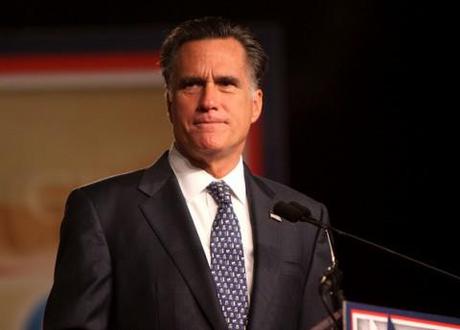

Mitt Romney: Taxing times? Photo credit: Gage Skidmore, http://flic.kr/p/aqnGZ7

Republican presidential Mitt Romney has released his tax returns, following weeks of pressure from rival GOP candidates and the media. In not-exactly-shocking news, the tax forms revealed that the former governor of Massachusetts is very wealthy indeed, pulling in $21.7 million in 2010. What’s caught the attention of the world media is the one-time GOP frontrunner’s tax rate: Romney’s 2010 income was taxed at around 14 percent – considerably lower than the average US rate. And Romney has offshore accounts in well-known tax havens Bermuda and the Cayman Islands, as well as previously holding a Swiss account.

So do the Romney tax returns have the potential to damage his run for the Republican nomination? On the one hand, there is nothing illegal about Romney’s calculations, and he’s not the only wealthy US citizen to take advantage of the lower tax rate for capital gains. However, some commentators suggested that the GOP candidate’s large income leaves him open to the charge of being out of touch with voters; and that the lower-than-average tax rate may fuel resentment.

Romney has endured a difficult few weeks, having been stripped of his win in the Iowa caucus and soundly beaten by former Speaker of the House Newt Gingrich in the South Carolina primary. According to The New York Times, recent polls show a big swing towards surging Gingrich ahead of the Florida primary. Can former frontrunner Romney claw back a victory or is the nomination slipping from his grasp thanks to those pesky tax returns?

Problem of perception. Romney’s main problem is “the damaging perception that he is part of the elite – the ‘one per cent’ that lives by different rules from ordinary Americans and therefore cannot understand the pains of the ordinary working man or woman”, wrote Peter Foster on a Telegraph blog. According to Foster, the global financial crisis has led to increased scrutiny of inequality, which means Romney’s lower than average tax rate will be in the spotlight. What’s more, Foster said, Romney risks representing “the recklessness and greed” of the financial sector in the US public’s mind.

“Americans generally don’t begrudge legitimately earned wealth. They do, however, get ticked when the high end pays low-end taxes,” said The New York Daily News.

Florida voters unimpressed. Voters in Florida were disquieted by the release of Romney’s tax returns ahead of the state’s primary, reported The Los Angeles Times: “Voters were left to ponder. Several said they were bothered by Romney’s enormous income, which he made off investments while essentially running full time for president.” According to The LA Times, Romney’s problem is that of demographics: “The group most likely to take offense at [Romney's tax returns] is also the bloc Republicans most need in the fall to defeat President Obama — lower-income and working-class whites.”

Slate has created a handy Mitt Romney income calculator, allowing you to find out how long it would take the former Massachusetts governor to earn your annual salary. Hint: unless you’re super-rich, not every long.

Good for Democrats, bad for Republicans. Romney’s Republican rivals are likely to avoid the subject of his tax rate because they “can’t really attack the contents of his tax returns without directly attacking their own ideology”, said Jim Newell at Gawker. As Newell pointed out, Romney can actually thank his closest rival in the GOP race Gingrich for the lower investment income tax rate, as this was “put in place partially by Newt Gingrich’s 1990s capital gains tax cut rate”. The Democrats, however, are likely to try to make political currency from the revelations: “The key will be to point out that Romney’s wealth came from an especially exploitative niche of finance capitalism, and not because he invented some really fantastic machine in his basement,” wrote Newell.

Republican House Speaker John Boehner defended Mitt Romney’s lower tax rate: “There’s a reason we have low rates on capital gains and that’s because it spurs new investment in our economy and allows capital to move more quickly,” said Boehner, reported The Wall Street Journal.

Gingrich would make Romney even richer. Looking at the GOP candidates’ tax plans, Steven Gandel revealed at Time’s Business blog that Romney’s proposals would enhance his own income by $3.4 million – but “it’s Gingrich’s plan that would lower Romney’s personal tax bill the most”. As Gandel said, “The one candidate for President in 2012 with a plan that would raise taxes on Romney is President Obama… Just another reason Romney will probably be voting Republican in 2012.”

More to come? “The former Massachusetts governor only released a limited amount of data, two years worth of returns without any supporting information from any partnership that he invested in,” wrote Ben Jacobs at The Daily Beast, suggesting there may be more revelations to come about Romney’s income. However, Jacobs also said there were unlikely to be any discoveries of financial wrongdoing: “The scandal isn’t that Romney has done anything wrong. Instead, the real scandal is that it’s all legal.”