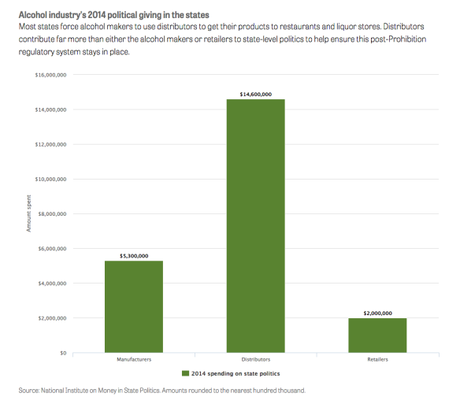

In the 2014 elections, distributors gave about $14.6 million to state candidates, parties and ballot issue groups, twice as much as alcohol manufacturers and retailers combined.

Spending wouldn't offer power if it didn't impact decision making, as we've seen with AB InBev's voluntary incentive program to offer distributors up to $1.5 million if their sales include 98 percent on AB InBev brands. Even the projected average intake of$200,000 for distributors is nothing to overlook.

About 500 of roughly 3,300 wholesalers focus on AB InBev products, with 21 owned by the multinational company itself.

While not a part of this program, some brewers have already claimed AB's business practices have impacted sales and sale potential for smaller breweries, which even led to an investigation by the Department of Justice.

But as much as these topics have been discussed in argumentative blog posts or heated conversations over a pint, there must be something more quantitative, right?

There is.

In a study released by Clemson last year, it was found that between 1984 and 2013 states that didn't limit brewers from acting as distributors of their brands had 75 percent more brewers entering the market than states that didn't.

"Most specialty brewers start out as very small enterprises and it may be costly for them to find or negotiate small-volume sales with a wholesaler," said Jacob Burgdorf, economics Ph.D. candidate in Clemson's College of Business and Behavioral Science. "The more restrictive the laws are, the fewer breweries entering the market. There is a noticeable decrease in the number of new brewers in states with more restrictive laws relative to those without them."

Additionally, restrictive franchise laws that create tight contracts with distributors reduce brewery entry by 34.3 percent, the study found. Combined, Burgdorf believes these outcomes "lead to less variety and consumer choice."

In layman's terms, restrictive policies - whether legal or through perceived market difficulties - have great potential to restrict the number of opportunities taken.

Many states benefit from some kind of self-distribution mandate (all laws can be found on this Brewers Association page) and that bodes well for the majority of U.S. brewers. According to the Brewers Association's 2015 Brewery Operations Benchmarking Survey, breweries making less than 1,000 barrels annually worked with an average of 1.2 in-state distributors and 0.3 out-of-state distributors. Given that either two-thirds (via Brewers Association) to three-quarters (via National Beer Wholesalers Association) of American breweries fall under that threshold, it makes sense that these businesses thrive on self-distribution. The survey found that these small breweries self-distributed about 63 percent of their beer and kept 97 percent in-state.

The picture changes considerably for companies making more than 15,000 barrels yearly, as those outfits rely more on sales in out-of-home markets. In fact, those breweries work with just 4.7 in-state distributors and 57.1 out-of-state distributors, on average.

That makes sense when you look at where the beer actually ends up. On average, more than 93 percent of production from breweries making more than 15,000 barrels annually is distributed at the wholesale level and 42.7 percent of that beer travels out of state, according to the survey.

When we consider the reliance on distributors for these companies, especially in terms of more local breweries making the jump to increase production and reach, the AB incentive program seems like a rather large deal.

As we wait to see how all this plays out for beer, a similar situation is playing out in the world of wine, albeit not in an apples-to-apples comparison.

Earlier this month, two of the country's largest wine wholesalers agreed to merge, bringing together $11.8 billion in sales revenue from Southern Wine & Spirits and the $3.7 billion of Glazer's Inc., which "creates a distribution force of unmatched capabilities, scope and dedication." Sound familiar?

Skipping the intimate details, the biggest questions are how this merger impacts what wines people will see on shelves or how much it'll cost them. The answer depends on who you ask:

Executives at larger wineries and major retailers told Wine Spectator that they believe the deal will not hurt selection.

"Southern is clearly a dominant player and they understand their space very well," said the CEO of one mid-size company that owns a dozen wineries. "There are so many different suppliers in the wine, spirits and beer business and they all have unique needs. Southern is evolving and even though they are getting bigger, they continue to focus on more specialization to better serve their suppliers and customers."

But smaller wineries worry that the larger a distributor gets, the less attention they can give small brands. And since those distributors are such big players, they function as gatekeepers for the market.

"If you're a small winery with Southern, you didn't get much attention before this deal and now you'll probably get less," said the founder of one small California winery.

Sounds like a situation playing out in California.

Southern Wine & Spirits is actually branching out, in a way, to beer. In December, the Kroger grocery store company announced that they would partner with the alcohol wholesaler to manage adult beverage selection for their stores. The problem? The program would be funded by suppliers and wholesalers, creating something of a "pay to play" system.

As Brewers Association director Paul Gatza pointed out, his first concern is whether the agreement is legal.

"The second is what it means for market access, as one can assume that beverage alcohol suppliers with fewer resources could be squeezed out of this important grocery chain if they can't afford to or choose not to participate," he wrote in a editorial on the BA website.

Gatza's peers in liquor and wine have complained about the proposed change, too.

What does this all mean? Whatever the hot topics of beer may be in 2016, we're probably not done talking about this one just yet.

Access to market will be the next hard lesson. if you don't have direct sales, you better lobby your state reps.

- Good Beer Hunting (@goodbeerhunting) December 22, 2015

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac