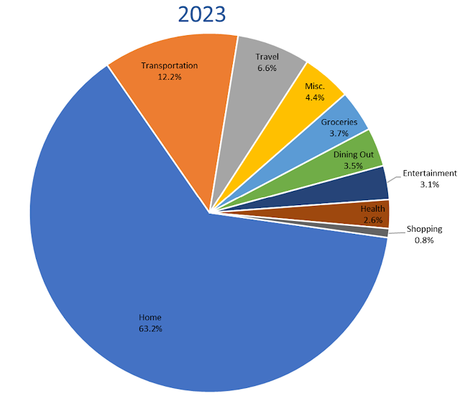

Who is ready for a slice of money pie? As you may know, I always do a debrief with myself at the end of each year to see where all my money has gone! I also do a quarterly net worth statement just to get a read on where things are, but I will not be posting that here! :)

Here are the categories in the order of largest percentage to smallest.

Home: 63.2%. Interestingly, last year my home category was 63.7% of my overall spending and in 2021 it was 64.1%, so I guess no matter how you slice it, the home category continues to be almost two thirds of my spending! This category includes mortgage, utilities, taxes and insurance, as well as other misc. items, such as home improvement, maintenance and furnishings. 80% of this number is mortgage and property tax. You may remember that I mentioned last year about how I was paying a little extra into my mortgage? This year, given the good rates on cash, I stopped doing that and put the money into high yield savings instead. Due to this, I decreased the actual dollar spending amount in this category by about 13% from last year.

Transportation: 12.2%. This normally includes Lyft/Uber, public transportation, car insurance, maintenance, registration, gas, tolls & parking, but this year I added bike maintenance and parking fees to the category as well. Despite commuting by bike from July to December, I still had public transportation costs, but the main culprit in this category was body work after my car got broken into. I also got four new tires for the Red Rocket and did a full body tune up on Bertha.

Travel: 6.6%. This category includes airfare, car rental, lodging and any groceries, dining out or transportation incurred while traveling. Although I did not travel internationally and much of my travel consisted of tent camping and eating my own meals, some of the other costs incurred during travel were quite expensive this year. I went to Alaska, and the rental car alone was about $1,500!! It was an SUV though and we actually slept in it several times, so saved on hotels, thank goodness. However, even with this, I spent about 50% less on this category than in 2022.

Misc.: 4.4%. This category includes gifts, haircuts, legal fees, fees for credit cards, tax prep software and education expenses. I had to pay for my yearly CFA dues, legal fees to set up a trust and annual credit card fees, but other than that, the bulk of this category was for gifts! (PS no haircuts in 2023 đŸ˜Š)

Groceries: 3.7%. This category went down by 38% from last year, mostly due to the fact that part of my purging process was to stop buying new stuff until I had used up older stuff! I would say that I did a pretty good job and have had fun being creative with cupboard items, but I still bought the regulars like butter, eggs, fresh veggies and cheese. My other saving grace for this category was less trips to Costco and/or only allowing myself to buy what I went in there for! I do have a tendency to grab yummy looking things oh a whim, but this year I put a stop to that! Funny though, out of my six visits to Costco, I bought tortilla chips on five of them. Some habits you just can't break.

Dining Out: 3.5%. This category includes eating out, coffee and booze. This one is a little misleading this year, as I decided that in an effort to spend time with people and have experiences rather than buying more things, I would enjoy meals with them! Given this, I bought meals for friends several times. I could technically call this "gifts," but for now I am going to leave it as dining out. However, it does inflate this category a bit, and I had a 200% increase over last year.

Entertainment: 3.1%. This category includes music, theater, sporting events, cycling and running & camping expenses. In 2023, I went to two shows (Les Mis and Book of Mormon), a couple of sporting events, but my biggest categories for this are still running (32%), hiking (20%) and cycling (19%). My biggest purchases were race fees (three races), a new GPS watch and a new rain jacket.

Health: 2.6%. This category includes health insurance, out of pocket costs, massages, medicines and vitamins etc. This year most of my visits were covered as preventative, so the bulk of this cost is the insurance itself.

Shopping: 0.8%. This category includes toiletries, clothing, misc. home items & appliances, electronics and books. Basically this year I bought three things in this category: a new camera, a 3-pack of underwear that I hated and feminine products. Trying to purge more has really made me think about things more before buying. Also some of the camping etc. items I did buy are included under the entertainment category.

I do also put some money aside for investments and saving each year, but since this money is not yet "spent" I do not count it in this analysis. I also do not include income taxes, but if I did, they would probably be my highest category! However, since I don't have much control over them, I am going to leave them out for now.

Do you do a yearly review of your finances? Do you have a budget? What is your biggest spending category?