The rise of non-fungible tokens, or NFTs, has brought hype to the digital market. These unique digital tokens that are distinct, verifiably scarce, and non-fungible have unlocked new possibilities for digital ownership and business for both creators and investors. NFTs cover various sectors, such as art, gaming, collectibles, virtual real estate, etc. Thus, the NFT community is growing fast, and its members need to keep up-to-date with the latest concepts in the market.

One of the important issues to learn before joining the NFT market is the concept of NFT floor price. Understanding NFT floor price enables you to further assess the demand and supply of NFTs and make more informed decisions about buying and selling NFTs in a market with lots of price fluctuation.

In the following, we provide a comprehensive guide on NFT floor price, explore its significance, and discuss the most influential factors on the floor price of an NFT.

What is an NFT Floor Price?

The floor price is commonly used by economists to represent how low the price of a certain asset, good, or service can be. The term is also used in the NFT market as a metric to measure the value of an NFT project.

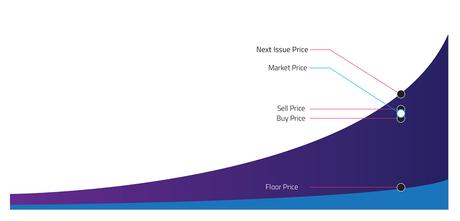

Simply put, the NFT floor price refers to the lowest price a buyer can pay to own an NFT on a secondary marketplace. It is determined by the market, and therefore, it is different from the mint price of an NFT.

NFT floor price usually increases immediately after mint to make a profit for the owner. There can be a significant increase after mint in an NFT price that sometimes is followed by a sharp decrease later. Thus, the NFT floor price can be a direct indicator of how the NFT market values a certain NFT or collection.

Types of NFT Floor Prices

There are several types of NFT floor prices that can have different meanings and usage to NFT buyers. Here is the list:

Real-time floor price

An NFT floor price is known to change from time to time since it is directly dependent on the current market value of an NFT. Real-time floor updates, thus, follow the trends of the NFT market where people make their trading decisions.

There are various reasons for floor price changes, including NFT rarity and utility, which, along with the increasing number of NFT investors, causes fluctuation in the floor price of NFTs or NFT projects by the second.

Decreasing floor price

As mentioned above, it is considered quite common to see the floor price of an NFT decline from time to time. Among the factors that cause an NFT floor price to decrease are the following:

- NFT rug pull! When an NFT collection is known to be a scam.

- Once NFT holders disagree with decisions made by NFT collection developers.

- If NFT utilities change or are expired.

- If an NFT project goes static and there are no new developments with it.

In some cases, there are no negative reasons for an NFT to experience a decrease in its floor price. Sometimes, holders of an NFT collection are merely impatient and if they do not see the increase in their token price, they choose to sell their tokens and invest in other NFT projects in the hope of making a profit. It is important to know the reason for a decline in the NFT floor price. It enables investors to make the right decision to keep or sell their tokens.

Increasing floor price

If there is good news around an NFT project, its floor price goes on the rise. Some reasons for the increase in the floor price of an NFT or a collection are:

- New development or partnership by NFT developers

- Additional utility and use cases of the NFT

- Increasing the number of investors in the NFT collection

Although an increase in the floor price of an NFT is good news for its holder(s), investors should be careful about quit hypes in an NFT floor price. Investors are required to search for the reason for an NFT’s price pumping since it is not always the best time to buy an NFT once its floor significantly increases. In general, it is more profitable to buy an NFT when the floor price shows a decline, keeping in mind that the price decrease is not the result of some negative reasons.

How to Calculate the NFT Floor Price?

The floor price is a term to show how low an asset can go. The NFT floor price is a sale price that is cheaper than all the other sellers within the same NFT project. It is determined by NFT holders, meaning that the floor price is calculated as the lowest price an owner wants for its token.

Once an investor buys an NFT, she is able to list the token for sale. The floor price is usually calculated based on certain features of an NFT, including rarity, utility, history, etc. It means that NFT collectors can set new floor prices by buying them and changing their floor prices. The process is called floor sweep, where an investor buys several NFTs from a collection to increase their floor prices.

Factors Affecting the Floor Price

There are several factors that can cause the floor price of an NFT to rise or fall. Knowing these factors and their potential influence on the floor price of an NFT can help an investor make more informed decisions while trading NFTs in the market.

NFT uniqueness and rarity

If you are familiar with NFTs, you definitely know that the uniqueness and rarity of an NFT directly influences its price, including floor price. The more scarce and unique an NFT is, the more expensive it is. NFT collectors and investors usually look for one-of-a-kind and rare tokens to buy.

Demand for the NFT

Demand for an NFT is one of the most influential factors in determining the floor price of an NFT. The more the demand for an NFT, the higher its floor price will be. And if there is less demand for an NFT, its floor price will be lower in the NFT market. Thus, market supply and demand determine the floor price of a token.

Utility and value

NFTs that provide real value and utility in the market experience a higher floor price compared to those that offer no value or utility to investors. Many NFTs provide little utility to their holders and their floor prices decline over time. Therefore, the real-world value and utility of an NFT are essential to determine the floor price of the token.

Reputation of the developer team

NFT collections that are developed by a well-known NFT developer usually have a higher floor price. Such well-known developers have created trust between the creators and NFT investors. An NFT team developer with a good reputation in the market can easily attract the attention of their target investors and cause price competition among holders. Their projects usually have a higher floor price compared to others.

Collaboration

Another factor in determining the floor price of an NFT is the collaboration between well-respected teams or NFT artists. For example, if VeeFriend and Larva Labs, two famous NFT developers, work on an NFT collection, it is expected that the tokens have a higher floor price and maintain an even higher floor price in the secondary market. It seems that their reputation and popularity in the market cause more trust and, therefore, a higher floor price.

Market trends

Market trends, including the popularity of an NFT artist or NFT developer team, lead the community to look for a specific type of NFT, which reinforces the NFT market. An increase in the number of NFT investors seeking a certain type of NFT elevates the floor prices of those NFTs. Also, when NFTs are provided with more utility in the digital world, such as gaming and online museums, the market feels the demand for certain types of NFTs, and as the demand expands, the floor price significantly increases.

Floor Price History of an NFT

The past and present events in the NFT market can also influence NFT floor prices. NFTs that have previously sold for high prices usually make NFT investors believe in their greater values and, thus, higher floor prices.

The ownership history of an NFT can also determine its floor price. All the information about an NFT, including creator(s), owner(s), and transactions, are permanently recorded on the blockchain. An NFT that was created by a well-respected creator and owned by a distinguished NFT investor can have a higher value or floor price. This suggests that digital tokens with notable previous owners are usually sold for higher floor prices compared to those lacking such a feature.

FAQs

Is floor price a reliable metric?

NFT floor price can be a good metric for evaluating how well the NFT community accepts and supports an NFT project. An increase in demand for certain NFTs suggests an increase in their floor prices.

Is the floor price different from the mint price?

The floor price of an NFT is different from its mint price. NFT floor price refers to the lowest price an NFT sells for. But the mint price represents the price an NFT has at its release.