In the fluctuating realm of cryptocurrency, meme coins have burgeoned, merging internet culture with financial speculation.

‘Meme Coin Mania: The Internet’s Next Breakout’ delves into this phenomenon, analyzing the precipitous rise of tokens like Bonk and their impact on investment strategies.

We investigate the factors driving their popularity and market response, offering an incisive look into the future of these digital assets that are reshaping the landscape of currency and culture.

Bonk’s Unprecedented Surge

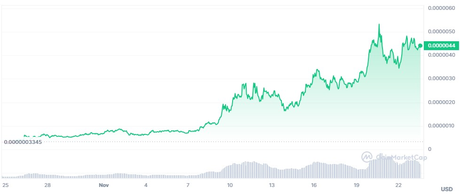

The meteoric ascent of Bonk cryptocurrency epitomizes the volatility and potential of the digital asset market, with a remarkable 1,300% price surge in the past month capturing the attention of traders and investors alike.

This less-known coin’s leap forward, outpacing meme coin giants like Dogecoin, reflects a growing market interest and optimism.

The inclusion of Bonk on major trading platforms such as Bitmex and the endorsement by Binance for perpetual futures trading have bolstered its legitimacy and accessibility, contributing to the bullish sentiment.

As market participants digest these developments, Bonk’s trajectory serves as a testament to the rapid shifts in value that can occur in the evolving cryptocurrency landscape, underlining the importance of market sentiment and platform support in driving the success of digital assets.

Bitcoin as Cramer’s Pick

Financial expert Jim Cramer has endorsed Bitcoin as a worthwhile investment, highlighting its potential for significant growth in the cryptocurrency market. With a track record for recognizing valuable assets, Cramer’s advocacy underscores Bitcoin’s established status and maturation within the financial sector.

His guidance comes as Bitcoin continues to gain institutional adoption and recognition, suggesting a level of stability and long-term viability that is attractive to both retail and institutional investors.

Cramer’s recommendation reflects a strategic perspective, considering Bitcoin’s prominence and resilience in a volatile market. His endorsement could sway public sentiment, reinforcing Bitcoin’s position as a leading digital asset.

Investors looking to navigate the complex crypto landscape may find confidence in such expert backing, emphasizing Bitcoin’s role as a cornerstone investment in the emerging cryptocurrency ecosystem.

DOGE’s Millionaire Phenomenon

Amidst the fervor surrounding meme cryptocurrencies, the surge in DOGE millionaire wallets serves as a testament to the digital asset’s growing allure among affluent investors. The addition of 100 new millionaire wallets indicates a significant shift wherein DOGE is not just a cultural phenomenon but also a serious investment contender.

This trend reflects a broader acceptance of meme coins within the portfolio strategies of high-net-worth individuals, suggesting a confidence in the potential for substantial financial gains. The emergence of these wallets underscores the appeal of DOGE as a lucrative investment beyond its internet fame.

Analysts observe this uptick as a marker of changing investor sentiment, pointing to a landscape where meme coins are increasingly woven into the fabric of crypto-asset allocation.

Cardano’s Profitable Trajectory

Experiencing a noteworthy ascent in the cryptocurrency market, 33% of Cardano holders have realized profits from their investments. This figure underscores Cardano’s emergence as a formidable player within the digital asset space.

As an infrastructure coin with a robust technological foundation, Cardano’s profitability stems from both its innovative proof-of-stake mechanism and a growing ecosystem of decentralized applications.

The strategic positioning of Cardano, with its emphasis on scalability and sustainability, has garnered a significant investor base, thereby translating into tangible financial gains for a substantial proportion of its community.

Market analytics suggest that Cardano’s ascension is not merely speculative but is underpinned by a solid value proposition, which could propel it into a more mainstream adoption trajectory, further reinforcing its profitable status among discerning cryptocurrency investors.