Geopolitical risks are mounting in Turkey, and the lira is on a steady decline for the 8 th consecutive week against the dollar.

Coronavirus relief package talks in the US continue to remain sluggish. The size of the bill is the point of contention between the two parties.

The contest between President Trump and Joe Biden becomes stiffer, as the election date, Nov 3, comes closer.

Brexit talks are intensifying, but sticking points prevent conclusive talks between the two countries.

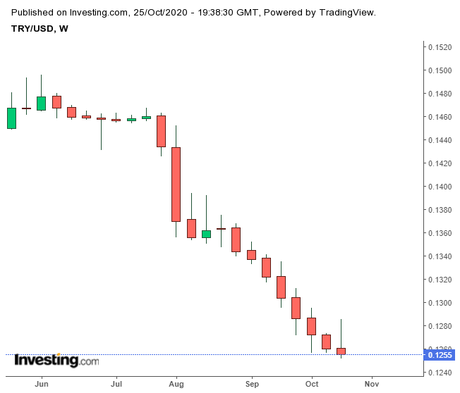

TRY/USD

Lira Falls For 8th Straight Week

Turkey's central bank has kept interest rates unchanged, disappointing investors and experts. On Thursday, the central bank of Turkey kept rates at 10.25%. Analysts expected a hike in interest rates to curb inflation in the country, but rates remain unchanged. Many experts had asked the government to raise interest rates to keep inflation under control.

The Turkish currency has weakened with poor economic conditions in the country. Political tensions are creating chaos and not helping the current situation. On Thursday, the lira plunged to record lows by losing 1.6% after the move from the central bank to tighten the money supply in the economy.

The currency has been declining continuously for the 8 th straight week. It has dropped from high levels at 0.1370 in the last week of July. It then dropped to 0.1286 by the end of September and continues its fall in October to the current rate to 0.1250 levels on Friday, 23 Oct.

In September, the government had brought a steep hike in interest rates from 8.25% to 10.25%. Investors expected another hike in October to attract foreign investors into the country. It was a sudden move that spared the Turkish currency momentarily from its continuous decline.

The current move will help central banks in Turkey to raise average lending rates without bringing an increase in the benchmark rate.

The Turkish currency has come down by more than 30% against a basket of major currencies this year. It has been the worst-performing currency so far.

The Fall of the Lira

In 2018, the lira crashed as interest rates fell below inflation. The central bank had to hike interest rates to 24% to bring the currency under control.

In 2020, the central bank is taking steps to prevent the depreciation of the lira. By selling foreign currencies and dollars from its reserves and domestic banks, the central bank is buying the lira.

Early in 1999, political uncertainty brought the government to a halt, and the lira crashed with the growing chaos in the economy. Immediately later, an earthquake further dented the economy, and there was an economic crunch that took its toll on the Turkish lira.

However, the economic shake-up has made foreign investors abstain from investing in Turkey. They have left the currency bond market and sold their stocks in the Turkish market. About $5.7 billion worth of stock is sold by foreign investors in the Turkish market recently.

Further, the US sanctions are hurting the economy. The pandemic which has shattered the global economy has brought trouble to the Turkish economy too. The credit growth has not slowed down, say experts.

Policy mistakes are costing the country, say a few critics. The government is not helping to bring a balance into the economy.

The USD/TRY came close to hitting the psychological resistance at 8.0 levels. The USD/TRY reached up to a high of 7.9767 before closing at 7.9617 on Friday, 23 Oct.

USD Index

Election Expectations Keep Investors Wary about the US Dollar

The US Dollar Index continued to trade below the 93.0 level last week. On Friday, 23 Oct, it closed at 92.75 levels. The forthcoming elections keep investors wary about investing in the market. The US Dollar Index is just near its seven-week low, and the Dollar Index fell 0.2% against other major currencies.

A fresh coronavirus package continues to evade the US. Speaker Nancy Pelosi says "it is up to President Trump to act". But Treasury Secretary Mnuchin says, "The deal is possible with a compromise from Pelosi".

GBP/USD, EUR/USD

The Pound fell against the US Dollar and the Euro last week after the data from the Purchasing Managers Index dropped to a four-month low. The British Pound fell 0.4% on Friday; however, it is up 0.9% for the week. The GBP/USD closed at 1.3040 levels on Friday, 23 Oct. The Sterling strengthened on Wednesday, Oct 21, with hopes of an agreement on the Brexit talks, but was unable to move in the positive direction, with talks still held up.

The Euro strengthened against the dollar and was up 0.3% on Friday, 23 Oct, as it went back to the 1.1850 levels on Friday, 23 Oct. The EUR/USD has been moving within the 1.1810 and 1.1850 levels for three days.

USD/JPY currency pair declined to 104.77 level, driven by the US election uncertainty.

The Beige Book of Federal Reserve has suggested that the US economy is improving at a "slight to modest" pace. Weekly jobless data to be released this week will give further clarity on the economic conditions.