Many of us would have seen the news on the new subsidised insurance which MINDEF is providing to all personnel including regulars, NSF and NSmen. This also extends to your spouse and children. You can read the news here.

The purpose of this post is to uncover the protection provided and the premiums payable. From what I see so far, the coverage we get and the premiums payable is so much lesser than if we were to get from outside insurance agents. You'll be surprised it is about half the cost. This is one of the 30 recommendations by the Committee to Strengthen National Service (CSNS) to better recognise the contributions of national servicemen to national defence and security, and to strengthen our care for them.

If you've served national service, this will be of interest to you. If not, if your spouse has served national service, you can also get the insurance through him or her.

What is the MINDEF & MHA Group Insurance?

Under the MINDEF & MHA Group Insurance, there is group term life and personal accident insurance. Even if we do not buy any insurance, from 1 July 2016, we will automatically be provided with $150,000 group term life and $150,000 group personal accident insurance coverage during the period of our full-time NS and operationally-ready NS (ORNS) duties. The premiums are fully paid by MINDEF and MHA.

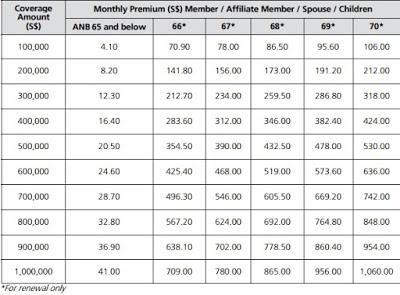

To get additional coverage, we can opt for the voluntary scheme. This scheme will only be available from 1 July 2016 for MHA personnel and 1 October 2016 for MINDEF personnel. We can get term life and personal accident insurance through this scheme. I will focus more on the MINDEF/SAF group. The premiums for the Group term life insurance is as below:

(Group Term Life Premiums)

As we can see, for a coverage of 1 Million, the premiums is only $41 per month. This covers 1 Million in the event of death or Total Permanent Disability only. If we compare to a term life insurance in the market using compare first website, the lowest will be $71 per month.

If we're thinking to just get insurance for death and total permanent disability, then it wouldn't be much of an issue. However, if we want to add in riders for critical illness, there are certain limitations for this scheme.

The limitations are:

- Critical illness only cover maximum $350K

- The premiums are not flat but increasing

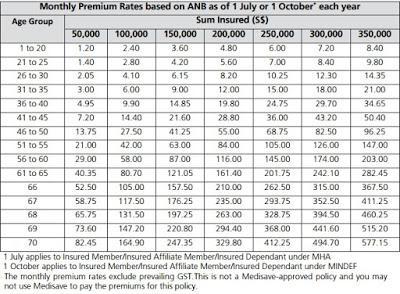

The critical illness rider under the Group term life insurance is called "living care". It covers against 37 common critical illness. Here are the premiums payable:

(Living care rider premiums)

As we can see, the premiums are in age bracket and not flat rate. This means we have to pay more per month as we hit the next age bracket. The problem is when we get pass 50 years old, the premiums can be quite a lot and even more when we are above age 60. If we are planning to add in this rider, there may be a problem in later parts of our life.

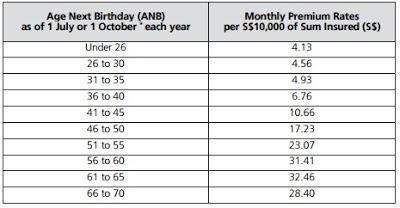

There is also another optional rider called disability income. This coverage will replace your income in the event of disability. The annual coverage amount is based on 50% of your monthly basic salary multiplied by 12 times up to a maximum annual benefit of S$120,000.

Here is the premiums table:

Similar to the living care rider, the disability income rider premiums are increasing. A point to note is the riders have to be bought together with the Group Term Life or Group Personal Accident insurance. We cannot buy the riders only without the main insurance.

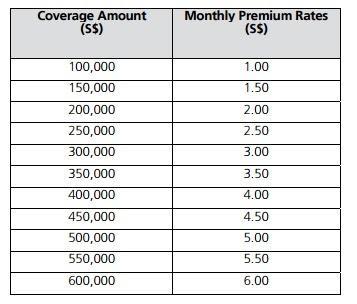

Group Personal Accident insurance

For the personal accident insurance, it provides coverage in the event of an accident. We can cover up to $600,000 at cheap premiums.

Here's the premiums table:

(Personal Accident Premiums)

For personal accident, the premiums are on a flat rate and doesn't cost much. For the full list of items and conditions we can claim, you can refer to the brochure here.

List of resources

Lastly, I've complied the list of brochures from the website which I've wrote in this post. You can refer to the brochures for more information on the coverage and the premiums. I understand that to apply for the insurance, we cannot get through the public insurance agents channel and have to purchase direct from Aviva.

- Group Term Life Product Summary

- Group Personal Accident Product Summary

- Living Care Product Summary

- Disability Income Product Summary

For the full suite of insurance offered under the MINDEF & MHA Group Insurance, you can refer to the website here.

The above products are more for MINDEF personnel. For MHA personnel, you can refer here. It is quite similar from what I see.

I hope this post is useful for those who want to find out more on the new group insurance for people who served national service and played a part in contributing to national security. Don't forget this applies for your spouse and children as well so you can also buy for them through the voluntary scheme.