In my previous post on " You Can Never Retire If You Only Save 10% Of Your Income", I said if we only save 10% of our income, it is impossible to retire. There was a comment in that post saying that since we can't retire on 10% savings, then maybe we can retire on our CPF savings which we contribute 37% of our salary on a monthly basis.

In case you didn't realise, yes we contribute 37% of our monthly salary to our CPF. This is quite a high savings rate to speak of. 20% is contributed by us and 17% is contributed by our employer. It goes into 3 separate accounts mainly the ordinary, special and medisave account.

Most of us use CPF to pay for housing loans and medical insurance

However, as we all know, most of us will use our CPF money to pay for our housing loans and also medical insurance. In most cases, young people now and in the near future will need to pay about $1200 per month for their housing loans base on a $300,000 price HDB flat. If we divide equally between husband and wife, each will need to pay about $600 for their housing loan. For a fresh graduate who earns $3000, $600 is almost all that he contributes to his ordinary account. Assuming if salary remains constant, this person would have close to nothing in his ordinary account when he reach 55.

How much CPF will we have after using it for housing?

It is a good idea to rely on CPF for your retirement? If we think that we don't need to have our own personal savings because there is CPF, will we be in big trouble?

- Starts with $2500 salary and assuming it increases 3% per year

- Buys $300,000 HDB flat ($275,000 after grant)

- Pays $556/month for housing loan from CPF OA (Divide by 2 with spouse)

Let's demystify how much CPF will we have after using it for housing. Many people say that the future generation of young people will have no money left in their CPF after paying for the high housing loans. Is this true?

I've done the calculation and here is the scenario and the result:

From the above scenario, this person will have $580,978 in total from all 3 CPF accounts even after finishing paying for his or her housing loan. Doesn't sound too bad after all.

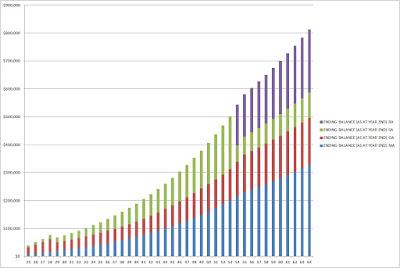

From a chart perspective, here's how the CPF money will grow:

*Above figures are estimated and assumes no overflows from MA in excess of Medisave contribution ceiling

How much would we have if we did not use our CPF monies at all?

On the other hand, if we did not use our CPF money at all to pay for housing loans, how much would we have?

The number is...... $852,515

This is $271,537 more than the previous example of using CPF for housing. If you notice, the amount paid for the housing loan is only $166,800 per person ($556 x 12 months x 25 years). But, if the money is left inside CPF, there is about $100,000 more due to the interest compounded in the CPF accounts.

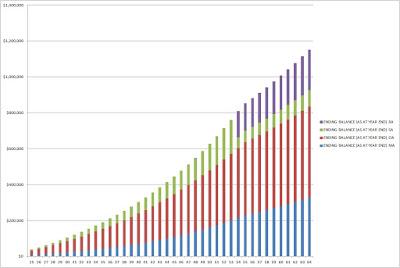

Here is the chart for the scenario of not using CPF money at all:

*Above figures are estimated and assumes no overflows from MA in excess of Medisave contribution ceiling

Look closely at the chart again. After age 55 to 65, the person who doesn't use his CPF money at all is a millionaire at age 65. In fact, he has more than a million dollars at $1,152,048. Just by a starting salary of $2500 and growing at 3% per annum, a person can become a millionaire by age 65 if he choose to leave his money in his CPF account.

Should we use or keep our CPF money?

Using your CPF to pay for your housing loans or keeping your CPF money inside to earn higher interest is a decision we all have to make. What I have done is simply to show you the difference between using and not using your CPF money. The example above is never perfect with various assumptions. Some may say a starting salary of $2500 is not realistic and a consistent 3% salary increment doesn't sound realistic too. What if we lose our job along the way? Yes, these are all valid concern but the model above is just to give you a rough guide base on the assumptions.

There are also instances where we will earn higher salaries which is even better for us. I have done the calculations before that if we save $1500 per month and invest it at 5% ROI, we will achieve a million dollars in 28 years. CPF gives us interest of about 2.5%-5% for us who are below 55. It is possible to accumulate a substantial amount of wealth through the CPF system alone. Never rely on CPF for your retirement? It really depends on how you use it. Most of us will not be able to rely on CPF for retirement if we choose to empty it early in our lives.

or follow me on my Facebook page and get notified about new posts.

Related Posts:

1. Changes to the CPF - CPF Focus Group Discussion

2. The affordability of housing in Singapore and the various housing grants available