Ever since the first Lebanese beer was produced eighty years ago, the local beer market has been dominated by a single brand for the majority of its history. However, over the past few years, a new craft beer movement, which has changed the beer market landscape throughout major markets, is currently challenging the status quo in Lebanon by introducing a more diversified lineup with new styles and tastes.

Written by Issa Frangieh as part of BLOM Bank’s Weekly Lebanon Brief”

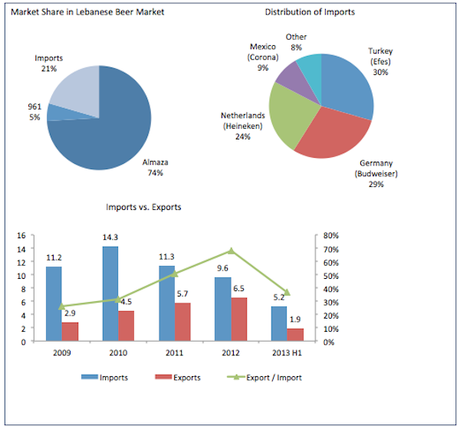

The market size for beer consumption in Lebanon is estimated at 29 million liters annually, placing the country in the 90th position internationally from a basket of 123 countries on a per capita basis. Almaza, the market leader, accounts for 74% of the local market, or 21.7 million liters. Foreign imports such as Budweiser, Heineken, and Corona account for 21%, while the share of 961, a relatively new craft brewery, is estimated at 5% or 1.6 million liters.

The Lebanese beer market with 5.5 liters per capita has considerable room for growth when comparing Lebanon to the United States with 80 liters per capita or Europe with 75 liters. However, when considering that roughly half the country doesn’t drink alcoholic beverages for religious purposes, the practical ratio would be double or 11 liters per capita. This low ratio can be attributed to cultural differences where beer in Lebanon is consumed mostly to quench thirst or during a nice day at the beach. In contrast, consumers in Europe and the United States treat beer as the primary drink of choice at meals and parties, and even on a daily basis to unwind after a long day’s work. The key reason behind this difference in consumer behavior is that beer in Lebanon has taken a back-seat to the blossoming wine culture, which boasts over 30 wineries. This doesn’t come as a surprise since the country’s natural environment favors wine production. Thus, for most of its modern history, Lebanon has had one brewery to call its own.

Founded in 1933 by the Jabre family and their friends, Almaza continues to be the largest brewery in Lebanon producing an estimated 24 million liters annually. Its brand is recognized across the globe as the ultimate Lebanese beer bringing nostalgia for those who encounter it abroad, while enjoying a loyal following at home. Its dominance in the local market has been established through two key events: In the early 1960s, one of the founders met with Amstel, later acquired by Heineken, and offered them a 10% share in the Lebanese brewer in return for their technical supervision of the production process. This enabled Almaza to reform its operation and considerably expand its capacity while improving the quality of its beer. The second event was the move of Heineken into Lebanon, where it acquired both Almaza and Laziza in 2002 and 2003, turning the latter into a non-alcoholic beer and thus strengthening Almaza’s position in the marketplace as the sole Lebanese beer.

By definition, a craft brewery is a relatively small, independently-owned brewery that employs traditional brewing methods emphasizing flavor and quality. The craft beer movement that recently exploded in the United States and has existed in Europe for hundreds of years, is at the center of changing consumer behavior in relation to beer. To put this into perspective, the total number of breweries in the United States rose from 42 in 1978 representing the mainstream beers to 2,750, according to the Brewers Association, with another 100,000 individuals brewing in their own homes for personal consumption. The styles on offer are limitless with a blend of flavors that can suit each and everyone’s taste pallets.

Looking back at the Lebanese beer market, it seems Lebanon is lagging on this new movement. But considering the security and political challenges that keep most citizens occupied, we can at least say that we’re in the right direction. While 961 may be the only craft brewer found on the market, demand for its products and quick gains in market share confirm Lebanese consumers are welcoming new beer styles. Mr. Hajjar states that “Lebanese are tough consumers, it takes a lot to have them change their minds once it’s set”. This is no surprise, as most Lebanese had never tried a craft beer before trying his 961, which has a richer more complex flavor than what they’ve been accustomed to throughout their lives. He adds that “mass-producers market beer as an adult soft-drink, which should no longer be the case. Beer should be part of the culinary experience; you don’t drink the same wine with meat and fish, why should you have the same beer.” In fact, when visiting 961’s website, there’s a section dedicated to pairing beer with food and cheese. For example, their wheat beer goes well with vegetarian mezze while the red ale makes a better complement for “kebbe” or “shawarma”. Almaza has also taken note of this new trend and introduced a dark beer of its own labeled Pure Malt, along with a light beer; however the company did not wish to comment for this study.

Speaking with Mr. Hajjar of the viability of the brewing business in Lebanon and the possibility of other brewers popping up, he responds that 961 is yet to be profitable. The costs associated with the business are discouraging, especially since most of his key ingredients are imported from Germany, Czech Republic, and the United States. This applies to anyone wishing to brew here, including Almaza which imports from the Netherlands, as the grains needed to produce beer are not available in Lebanon. Shipping costs are thus added into the equation, along with customs and taxes that can significantly hurt the bottom-line. Even bottles are imported as the glass industry, an energy-intensive business, suffers from high utility costs in Lebanon which can only be forwarded to the end-buyer. However, brewers cannot escape the high electricity bill, as it’s needed to heat and cool their batches, control room temperature, and operate machinery. Mr. Hajjar estimates his electricity bill to be around 10-fold that of a similar brewer in a more developed country such as the United States or in Europe.

While commercially operating a brewery seems to be a stretch for most Lebanese, home-brewing may be the answer to create a more diversified marketplace. Recently, a new beer under the name “Schtrunz” was launched through a beer tasting event, introducing various new styles to enthusiasts and social drinkers alike. Mr. Emile Strunc, a Lebanese of German descent, has been brewing in his home for recreational purposes since 1995. When asked on whether he wishes to expand and offer his product widely, he responds that he’s taking his time and enjoys brewing not just as a business, but as a passion. Recently, he increased his production abilities to 100 liters per brew. If he wishes to launch commercially, then he can brew three times per week, bringing his annual capacity to 15,000 liters of handcrafted beer. Ideally, he would like to raise this to no more than 500 liters per brew in order to maintain his close involvement with the various stages of production, resulting in 75,000 liters annually.

Mr. Strunc, an astute business consultant, treats the current stage as market research where he’s maintaining close proximity to the Lebanese consumer through face-to-face contact in order to receive immediate feedback on his product. He reads people’s reactions as they try the specialty beers he offers, such as the Black IPA that people either love or hate, a dark wheat beer that’s filled with flavor, or a refreshing Kolsch – which is known to be brewed only in Cologne, Germany. When asked on whether he encourages others to pursue home-brewing, he responds that “in order to become a craft brewer: (1) you need to have a passion (2) you need to use 100% grain (3) you can only use the purest yeast strains and hops.” While the first rule may exist for many, the second and third set a challenge as it would require one to import before even going through the learning process.

As for how the beer market is performing in 2013, it appears beer consumption is down y-o-y as businesses in general struggle with the economic challenges in the country due to the political stalemate. 961 has been growing sales by adding new outlets as it still covers only a partial share of the retail distribution channels. The brand recently just became available at supermarkets as it took considerable effort to get placed next to established brands with strong relationships. When asked if 961 will be increasing its capacity, Mr. Hajjar responds “we’re not investing here until further clarity is reached on the political landscape.” It has also been a tough year for both Almaza and 961 as a considerable share of their business is exported to Syria, which they’ve been unable to properly execute.

Exports constitute a significant share of the brewing business. We estimate Almaza to export roughly 10%, or 2.33 million liters annually, to various destinations such as Syria, United States, Turkey, and UAE. As for 961, they started exporting in 2012 and are now targeting to export more than half their production, as the company is able to charge much more internationally. For example, their 6-pack in Australia is priced at $25 in stores, whereas in Lebanon, they’re priced at around $6. This offers 961 better profitability sorely needed at this stage of the business, as it’s grown to a mature operation that should be generating profits. In Lebanon, consumers are highly price sensitive as most still treat all beers the same because they’ve never had exposure to craft beer. With industrially produced beer, the large operation benefits from economies of scale enabling them to charge within the LL 1500 – LL 2000 range at the retail level. Furthermore, the cost to produce a craft beer is almost double that of an industrial beer due to the quality and quantity of ingredients needed to create its distinguished taste. A 330 ml of craft beer in the United States can fetch up to $10 a bottle; it’s treated as a luxury drink to be savored. With all these factors, 961 may soon have to raise their prices in the Lebanese market with the hope that their market penetration strategy pays off. The main bet here would be that after consumers have tried their product, they not only switch to 961, but will accept paying a premium for their beer. While still small in size, Schtrunz Beer already charges LL 5000 for its beer, and is barely able to keep up with demand; its business is still being generated only through word-of-mouth.

If a change in consumer behavior eventually does materialize, where beers may be priced at double or triple others as with wine, we can expect to see new brewers popping up in the market to capitalize on this trend. Lebanon, as usual, will eventually catch up and perhaps one day brew a beer culture of its own.

Written by Issa Frangieh as part of BLOM Bank‘s Weekly Lebanon Brief”

Expect two new breweries to enter the market in 2014 of which one main competitor to Almaza produced by Kassatly Chtaura.

COMMENTS ( 1 )

posted on 02 September at 23:00

After searching google all night i finally got in...

sweetandmessydiscount Account - http://discount.sweetandmessy.com/track/MTU5LjUuMjAuMzM5LjAuMC4wLjAuMA