Millennials have experienced the stock market and Great Recession making them a bit more risk-averse than prior young generations. Their debt is primarily in credit card bills and student loans. Because of the recession and slow job recovery, we have yet to see how they perform on mortgages and other major loans. According to a study done by Accenture, some 43% of them consider themselves to be conservative investors.

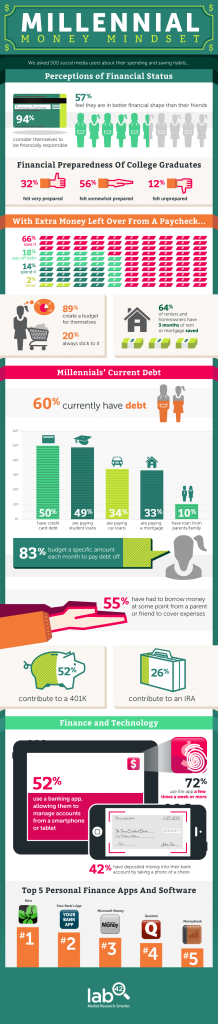

Nearly 9 in 10 Millennials create a budget for themselves, with the majority saving money and paying off debts. In terms of saving money, two-thirds of them save the cash left over from their paychecks and 18% of them pay off debt, according to a study by market research firm Lab42. About half of them, 52%, have student loan debt that averages $37,100 and 45% of them have credit card debt that on average totals $5,448, according to a study released last year by ING Retirement Research Institute.

But less we think they are all work and no play, some 41% of them say that vacations and travel are their most important reasons for saving money.

For more information, see the infographic below: