The dollar came back into focus following the 4th July celebrations which had seen markets hit the pause button. May’s non-farm payroll had been forecast to highlight 160,000 jobs added to the US economy. However, the number stunned and saw the US dollar gain heavily against many of the majors.

Economists had been slightly downbeat on the USD, with some saying that its run could be coming to an end as future growth arguably has been less notable in recent month. Any doubters would have been forced to eat their words on Friday with the June’s jobs data showing an incredible 224,000 roles being added to the US economy against the forecast 160,000. The data cushioning the disappointment of May’s reading which saw the number of 160,000 being missed by 88,000. Causing many to question the US’s typically robust employment market.

June’s employment data

The 224,000 new jobs created in June represented the largest increase in 5 months, demonstrating that despite the uncertainty to the US economy caused by the White House’s trade war, the economy remains resilient. June’s reading is comfortably higher than the first half of the year’s average which sits at 172,000. Both this month and the average easily surpassing the 100,000 a month needed in order to keep pace with the growth in the working age population. Incredibly the manufacturing sector; arguably the most vulnerable to the trade war increasing by 17,000 in June and 3000 in May.

Despite the jobs growth, unemployment in the US did increase marginally rising from 3.6% in May to 3.7% in June. This was largely ignored by markets and didn’t take anything away from the Non-farm reading. The slight decline being attributed to payroll number contraction decreasing in the retail sector.

An area of the US employment data which does appear to be struggling is wage growth which has slowed since late 2018 and shows no signs of a turnaround as yet. Wage growth fell from 0.3% in May to 0.2% in June. Annualised wage growth remains at 3.1% despite the decrease in June.

Are the FED now rethinking their rate cut strategy?

Markets had anticipated a rebound in US job numbers, however, not to the extent that markets witnessed. Another poor number would have almost certainly seen the FED strongly consider cutting interest rates by 0.50% at the end of the month, as it stands that possibility now seems much more unlikely despite the constant issues caused by Trump’s trade war. It is however estimated that a more modest 0.25% will occur before the end of the year subject to scenario posed by the trade war, the general global economy and US economy. Business sentiment has also waned recently, and this will also have an impact on the Fed’s upcoming decision.

Markets will not have long to wait to get a clear picture of the Fed’s sentiment and thoughts both on the trade war and the US economy. This week Jerome Powell testifies on the semi-annual monetary report. His sentiment is almost certain to assist or hinder the USD, treasury yields and the indexes.

USD enjoys gains

The jobs report motivated the USD with the EUR/USD pair falling from 1.1267 to 1.1213, the pair has gained slightly and currently trades at 1.1218 at the time of writing.

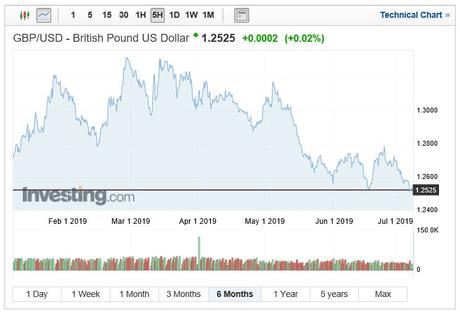

The Pound which continues to come under sustained pressure fell to 1.2512 a multi-month low with cable showing very little resistance or recovery. The Pound once again finding itself in limbo due to the ongoing tory leadership race and continual lack of direction or solutions for Brexit.

The two candidates, Jeremy Hunt and favorite Boris Johnson are currently touring the UK and debating in front of Tory party members. The race winner which shall be announced on the 22nd of July will either be a significant hindrance or benefit for Sterling. Hunt who is keen to seek a deal and open to prolonging Article 50 appears, at least to financial markets, to have a much softer edge to his Brexit. Johnson, on the other hand, has claimed that he prefers a deal but would not shy away from leaving without a deal if the EU weren’t open to renegotiating, a stance which they still hold firm on.

If the presumed front runner Boris Johnson was to win the race, there is also a story gaining pace that they could call a general election in order to gain a more significant parliamentary majority. Which could cause its own level of uncertainty as regards Pound pricing.