Despite skepticism, many NFTs are as valuable as real estate. Initials’ Simon Callender explains how their value opens up customer equity.

When you mention NFT, many may cringe at various judgments and assumptions. It’s hard to fathom at first. Why spend so much for a Jpeg that anyone can right-click, copy, and save to their desktop?

NFTs are more than simply a Jpeg. They herald a new era of digital ownership and will change how companies, influencers, and consumers interact online and offline. Data show that NFT is not a fad. NFT transactions rose from $40 million in 2018 to $338 million in 2020. They’ll hit $25 billion in 2021. Sales declined slightly in 2022 due to macroeconomic issues.

What is NFT?

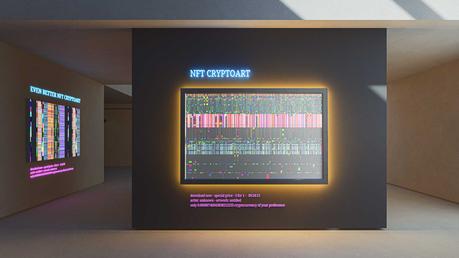

NFTs are cryptographic assets with unique identifying codes and metadata. It is unique, recognized, and verifiable from other NFTs.

Take Tom’s phone shot of his automobile. He can email Lucy a near-identical copy of the picture. It’s nearly identical and impossible to “prove” who owns the original.

Let 1,000 people see that photograph. Who owns the original? Tom may come to claim it. He cannot prove digital ownership cryptographically. NFTs follow.

Tom mints an NFT of his automobile on Ethereum. Tom has 100% verified digital ownership because the NFT is aired publicly. Etherscan, an Ethereum blockchain transaction network, shows when the NFT was created, who owns it if it was transferred, to whom wallets, and so on.

Blockchain transactions are irrevocable, so no one can argue over ownership. NFTs can hold digital and physical assets like real estate and art, creating new use cases.

Is NFT worth it?

NFTs allow any firm to engage directly with its customers and everyone to “own” a verifiable interest in the web3 ecosystem, giving individuals influence over enterprises. NFTs and digital assets prevent corporations and centralized institutions from taking control.

Rally, a blockchain platform, lets businesses and communities create autonomous digital economies. By issuing these “social tokens” (basically a cryptocurrency), producers can open new revenue streams and fans can access unpublished content or products.

Instead of paying YouTube a percentage of advertising revenue, influencers and creators can encourage fans to participate in their economy and reward them with cash. Fans can now actively “own” their favorite influencer or creator’s success.

New trade and opportunity

To demonstrate how brands are creating new commerce and opportunity, consider a real-life example. Bud Light’s “N3XT” NFTs debuted in 2022. 12,722 unique tokens gave consumers voting rights on future brand merch, access to brand and partner events, unique roles in Bud Light’s Discord channel, and other prizes.

Since the NFT release sold out, anyone who wants to stay in this community must buy one on the secondary market from an existing holder (typically at a higher cost than the mint price).

This example shows why NFTs are more than Jpegs. They reflect the discovery of digital art ownership, which could change commerce and inspire new businesses and startups.