Eldershield has been renamed Careshield life with additional enhancements to provide for better long term care financing in the event of disability. I have got some additional information from MOH which I will share in this article.

To read up more on the basic of what Careshield Life is about, you can refer to a previous article I wrote here.

This article will focus on:

- The premium structure for those who are already on Eldershield and;

- Financial assistence for those who are currently disabled and do not have any Eldershield at all.

Why the need for the disability income?

Careshield life to me is a form of disability income. For those who have disabled family members at home, you'll probably understand the advantages of having this as all the different cost that adds up can be quite significant in the long run. For those of us who do not have disabled family members at home, we should prepare in advance just in case something happens. This is the purpose of insurance in itself.

Singapore is facing an ageing population issue. To make premiums affordable and still provide some sort of safety net, Careshield life was introduced. This is like the enhanced Medishield life which was introduced and became compulsory for everyone to be insured for hospitalisation insurance. By risk pooling, premiums could be made affordable. However, if you've read on the news, there has been several discussions on the premiums of hospitalisation insurance increasing in the future as those insurance companies suffered more losses for the second straight year. This is another issue altogether which I will not discuss in this article.

Premium structure for Existing Cohorts

Now back to Careshield life, more information has been released on the premium structure for existing cohorts. There are generally 3 groups of people n this existing cohort which is estimated to be around 2 Million Singaporeans. This group of people are those who are born in 1979 or earlier and do not have any existing disabilities.

Let's go into detail on 3 different groups of people in this existing cohort.

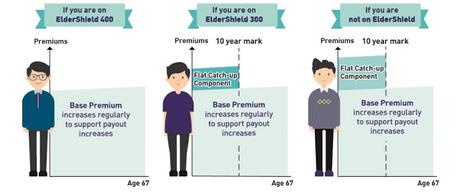

Group 1: If you are on Eldershield 400

Those who are on Eldershield 400 and never opted out will pay only a base premium, which increases over time until age 67.

Those who join at age 59 and above will have a 10 year premium payment term, so that annual premiums are more manageable.

Group 2 & 3: If you are on Eldershield 300 or not on Eldershield at all

For those on Eldershield 300 or not on Eldershield at all, besides paying a base premium as above, they will pay an additional Catch-Up Component, because they paid less premiums than those on ESH 400. Catch-Up Component is a fixed amount paid over 10 years.

You can refer to the below illustration for a better understand of the premium structure for existing cohorts:

Participation Incentives For Existing Cohorts

For existing cohorts, it is not compulsory to join Careshield life. This group of people can continue being insured on their Eldershield or not be insured at all. Careshield life is only compulsory for those born on or after 1980. However, those who are on Eldershield 400 and aged 41 to 50 in 2020 and not severely disabled will be auto-enrolled in 2021. They can still opt out within 2 years of auto-enrolment and receive premium refund

It is important to note that most people who are on Eldershield 300 or 400 will only receive $300 or $400 per month for up to 6 years only. This coverage might not be enough for most people as disability is more often than not, a long term healthcare issue. To encourage this group of people to join Caresheild life, there will be a participation incentive of up to $2500 which can be used to offset the premium payable. This participation incentive will only be applicable if existing cohorts join within 2 years from 2021.

Here are the various participation incentives payable:

How about those who are born in 1979 or earlier and are disable and cannot join Careshield life?

For those born in 1979 or earlier and are disabled, they have no insurance protection at all and it can be financially straining for their family members to handle. Good news for this group of people is that there will be additional support for them.

1. MediSave Cash Withdrawals for Long-term Care

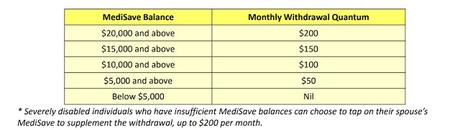

Firstly, MOH will allow the withdrawals of cash from Medisave for long term care needs moving forward from 2020. They can withdraw up to $2400/year (or $200/month) as cash for each severely disabled individual. This can be from individual or spouse's account. This is subjected to a minimum Medisave balance of $5000 which means for those who have $5000 or less in thier Medisave account, no amount can be withdrawn.

The eligibility criteria will be: "unable to perform 3 or more ADLs, similar to CareShield Life"

You can refer to the below table on the monthly withdrawal quantum for various Medisave balances:

This Medisave withdrawal also applies to those who have Eldershield or join Careshield life later.

MOH will also set up Elderfund for lower-income Singaporeans (aged 30 and above) who are severely disabled and need additional support for LTC costs, from 2020. They can get up to $250/month for life for as long as disability continues.

This is targeted at those who are not able to join CareShield Life, or have low MediSave balances and insufficient savings for their LTC needs. Singaporeans who are still unable to meet their LTC needs after these subsidies and assistance schemes can still tap on MediFund or ComCare.

There are a few timeline which we will be looking at for this Careshield life. I belong to the compulsory group who are born on or after 1980.

- Singaporeans born between 1980 and 1990 will be enrolled in CareShield Life, with younger cohorts enrolled when they turn 30

- MediSave Withdrawals for Long-term Care and ElderFund will also be implemented

- Singaporeans born 1979 or earlier can join CareShield Life

or follow me on my Facebook page and get notified about new posts.