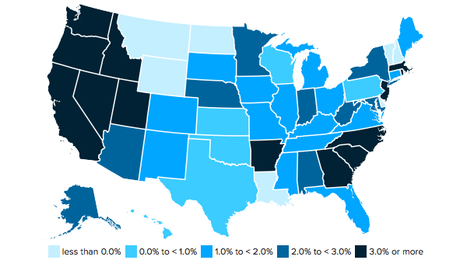

The chart above, from the Economic Policy Institute, shows the percentage rise in income in each of the 50 states. Here is what David Cooper and Julia Wolfe at EPI had to say about the income rising:

State income data from the American Community Survey (ACS), released today by the Census Bureau, showed that from 2015 to 2016, median household income rose moderately across the country, with all but 7 states and the District of Columbia posting gains in inflation-adjusted household income. The ACS report showed a 2.1 percent increase in inflation-adjusted median household income for the country as a whole—an increase of $1,157 in the annual income of a typical U.S. household. This is similar to, albeit slightly lower than, the 3.2 percent increase in household income that the Census Bureau’s reported earlier this week using data from the Current Population Survey (CPS). The ACS and CPS have different samples and cover a somewhat different timeframe, which can lead to slightly different estimates. In 2016, median household income ranged from $41,754 in Mississippi (17.5 percent below the median for the country) to $78,945 in Maryland (37.0 percent above the median for the country.) From 2015 to 2016, the largest percentage gains in household income occurred in Idaho, where the typical household experienced an increase of $2,922 in their annual income—an increase of 6.0 percent. Massachusetts (5.3 percent), Oregon (4.9 percent), North Carolina (4.4 percent), Arkansas (4.3 percent), and New Jersey (4.1 percent) all had increases of 4 percent or more. Twelve other states (Nevada, California, Utah, South Carolina, Washington, Georgia, Rhode Island, Alaska, Maryland, Arizona, Indiana, and Nebraska) experienced income growth that exceeded the national average. Median household income was essentially unchanged over the year, after adjusting for inflation, in 4 states (Hawaii, Oklahoma, Vermont, and Montana), and it declined in 5 states (New Hampshire, Delaware, North Dakota, Wyoming, and Louisiana) and the District of Columbia. The states with the largest percentage declines—North Dakota at 1.1 percent, Wyoming at 1.8 percent, and Louisiana at 2.5 percent—are all states whose economies are heavily dependent upon energy production. Thus, it is likely that these declines are the result of falling energy prices, which slowed economic growth in these states. While the widespread income gains in 2016 are welcome news, it is clear that we still have more work to do to fully recover from the Great Recession. Median household incomes in most states remained below to their pre-recession levels, after adjusting for inflation. In 2016, there were 27 states in which inflation-adjusted median household income was lower than it was in 2007. Moreover, there are 23 states in which household incomes were still lower in 2016 than they were in 2000—more than 15 years without improvement in living standards for typical households in these places. Policymakers should continue to pursue policies—like raising the minimum wage and expanding the right to overtime—that boost incomes, and the Federal Reserve should keep its foot off the brakes until the recovery reaches working people in every state and every sector of the economy.