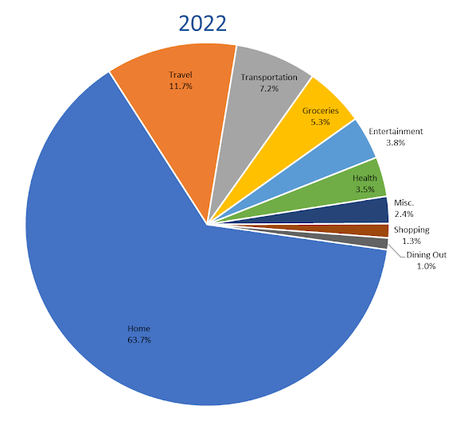

Well jeez, it is that time of year again! Who wants a slice of money pie? As you know, I always do a debrief with myself at the end of each year (and a check in each quarter although I do not bore you with those details) to see where all my money has gone! You can find past years here.

Here are the categories in the order of largest percentage to smallest.

Home: 63.7%. Not surprisingly, this category continues to lead the pack and this year's 63.7% was pretty much the same as last year's 64.1%. This category includes mortgage, utilities, taxes and insurance, as well as other misc. items, such as appliances, stuff from the hardware store, home improvement and furnishings. The bulk (73%) of this category consists of mortgage payments, partly because it is large, but I also contribute a little bit extra to my principal each month.

I did do a few things around the house like fixing my furnace ($150) but nothing big (like last year's > $1,000 tree trimming). I think with this category, no matter what you do to cut costs, there is always something. This year, due to rising costs, my PG&E (electric and gas) bill was basically double last year's bill much of the time.

Travel: 11.7%. This category includes airfare, car rental, lodging and any groceries, dining out or transportation incurred while traveling. Although most of my travel consisted of tent camping and eating my own meals, some of the other costs incurred during travel were quite expensive this year. I spent about $500 more on my international flight than I did in 2019 so it makes sense that airfare was about 36% of the travel expense (next highest was lodging at 25%)!

Transportation: 7.2%. This includes Lyft/Uber, public transportation, car insurance, maintenance, registration, gas, tolls & parking. Although gas prices were through the roof this year, I actually spent about the same as I usually do in this category. I definitely spent less on public transportation because I had some credit left over from 2020 on my transit card, and I did not have to do any major car maintenance.

Groceries: 5.3%. I guess we all have to eat and I definitely did not skimp in this category (however, my dining out category was basically nonexistent). My weakness is Costco; I cannot get out of there without spending at least $100 (and sometimes a lot more). However, their egg prices are still the best ones in town right now (about $12.00 for five dozen). But I never just buy eggs!

Entertainment: 3.8%. This category usually includes music, theater, and running & camping expenses. This time I added cycling to the mix and I bought both a stationary bike and a mountain bike, so the bulk of the number is split between running (39%) and cycling (38%). Most of my running number is race fees (three races) and shoes (five pairs - when they are on sale, I stock up).

Health: 3.5%. This category includes health insurance, out of pocket costs, massages, medicines and vitamins etc. I don't really pay many or any out of pocket fees that don't get reimbursed, but the premium each month is not super low. However, if I had to pay for my own insurance rather than group insurance, it would be about two to three times higher, so I am happy!

Misc.: 2.4%. This category includes gifts, haircuts, fees for credit cards, tax prep software and education expenses. I only got one cheap haircut and did not pay for any education this year, so most of this was gifts!

Shopping: 1.3%. This category includes toiletries, clothing, misc. home items & appliances, pet stuff, electronics and books. The majority of this went to the cat (flea treatment and litter ain't cheap!) and the next biggest expense was the bidet!

Dining Out: 1.0%. This category includes eating out, coffee and booze. As you can see, it was my smallest category, which makes sense as I do not really eat out much. The bulk of it was really two dinners where I treated, but otherwise, this category was tiny.

However, don't be completely fooled, as I do categorize any dining out that is done on a vacation as "travel." This is why I like to look at the combined categories of Dining Out, Travel and Entertainment to kind of gauge where I am with my fun spending items. If you look at them all together, they would constitute 16% of my overall spending.

I also have two categories that I do not put on here since they are not actual money spent, but I do put some money aside for investments each year and some aside for savings. I think that it is very important to do both, even if the amount is minimal, and especially if you can do it before taxes. You can find more info in this post about how I feel about setting money aside.

Do you do a yearly review of your finances? Do you have a budget? What is your biggest spending category?