Singtel is really a big company. Its market cap is worth $50 Billion with over 650 Million mobile customers in 21 countries. Singtel was the first stock which I purchased when I started investing. That was probably 8 years ago now. The telecommunication industry is facing some headwinds and all 3 listed telcos share prices have fallen significantly. Singtel took the hit too and many investors added to their position hoping to get good value investing in a stable blue chip company with more than 5% dividend yield.

In this article, I will dissect Singtel's businesses so that we can understand it more on what is happening and what may happen in the future. Let's start off with its share price. Share price of Singtel has mostly traded in side ways until recently in early 2018 where it plunged to new low. It hit $3 before coming back up to above $3.20. Currently, share price of Singtel is at a 5 year low with dividend yield of more than 5%.

Financial Highlights FY2018

For FY2018, Singtel achieved an operating revenue of $17 Billion, which is a 4.9% increase from previous year. EBITDA came in at $5 Billion which is 1.8% higher than previous year. However, underlying net profit declined -8.4% from previous year due to lesser share of associates profit.

Share of associates pre-tax profit declined from $2.88 Billion to $2.46 Billion. This is a 14.6% decline which is quite significant. Earnings from Airtel India and Telkomsel were impacted by intense competition and mandated reduction in mobile termination charges in India, as well as lower contribution from NetLink NBN Trust following the reduction in economic interest of 75.2% in July 2017. The decline was partly mitigated by higher contribution from Intouch (acquired in November 2016).

For Singapore, Singtel achieved lower EBITDA of $2.18 Billion from $2.21 Billion in the previous year. This is a slight decline showing the resilience of its Singapore's business despite the tough competition. Optus, a wholly owned subsidiary in Australia achieved higher EBITDA of $2.90 Billion as compared to $2.78 Billion in the previous year. This is quite good performance at the Australia side.

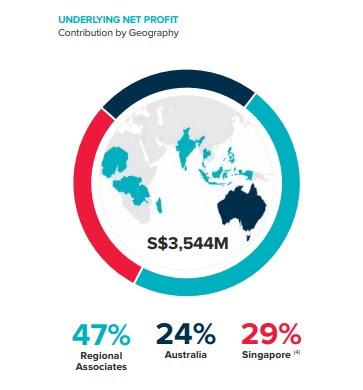

In terms of revenue contribution, Singapore only makes up 29% of its underlying profit with 47% coming from regional associates and 24% coming from Australia.

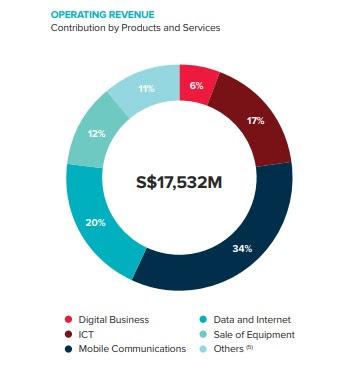

Singtel is quite a well diversified business and as we can see from the breakdown below, they are not just a mobile communications company anymore. Only 34% of its operating revenue comes from mobile communications and 20% comes from data and internet. They also have ICT and digital business which contributes about 23% in total to its operating revenue.

Dividend has been stable for the past 4 years at 17.5 cents. Singtel also made a commitment to continue giving 17.5 cents of dividend at least for the next 2 years. Looking at its group free cash flow (FCF) of $3.6 Billion which has increased from $3 Billion, I have no doubt Singtel can continue to give dividends in the future. Dividends paid to shareholders was about $2.8 Billion which is lower than its free cash flow. The free cash flow is the cash generated from operating activities minus the CAPEX. It is important to look at FCF to know the actual cash which the company has at the end of the day.

Singtel's Business Segments

Let me briefly go into Singtel's business segment to have an appreciation of the type of company it is becoming today. In fact, in its 2018 annual report, its theme was "ready, set digital". This shows the resolve it has to transform its business from a traditional telco company into a digital company. I believe this is the right was to go as areas such as cyber security, ICT, digital marketing and data analytics will be a huge market in the future.

Singtel has mainly 3 business segments for its business. They are group consumer, group enterprise and group digital life. Group enterprise consist of its ICT, cyber security, cloud and smart technologies business segments. Lastly, for group digital life, this consist of digital marketing (Amobee), regional premium OTT video (HOOQ) and advanced data analytics and intelligence (DataSpark).

Group Consumer

Group consumer is its business on mobile communication and all the telecommunication things which it has been doing all along. Operating revenue and EBITDA grew 2.7% and 2.3% respectively with growth in Australia partly offset by decline in Singapore.

In Singapore, operating revenue fell 2.7% impacted by fierce competition in mobile services and continued decline in voice services due to data substitution. Australia on the other hand did well where the increase in operating revenue was driven by strong customer additions in mobile and fixed broadband, increased Equipment sales and higher National Broadband Network (NBN) migration revenues despite the temporary suspension in connecting and migrating customers to NBN's HFC network. Optus also gained 384,000 customers in FY2018.

Group Enterprise

Group enterprise achieved stable operating revenue with growth in ICT and and equipment sales offsetting decline in traditional carriage services. ICT services had good contributions from cyber security, cloud and smart cities business.

Group Digital Life

For group digital life, this is still a growing business with strong operating revenue growth. This is a segment to take note of as its operating revenue doubled to $1.08 Billion driven by first time contribution from Turn (acquired in April 2017) and strong performance from Amobee's media and social businesses. While operating revenue is strong, EBITDA and EBIT still declined but at a lower amount. Amobee achieved positive EBITDA for the year while HOOQ's losses narrowed on higher operating revenue.

I believe group digital life will see a positive EBIT soon if revenue continues to have strong growth. Losses has narrowed from $190 Million to $120 Million.

Breakdown and analysis of Associates profits

The decline of associates profit of 14.6% is a concern and this, I believe is what is sending the share price down. The associates are in various countries as below:

- Telkomsel (Indonesia)

- AIS (Thailand)

- Globe (Philippine)

- Intouch (Thailand)

- Airtel (India & Africa)

Of all the associates, most are stable and growing except for Airtel's India business. There was intense competition and aggressive pricing by a new player which caused Airtel's revenue in India to drop 13%. In Africa, operating revenue is stable.

For other associates, Telkomsel had 5% revenue growth and 2% EBITDA growth. AIS had 5% revenue growth and 11% EBITDA growth. Globe had 7% revenue growth and 11% EBITDA growth. Intouch was newly acquired in November 2016. Intouch's post-tax contribution was S$86 million.

Is Singtel A Good Investment?

Singtel is weathering the change in the telecommunication industry. As we can see, apart from the competition in Singapore, else where around the world, India also has intense competition which affected its associates revenue. Singtel is rapidly expanding into other areas of business especially in the areas of cyber security and digital business. The future world will be really focused on smart nations where capabilities such as cyber security and data analytics will be in demand. I believe Singtel will see tremendous growth in these areas of business not just in Singapore but other parts of the world too.

At current dividend yield of more than 5%, this represents a good opportunity to invest in a blue chip company with strong free cash flow. Furthermore, the management has made a commitment to pay 17.5 cents of dividends for the next 2 years. I have added to my investment in Singtel on various occasions. This investment makes up the base of my portfolio now where I can look forward to stable dividends. I will be looking closely at the associates profit (mainly Airtel's India business) and the impact from the entry of the 4th telco in Singapore.

or follow me on my Facebook page and get notified about new posts.