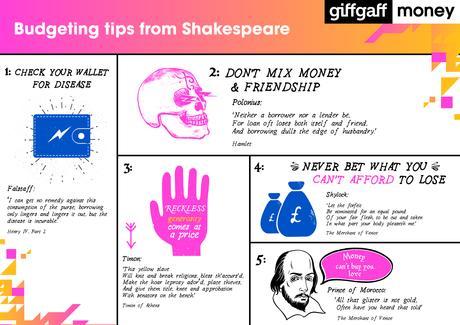

To celebrate the 400th anniversary of William Shakespeare's death, giffgaff money translates the Bard's monetary wisdom for modern day saversTop 5 money-saving tips include sage lessons on borrowing, budgeting and over-stretching your finances

To celebrate the 400th anniversary of William Shakespeare's death, giffgaff money translates the Bard's monetary wisdom for modern day saversTop 5 money-saving tips include sage lessons on borrowing, budgeting and over-stretching your finances

23 rd April marks the 400 th anniversary of the death of Williams Shakespeare. In order to commemorate this, giffgaff money - which de-mystifies money matters by offering jargon-free and myth-busting help online, has asked Shakespeare expert Hannah Manktelow to assemble some of his most helpful financial lessons, and translate this for the modern day layman.

Says Hannah: ' Shakespeare is more famous for his tales of love and power than his financial advice. But if you look closely at his plays you'll find some valuable monetary wisdom: how to spend it, how to save it, and how to avoid losing all your wealth and ending up living in exile, hating mankind.'

Here are the 5 Top Tips for managing money by The Bard himself:- Check your wallet for disease

Falstaff: 'I can get no remedy against this consumption of the purse; borrowing only lingers and lingers it out, but the disease is incurable.'

Henry IV, Part 2Falstaff is one of Shakespeare's most popular comic characters, a loveable drunk who parties relentlessly with Prince Hal, the future King Henry IV. But while Falstaff is entertaining, he's not exactly a financial role model; despite holding a knighthood, he's always in debt, and lives off borrowed or stolen money. Most people borrow a little cash from friends occasionally, but if, like Falstaff, your wallet is terminally ill, you need to break the cycle and get your spending in check. The portly knight meets a sorry end when the Prince inherits the crown and, unwilling to be associated with such a scrounger, disowns Falstaff and renounces his former lifestyle. Don't let it happen to you!

- Don't mix money and friendship

Polonius: ' Neither a borrower nor a lender be,

For loan oft loses both itself and friend,And borrowing dulls the edge of husbandry.'HamletPolonius is an advisor to Hamlet's royal family, but in these lines he's offering guidance to his son Laertes, who's just about to leave for France. Although Polonius is often mocked for his wordiness, sometimes his waffling contains pearls of wisdom. His words are as true today as they were in Shakespeare's time: think carefully before lending money to a friend, as if they don't repay you'll resent them and risk losing your friendship as well as the cash.

- Reckless generosity comes at a price

Timon: ' This yellow slave

Will knit and break religions, bless th'accurs'd, Make the hoar leprosy ador'd, place thieves, And give them title, knee and approbation With senators on the bench.'Timon of AthensTimon of Athens is hardly ever staged, but it has a pretty strong message about money at its core. The play tells the tale of Timon, a wealthy Athenian who ruins himself with his irresponsible spending. He hosts lavish parties, pays his friend's debts, and gives his servant money for his wedding - but when Timon's creditors come calling and he finds he's lost his fortune, none of his former buddies will help him out. He ends up living in the woods, mad and embittered against the world. If Timon had only kept an eye on his accounts, and taken a step back to think about his friendships, he might have realised his acquaintances were just there for a good time and saved himself a lot of trouble. It's always nice to treat those closest to you once in a while, but if you're constantly putting your hand in your pocket to fund other people's lifestyles, a rethink might be in order.

- Never bet what you can't afford to lose

Shylock: 'Let the forfeit

Be nominated for an equal poundOf your fair flesh, to be cut and takenIn what part your body pleaseth me.'The Merchant of VeniceIn The Merchant of Venice, Antonio makes a foolish agreement with Shylock, a moneylender: if he doesn't pay back a loan within the agreed time, Shylock can take a pound of his flesh in compensation. Antonio is sure he'll be able to get the money in time, but his investments fail and so Shylock seeks to take what he's owed. Though most of us wouldn't go so far as to put our body parts up as insurance for a quick loan, it's worth remembering that all credit has to be repaid eventually - so don't bet your economic future on a gamble that might not pay off.

- Money can't buy you love

Prince of Morocco: 'All that glister is not gold,

Often have you heard that told'The Merchant of VeniceA subplot of The Merchant of Venice follows Portia, a rich noblewoman, in her search for a husband. Each of her suitors must pick one of three caskets - in gold, silver and lead - only one of which will grant her hand in marriage. The Princes of Morocco and Aragon choose the valuable gold and silver, and walk away with nothing, but nobleman Bassanio picks the lead and wins the right to wed Portia. It's a lesson that runs through lots of Shakespeare's plays - material possessions can't bring you happiness, and love is more precious than power and fortune. If the person you're pursuing can be won over by flashy gifts, they're probably more interested in your bank account than your heart.

Link to the above article can be found on giffgaff money's 'know-how' section here

For more information on giffgaff money visit: https://www.giffgaff.com/money/

About giffgaff moneygiffgaff money is a community based platform that aims to bring the same honest and communal principles to the financial sector as it has the mobile industry. It offers jargon free 'know-how' and 'top tips' - curated by both giffgaff and members of its community, as well as the potential to borrow up to £7,500 via peer-to peer lending.

Hannah Manktelow (@hannahmank) is a PhD student at the University of Nottingham and The British Library. She researches Shakespeare performance in the English provinces from 1769-2016, and is the author of The Bard in Brief: Shakespeare in Quotations.

For further information please contact [email protected] / 07791156326 or

About giffgaff- What it is - giffgaff is a contract-free mobile network 'run by you'. giffgaff is a Scottish expression meaning, you give me something, I give you something back.

- Background - It was founded in 2009 based on the belief that there is a better way to do mobile and boasts a consumer-centric approach that puts members at the heart of the brand's offering and is setting new standards for member satisfaction.

- How it works - Once a giffgaff SIM card is activated, members can buy any of giffgaff's goodybags (a bundle) that includes a mix of UK calls, text and internet and last for 30 days. Outside of goodybags, UK calls are charged at 10p per minute to mobiles and landlines and 6p per text, member to member calls and texts as well as calls to 0800 numbers are free, and international call rates are competitive.

- Phones - giffgaff has a range of unlocked mobile phones available on price plans that suit everyone, whether that's a one-off payment or a monthly payment plan.

- No customers, just members - Not only do the members run the forums, inspire the community and spread the good word of giffgaff far and wide, they have also been the brains behind some of giffgaff's best ideas, from how they want their mobile network run to what they want in the future.

- Example: giffgaffers janetihill, cherrycoke1983, shabazmoqsud suggested that it would be great to see who in a contacts list is on giffgaff. giffgaff did exactly that. The giffgaff iPhone or Android app shows who is on giffgaff, so you call them for free!

- Giving back - To reward members for running parts of the business, twice a year giffgaff members are rewarded via 'Payback', allowing them to convert the kudos they've earned into call credit, cash or a charity donation.

- Winning awards - This new approach to mobile is proving successful. Here's a few awards won recently:

USwitch winner for Network of the Year

USwitch Best SIM-only Network Award

USwitch Best for Data Award

USwitch Network Customer Service Award

USwitch Best Value SIM only Award

Winners of Which? Award for Best Telecom Services Provider

- 2014

Winners of Which? Award for Best Telecom Services Provider

Which? Recommended Pay as you go network

Which? Recommended Pay monthly network

- RateSetter was launched in October 2010 to offer an alternative to savers who are looking for a fair return on their money, and to borrowers who want a simple, low cost loan, delivered with an old-fashioned idea of customer service.

- RateSetter is not a bank. RateSetter does not lend money itself. RateSetter help ordinary people lend and borrow money.

- Borrowers say how much money they need, then they set the interest rate they're happy to pay. Savers say how much money they want to invest, then they set the interest they're happy to receive. RateSetter simply match them up.

- RateSetter was founded by Rhydian Lewis who after working closely with banks in his role at Lazard felt the opportunity for peer-to-peer lending was ripe. He was soon joined by Peter Behrens, who practised as a solicitor at Ashurst, before joining RBS as a banker.

- They set about establishing the principles behind RateSetter, and succeeded in raising seed funding from angel investors in early 2010. RateSetter is situated in the heart of London, in Southwark, just behind the Tate Modern.