Netlink NBN Trust has gotten the attention of investors lately but I think its still early in its developments. I'm personally invested in this stock which I believed will do well in the next 2-3 years. They also just reported their financial results for Q2 and 1H FY2020 where we saw revenue and profit after tax increased by 5.3% and 17% respectively.

Netlink NBN Trust is not your typical limelight stock like REITs which owns properties where we can see the physical infrastructure. Netlink's infrastructure is hidden mostly underground where they are in the fibre business making money from every residential fibre connections, non residential fibre connections and non building access points (NBAP).

Fibre is an important aspect in our world today. I was once a telecommunication engineer and I saw the growth of the fibre business to a huge extent when 4G was deployed. In today's context where we need to transmit large data through telecommunication networks, the fibre business will definitely keep growing. When 5G comes, this growth will explode and that is where I think Netlink NBN Trust will benefit greatly.

To know if Netlink Trust is a good investment, we need to first understand where they make their money from. Basically, they generate revenue from 2 primarily revenue streams:

- one-off installation and/or patching charges (as applicable) for each termination point (upon the initial connection) or service activation

- a monthly recurring connection charge

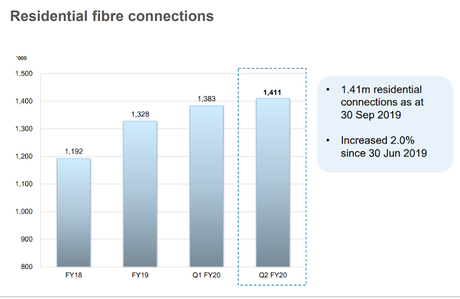

The largest part of their revenue comes from residential fibre connections. This means you and I are both contributing to Netlink's revenue as long as you have fibre at home. Netlink currently has 1.41 residential connections. The second largest of their revenue comes from non residential fibre connections. They have 46,742 non-residential connections currently.

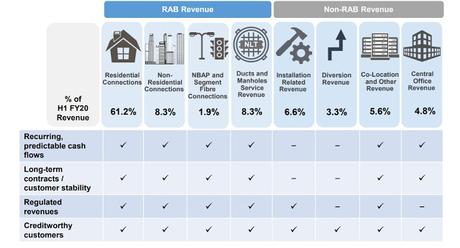

Here's an overview of Netlink NBN Trust's revenue streams:

One thing to take note of is that the prices of fibre connections and the recurring fees are regulated by IMDA under the Regulated Asset Base (RAB) model. This is effective from Jan 2018. During the last review, IMDA has set fibre connection prices such that Netlink will make a 7% pre-tax return on its past capital investments based on the RAB model. These prices will be reviewed every 5 years so the next review will probably be in 2022.

The next growth segment

Fibre has a lot to grow as we consume more data and especially when Singapore is moving towards becoming a smart nation. Being a smart nation, large data will be transmitted everywhere which means more fibre connections will be required.

We will see more CCTV systems, weather monitoring systems, autonomous vehicles and many more such services which requires more fibre connections. This will fall under their non building access points (NBAP) which makes up only 1.9% of their revenue streams currently.

Let me get a little technical to explain why more fibre connections will be needed in the future. In wireless technology, there are various frequencies which are used to transmit data through telecommunication networks. They can operate in 900MHz, 1800MHz, 2100MHz, 2800MHz etc. The lower the frequency, the longer the distance which data can be transmitted but the bandwidth will be lower. With higher frequency, the bandwidth is greatly enhanced but the distance which data can be transmitted is much shorter.

For 3G, it mostly uses 2100MHz where data can be transmitted at quite high speed with good distance. For 2G, it mostly uses 900MHz where distance is very good but speed is very low. For 4G, 2800MHz is used where the speed is much higher but distance is short. This explains why our 2G coverage was much better as compared to 3G or even 4G. To overcome the distance problem due to using higher frequencies, Telcos have to build more mobile base stations to enhance the coverage and still provide the speed to customers. Every mobile base station will need to be connected to fibre connection points which generates more revenue for Netlink Trust.

For 5G, IMDA released a factsheet on 5G public consultation 2019 which shows what frequency 5G will operate in. The frequency spectrum identified are 3.5GHz (3500MHz), 26GHz (26000MHz) and 28GHz (28000MHz). 5G uses this technology called millimetre wave or "mmWave" bands which brings ultra high speed to us. 5G is able to support 20 times faster speed as compared to the current 4G and also has the ability to support large-scale machine-type communications which will propel Singapore into a smart nation.

Now, knowing that 5G will use much higher frequency, the distance covered will be much shorter so more mobile base stations will have to be built and these base stations will most probably be built lower to the ground on lamp posts and streets. As mentioned above, each mobile base station will need a fibre connection so we will likely see a huge increase in NBAP connections revenue for Netlink when 5G starts rolling out. This will be in the next 2-3 years.

Here's a good overview of the 5G network set up to show there will be more NBAP connections:

The red antennas you see above are the possible 5G base stations which will be setup. All of these connections will require fibre connections which will benefit Netlink Trust greatly.

Q2 and 1H FY2020

Even before 5G comes, Netlink Trust is already delivering a good set of results for Q2 FY20. Residential connection increased 2% which most probably come from migration of cable users to fibre and also new residential buildings coming up in Singapore. If you've read the news, you would have saw that Starhub is stopping its cable service and migrating all their customers to fibre. This is good for Netlink Trust.

Distribution income (Dividends) increased by 3.3% QoQ with current yield of about 5.3%. Dividends is expected to be stable as they have a predictable recurring income stream. With the next growth segment coming up, I believe Netlink Trust will continue to do well. The downside will be that the government revised its pricing model downwards but that should not happen for the time being as the next review will be in 2022.