In the midst of the current memecoin craze, it’s worth noting that the Ethereum network’s gas fee has recently hit a multi-month high. The daily revenue of Ethereum has been multiplied by multiples due to the high transaction fee. Several individuals highlighted the growing network congestion and transaction execution challenges, whereas supporters of Ethereum celebrated the surge in earnings.

The top 10 spenders of gas-burning altcoins saw a shift as TROLL, APED, and BOBO emerged as popular choices, replacing WETH and $1 memecoins. This transition was quite interesting.

— Santiment (@santimentfeed) April 19, 2023

A highly unusual shift in top 10 gas burning #altcoins has emerged today. Instead of $ETH, $WETH, and $USDT being at the top of the fee distribution list, we're seeing new assets like $TROLL, $APED, and $BOBO among them. Read our latest deep dive.

https://t.co/7SlmJ59k2m pic.twitter.com/Y2kaLKZTrL

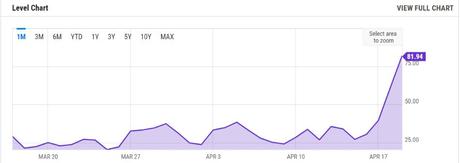

As of April 20, the average gas price for Ethereum transactions stood at 81.94 gwei. This marks an increase from the previous day’s average of 60.82 gwei and a significant jump from last year’s average of 44.42 gwei, representing a 34.74% increase from April 19 and an 84.46% increase from April 20, 2022. The Gwei unit is equivalent to one billionth of one ETH.

ETH gas fee increase in last month. Source: Ychart

ETH gas fee increase in last month. Source: Ychart

In terms of daily commission income, the second-largest blockchain has generated 28 times the revenue of Bitcoin, according to Anthony Sassano, an independent Ethereum educator. In light of the current meme frenzy, it’s worth noting that Ethereum layer-2 platforms like Arbitrum One have surpassed the BTC network in daily revenue.

According to advocates of Ethereum, the network’s growing utility is evidenced by the rise in revenue due to the high gas fees. Several individuals on Crypto Twitter promptly highlighted that the “extensive usage” mentioned is limited to a small number of users who are engaging in memecoin gambling.

This is literally evidence of extensive usage though lol

— Degentralisation

Ethereum gas fees are purely a function of how much usage is occurring

If something made Ethereum essentially un-usable the gas fees would be extremely low

For retail, https://t.co/BktSOrwNqo is the more meaningful page:

(@Degentralise) April 20, 2023

Several users have reportedly paid gas fees that were as high as several hundred dollars. Additionally, some users have expressed their dissatisfaction with having to pay a gas fee that was greater than the transaction amount.

The soaring gas prices have been attributed to a Maximal Extractable Value (MEV) trading bot that dominates memecoin transactions on a massive scale. Jaredfromsubway.eth has emerged as the leading gas spender in the last 24 hours, having spent $455 ETH and utilizing 7% of the network’s total gas.

bro has used 7% of the total gas on ethereum over the past 24hrs (455 ETH) just feasting away on $pepe

— beetle (@1kbeetlejuice) April 18, 2023

data from the legendary @hildobby_ https://t.co/j3SqtQnkKJ pic.twitter.com/hWavtdO1D5

Over the course of the last two months, our platform has executed over 180,000 transactions and incurred gas fees amounting to 3,720 ETH (equivalent to $7 million).

Content Source: cointelegraph.com