English: Modified version of :Image:World map.png, which was created by John Monnpoly (Photo credit: Wikipedia)

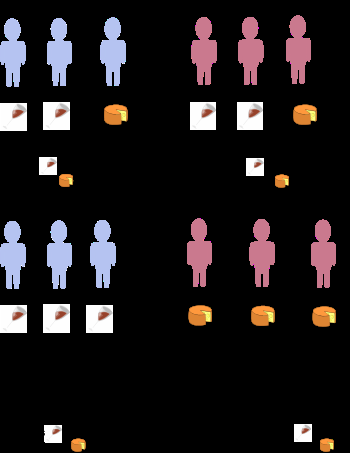

Avantage comparatif (Photo credit: Wikipedia)

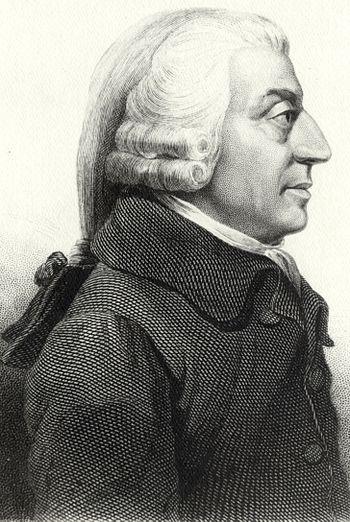

Profile of Adam Smith (Photo credit: Wikipedia)

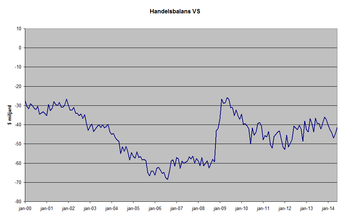

Graph of monthly trade balance figures of the US since 2000, in billions of US dollar, to be updated monthly, used in Handelsbalans, source of the figures: US Department of Commerce (Photo credit: Wikipedia)

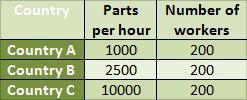

English: An example of absolute advantage. (Photo credit: Wikipedia)

Moscow: International Trade Center. (Photo credit: Wikipedia)

Triangle trade: Slaves being sold from Africa to The Caribbean, sugar from South America to New England, and Rum and other goods from North America back to Africa. (Photo credit: Wikipedia)

Here’s my Trade Theories Pinterest Board:

http://www.pinterest.com/socialmediaevie/trade-theories/

THEORIES OF INTERNATIONAL TRADE began to emerge in the 15th century. Here are some of the Trade Theories

A. Mercantilism is an economic theory and practice, dominant in Europe from the 16th to the 18th century. It promoted governmental regulation of a nation’s economy and attempted to augment state power at the expense of rival nations. High tariffs, especially on manufactured goods, are enforced.

“Mercantilism includes a national economic policy aimed at accumulating monetary reserves through a positive balance of trade, especially of finished goods. Historically, such policies frequently lead to war and also motivate colonial expansion.”

Mercantilists believed that nations should accumulate financial wealth, usually in the form of gold, by encouraging exports and discouraging imports. It was practiced from around 1500 to the late 1700s by European nations, including Britain, France, the Netherlands, Portugal, and Spain.

Mercantilist policies have included:

- Building overseas colonies;

- Forbidding colonies to trade with other nations;

- Monopolizing markets with staple ports;

- Banning the export of gold and silver, even for payments;

- Forbidding trade to be carried in foreign ships;

- Export subsidies;

- Promoting manufacturing with research or direct subsidies;

- Limiting wages;

- Maximizing the use of domestic resources;

- Restricting domestic consumption with non-tariff barriers to trade.

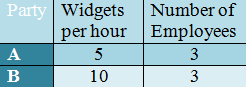

English: A table showing absolute advantage for party b. (Photo credit: Wikipedia)

1. How Mercantilism Worked

Trade was to benefit mother countries; colonies (in Africa, Asia, and North, South, and Central America) were considered to be exploitable resources.

Trade Surpluses ensued; the value of a nation’s exports exceeded the value of imports. Trade deficits were to be avoided at all costs.

Governments intervened in international trade to maintain a trade surplus. They banned certain imports, imposed tariffs or quotas, and subsidized home-based industries to expand exports. Removal of gold and silver from the nation was outlawed.

Colonialism involved the acquisition of colonies by mercantilist nations as a source of inexpensive raw materials as well as a market for higher-priced finished goods. “Trade between mercantilist nations and their colonies expanded wealth and created armies and navies to control colonial empires and protect shipping.”

Mercantilism was a flawed policy because it viewed international trade as a zero-sum game whereby one nation benefits only at the expense of other nations. “If all nations barricade their markets from imports and push their exports onto others, international trade would be severely restricted. Also, it kept colonial markets poor: they received little money for raw materials but were charged high prices for finished goods.”

B. Another Trade Theory is Absolute Advantage; the ability of a nation to produce more of a good product or service than competitors, using the same amount of resources. Adam Smith first described the principle of absolute advantage in the context of international trade, using labor as the only input.

“Since absolute advantage is determined by a simple comparison of labor productivities, it is possible for a party to have no absolute advantage in anything;[7] in that case, according to the theory of absolute advantage, no trade will occur with the other party. It is generally compared to the concept of comparative advantage which refers to the ability to produce specific goods at a lower opportunity cost.

Allegory of the Fredom of Trade (Photo credit: Wikipedia)

Return of the Bucintoro to the Molo on Ascension Day by Canaletto, 1732. Royal Collection, Windsor. (Photo credit: Wikipedia)

Absolute advantage is the ability of a nation to produce a good more efficiently than any other nation (produce a greater output using the same, or fewer, resources). Adam Smith reasoned that international trade should not be burdened by tariffs and quotas, but should flow according to market forces. A country should produce the goods in which it holds an absolute advantage and trade with others to obtain the goods it needs but does not produce efficiently.

Your textbook compares Riceland and Tealand.

In a world of two countries (Riceland and Tealand) with two products (rice and tea) where transport costs nothing, each produces and consumes its own rice and tea. In Riceland, 1 resource unit produces a ton of rice, but 5 units are needed to produce a ton of tea. In Tealand, 6 resource units produce a ton of rice, but 3 units are needed to produce a ton of tea. Thus, Riceland has an absolute advantage in rice production and Tealand has an absolute advantage in tea production.

a. Gains from Specialization and Trade

- Although each country now specializes and world output increases, both countries face a problem: Riceland consumes only its rice and Tealand consumes only its tea. The problem can be resolved through trade.

- Although Tealand does not gain as much as Riceland, it gets more rice than it would without trade. Actual gains depend on the total resources of each country and the demand for each good in each country (Figure 5.2).

- The theory of absolute advantage destroys the mercantilist idea that international trade is a zero-sum game. Because both countries gain, international trade is a positive-sum game.

- The theory argues against restrictive trade policies and for nations to instead open their doors to trade so their people obtain more goods more cheaply in order to raise living standards.

C. Comparative Advantage

Comparative advantage is the inability of a nation to produce a good more efficiently than other nations, but an ability to produce that good more efficiently than it does any other goods. Thus, trade is still beneficial even if one country is less efficient in the production of two goods, as long as it is less inefficient in the production of one of the goods.

1. Gains from Specialization and Trade

a. Suppose that Riceland now holds absolute advantages in the production of both rice and tea. In Riceland, 1 resource unit produces a ton of rice but 2 are needed to produce a ton of tea. In Tealand, 6 resource units still produce a ton of rice, and 3 units are still needed to produce a ton of tea. Thus, Riceland has absolute advantages in producing both goods.

b. Although Tealand has absolute disadvantages in rice and tea, it has a comparative advantage in tea; Tealand produces tea more efficiently than it produces rice.

c. By specializing and trading, Tealand gets double the rice than if it produced the rice itself, and Riceland gets twice as much tea than if it produced the tea itself (Figure 5.3).

2. Assumptions and Limitations

a. Assumes countries are only driven by the maximization of production and consumption. Governments get involved in trade for many reasons (e.g., concerns for workers or consumers).

b. Assumes only two countries engaged in the production and consumption of two goods. In reality, more than 180 countries and countless products are produced, traded, and consumed.

c. Assumes no transportation costs. In reality, transportation costs are a major expense of international trade.

d. Assumes labor is the only resource for production and is mobile within each nation but cannot be transferred. Other resources are clearly needed in production and labor is becoming more mobile.

e. Assumes specialization does not result in efficiency gains. In fact, specialization results in increased knowledge of a task and future improvements.

D. Factor Proportions Theory

Factor proportions theory states that countries produce and export goods that require resources (factors) that are abundant and import goods that require resources in short supply. Thus, the theory focuses on the productivity of the production process.

1. Labor versus Land and Capital Equipment

a. Factor proportions theory breaks resources into two categories: (1) labor and (2) land and capital equipment. It predicts that a country will specialize in products that require labor if labor cost is low relative to land and capital costs, and vice versa.

b. Factor proportions theory is conceptually appealing (e.g., Australia has much land and a small population; its exports consist of products that require much land whereas imports consist of manufactured and consumer goods).

2. Evidence on Factor Proportions Theory: The Leontief Paradox

a. Theory not supported by studies that examine trade flows.

b. Wassily Leontief tested whether the United States, which uses an abundance of capital equipment, exports goods requiring capital-intensive production and imports goods requiring labor-intensive production. He found U.S. exports require more labor-intensive production than its imports; called the Leontief Paradox.

c. One explanation is that factor proportions theory considers a country’s production factors to be homogeneous—particularly labor. But labor skills vary greatly within a country.

E. International Product Life Cycle

The international product life cycle theory states that a company will begin exporting its product and later undertake foreign direct investment as the product moves through its life cycle (a country’s export eventually becomes its import).

1. Stages of the Product Life Cycle

a. In the new product stage, stage 1, high purchasing power and demand of buyers spur a company to design and introduce a new product concept (Figure 5.4). Although initially there is virtually no export market, exports increase late in the new product stage.

b. In the maturing product stage, stage 2, the domestic market and markets abroad become fully aware of the existence of the product and its benefits. Demand rises and is sustained over a fairly lengthy period of time. Near the end of the maturity stage, the product generates sales in developing nations, and manufacturing is established there.

c. In the standardized product stage, stage 3, competition from other companies selling similar products pressures companies to lower prices in order to maintain sales levels. An aggressive search for low-cost production bases abroad begins and the home market may begin importing.

2. Limitations of the Theory

a. The United States is no longer the sole innovator of products in the world; new products spring up everywhere as the research and development activities globalize.

b. Companies today design new products and make product modifications at a very quick pace.

c. Companies introduce products in many markets simultaneously to recoup a product’s research and development costs before sales decline.

d. The theory is challenged by the fact that more companies are operating in international markets from their inception. The Internet has made this easier particularly for small and midsize companies. Also, small companies are more often teaming up with companies in other markets to develop new products or production technologies.

e. Yet the theory retains explanatory power when applied to technology-based products that are eventually mass-produced.

F. New Trade Theory

New trade theory argues: (1) there are gains to be made from specialization and increasing economies of scale; (2) companies first to market can create barriers to entry; and (3) government may play a role in assisting its home-based companies. It emphasizes productivity rather than resources.

1. First-Mover Advantage

a. As specialization and output increase, companies realize economies of scale, and unit production costs decline. Then companies expand, lower prices, and force competitors to produce at a similar level of output to be competitive.

b. A first-mover advantage is the economic and strategic advantage gained by being the first company to enter an industry. It creates a barrier to entry for potential rivals and may allow a country to dominate in a product.

c. Some make a case for government assistance; by working together to target new industries, a government and its home-based companies can be the first mover in an industry.

G. National Competitive Advantage

National competitive advantage theory states that a nation’s competitiveness in an industry depends on the capacity of the industry to innovate and upgrade. This theory attempts to explain why some nations are more competitive in certain industries. The Porter Diamond (the basis of national competitiveness) consists of: (1) factor conditions; (2) demand conditions; (3) related and supporting industries; and (4) firm strategy, structure, and rivalry.

1. Factor Conditions

Porter acknowledges the importance of basic factors (such as labor, natural resources, climate, and surface features) in what a country produces and exports, but adds the significance of advanced factors.

a. Advanced Factors

Include skill levels of the workforce and quality of the technological infrastructure. Account for the sustained competitive advantage that a country enjoys in a product.

2. Demand Conditions

a. Sophisticated buyers in the home market are important to national competitive advantage in a product area. A sophisticated domestic market drives companies to modify existing products to include new design features and develop new products and technologies.

3. Related and Supporting Industries

a. Companies in internationally competitive industries do not exist in isolation. Supporting industries provide inputs, forming clusters of related activities in the same region that reinforce productivity and competitiveness.

b. Exporting clusters are those that export products or make investments to compete outside the local area and can lead to long-term prosperity.

4. Firm Strategy, Structure, and Rivalry

a. Strategic decisions of firms have lasting effects on future competitiveness, but equally important is industry structure and rivalry among companies.

b. The more intense the struggle to survive among domestic companies, the greater is their competitiveness. This heightened competitiveness helps them to compete against imports and against companies that might develop a production presence in the home market.

5. Government and Chance

a. Government policies toward industry and export and import regulations can hurt or help competitiveness.

b. Chance events also can influence national competitiveness; they can help competitiveness or threaten it.

c. Porter’s theory holds promise but has just begun to be subjected to research using actual data on each of the factors involved and national competitiveness.

4. BOTTOM LINE FOR BUSINESS

COMMENTS ( 3 )

posted on 27 January at 20:14

I read this paragraph fully concerning the resemblance of most recent and previous technologies, it's awesome article.

posted on 26 January at 23:58

It's amazing in support of me to have a web site, which is beneficial for my know-how. thanks admin

posted on 13 November at 16:51

This is my first time pay a quick visit at here and i am truly pleassant to read everthing at one place.