(The cartoon above is by Joel Pett in USA Today.)

(The cartoon above is by Joel Pett in USA Today.)The following post is by Sara Goddard at the Wonk Wire:

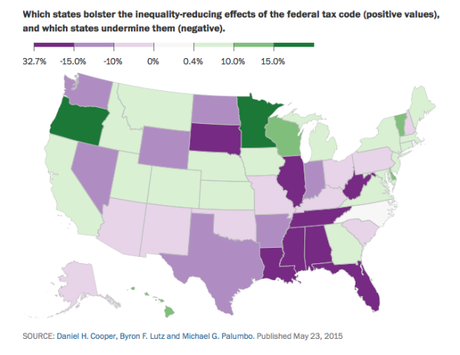

Christopher Ingraham: “We don’t usually think as much about the impacts of state taxes on inequality. A team of researchers at the Federal Reserve recently released a paper exploring the topic and found something, if not surprising, discouraging.” Many states “actually undermine the federal government’s anti-inequality measures.” “In essence, they take from the poor and give that money to the rich. I’ve mapped each state’s contributions to inequality reduction below. States in green have tax policies that build on the federal tax code, making the gap between rich and poor smaller. States in purple have tax laws that undo federal measures to address inequality.” “In some cases, the magnitude of the effects are quite large. The tax code of Tennessee, for instance, decreases federal anti-inequality efforts by nearly one-third.” “‘State-levied taxes, on average, work to exacerbate income inequality.’ There are a number of factors driving this, including state-level gas taxes, which tend to be regressive (everyone pays the same rate) and serve to moderately increase inequality.”