Luckily now there are many different ways to do this, the easiest probably would be by putting everything on one credit card and then just looking at their breakdown at the end of each month, quarter or year. However, I love Excel and pivot tables and so I continue to do my recap by using Fidelity Full View to aggregate my spending, downloading that to Excel and then playing around with it in Excel a bit. You could just use Fidelity alone, but I like having some extra info, like what country I was in and whether my meals were breakfast or lunch. That is just me though and most people don't need this level of detail.

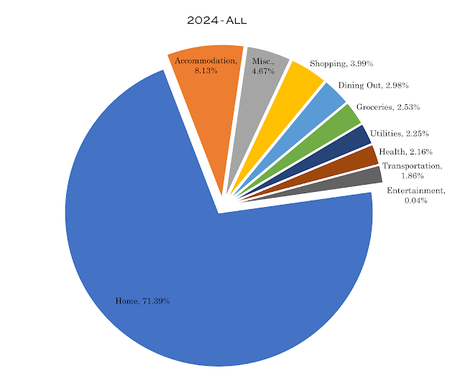

2024 was a strange year for me though, as I was only in a permanent place for the first three months of the year, and then I sold my house, which cost me an arm and a leg, and also made this the year that I spent the most in one year that I have ever spent before. This was despite the fact that once I started traveling, my average spend per month was about $2,600 a month. So this year's recap will be a little different; first I will show you the pie with the home costs included. Ridiculous, right?

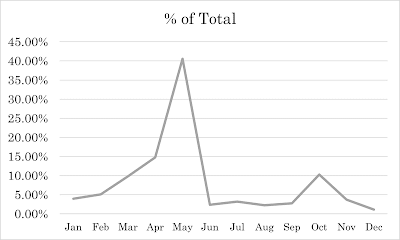

Also, here is a chart showing month by month. As you can see, I sold my house in May, and also had to pay for an (expensive) plumbing job in Octotober.

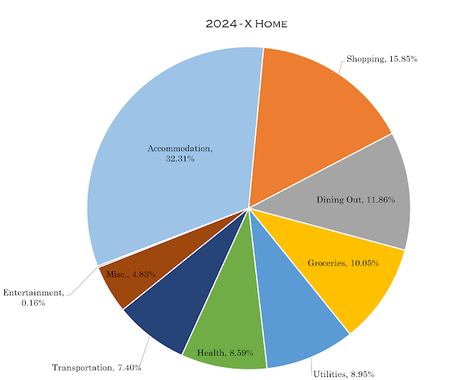

Next, I will talk about the costs excluding the home costs, since when I have them in, they make all the other slices way too tiny and skew the data too much.

From most to least, excluding the home category, here is where my money went:

Accommodation: 32.31%. This includes Airbnb, motels, hotels, camping, a subscription to the Warmshowers (cycling accommodation swap) network and a subscription to the Trusted Housesitters (pet sitting) network.

Shopping: 15.85%. This category includes toiletries, clothing, misc. home items & appliances, electronics and books. I also put any cycling related items in this category, which is why it is so high. I spent a lot of money on bike maintenance, bike accessories and gear, and I also got a new laptop. I probably should have put the bike mainenance in the transportation category, but...I didn't, and in 2025 I won't really have to worry about that as much.

Dining Out: 11.86%. This category includes eating out, coffee, booze and ice cream. This one is crazy, and way higher than normal for me, probably because I had 19 breakfasts, 43 lunches, 42 dinners, 48 coffees and 10 ice creams out, plus various drinks and snacks, bringing my total number of times dining out in 2024 to 192 times or basically once every two days! Yikes!! As a comparison, in 2023, this number was 52 (6 breakfasts, 16 lunches, 12 dinners, 16 drinks including coffee and 2 desserts), so I nearly quadrupled my normal amount.

When I stayed with or met up with people I often bought them a meal, so the dollar amount is a little higher than it would be otherwise. However, time spent with friends is priceless and so many of them (you!) were willing to put me up, and I appreciate that!

Groceries: 10.05%. Despite being on the road for much of the year and therefore having to buy groceries in smaller (more expensive) quantities, and more often (I went to the grocery store 162 times in 2024!), I only spent about $700 (or $58 per month) more in 2024 than I did in 2023. Go figure! I would have assumed it would have been a lot higher. I guess only being able to carry so much on the bike kept me from overbuying! Also I definitely dined out more than I normally do, so much of my food cost probably went to that.

Utilities: 8.95%. This cateogry is a new one for me, as I was putting some of these items in the Home category before, or the Misc. category, but now they bascially cover most of my fixed costs, aka non travel costs, such as computer security, credit card fees, phone, computer software, cloud storage, and subscriptions. I do pay a lot in credit card fees, but I used the bonus points from these to pay for four tickets to Germany, so I think it is worth it for the time being. I will reevaluate at the end of 2025 and will cancel any that are not worth paying for anymore.

Health: 8.59%. This category includes health insurance, out of pocket costs, massages, medicines and vitamins etc. I did most of my medcial stuff before I quit my job, which did cost me a little bit out of pocket, but the bulk of this is from my monthly insurance premium.

Transportation: 7.40%. This includes airfare, Lyft/Uber, public transportation, car insurance, maintenance, registration, gas, tolls, car rental & parking. Most of the cost here was gas, trains (I took Amtrak three times and Via Rail Canada once) and ride share, because when we were done riding from Canada to Mexico, we were in the middle of nowhere and it cost $250 to have someone pick me up and take me and my bike to El Paso.

Misc.: 4.83%. This category includes gifts, haircuts, legal fees, tax prep software and education expenses. I had to pay some taxes out of pocket. The biggest expense here was gifts by far; the second biggest was my CFA yearly fees, which cost about $300 per year.

Entertainment: 0.16%. This category includes music, theater, sporting events, museums, tours etc. However, the only thing I did was one "free" walking tour in Seattle, but otherwise, my entertainment in 2024 was mostly riding through or past places, walking around in towns, or eating, which is covered in a different category.

So, 2024 was a little unconventional and I am looking forward to seeing what 2025 brings. Just for fun, if I took what I spent for the year minus the home category and prorated it then adjusted it to be over a year again, I would have spent about 67% of my normal spending for the year at home in the Bay Area. This seems a little high so I am wondering if I will spend less for a year of international slow travel than I did for a year of moving every day but camping sometimes.

What do you think? Do you think I will spend less or more in 2025 than I did in 2024?

In 2025, I will give actual dollar amounts per month and will also break down which country I am in so that I can compare these at the end of the year. I know that some places I plan on being are known for being cheaper, but I am also curious to find out if some of the places that we (I) assume are more expensive end up being cheaper than I thought.

Do you track your spending? What was your highest spending category? How many times do you think you went to the grocery store and/or dined out last year?