There have been numerous changes to the banks' interest rates in Singapore lately. As interest rates rises for loans, good news for savers who have savings in the bank as the interest we can get on our savings account is increasing as well.

However, the interest on normal savings account is still not increasing but the banks have come up with more creative ways to attract customers and offer higher interest with some small conditions. Let's take a look at which are the best high interest rates account in Singapore today?

This is the bank account which I have most of my money in right now. They have revised their interest rates upwards without me not having to do any additional thing from before so those who already own this account will be happy to hear that as well.

The conditions is simple for this account. Let me summarise it:

- Salary credit of at least $2000 to OCBC 360 and you will get 1.2% on first $35,000 and 2% on next $35,000.

- Spend at least $500 on OCBC credit cards and get 0.3% on first $35,000 and 0.6% on next $35,000

- Increase account balance by at least $500 as compared to the previous month, get 0.3% on first $35,000 and 0.6% on next $35,000

- Insure or invest with OCBC Bank and get 0.6% on first $35,000 and 1.2% on next $35,000

In summary, those who hold more than $35,000 to $70,000 in OCBC 360 account will enjoy much higher interest than before. As you can see, just by having salary credit will earn you 2% for the next $35,000 in the bank account which is quite a decent interest rate to me.

$70,000 savings in OCBC 360 account with salary credit will get you interest of $1120 per year just like that. This is close to $100 per month free money.

For those who have extra cash lying around, CIMB fastsaver account is a no frails account which gives up to 1.5% interest with no conditions at all. It was 1% previously for first $50,000 in the account but they revised it to include 1.5% for the next $25,000.

This is quite a good account which I am using also. No salary credit, no credit card spend or anything required at all to earn that higher interest.

Standard Chartered Bonus$aver - $100 account opening special

The next account gives pretty high interest for those who can meet its conditions. With salary credit of at least $3000 and spending of $500 per month, you can get 1.78% interest on the first $100,000. If you can spend $2000 per month with the salary credit, then you get a very substantial total interest rate of 2.78%.

- Salary credit of at least $3000 with monthly credit card spend of $500 - 1.78% p.a.

- Salary credit of at least $3000 with monthly credit card spend of $2000 - 2.78% p.a.

You can pair this savings account with the SCB unlimited card to meet the spend category. This card also gives unlimited 1.5% cashback on all eligible spends. You can apply for the card here and get $100 cash + up to S$120 cashback from SCB.

The last account worth mentioning is the DBS multiplier account. Previously, they only give higher interest for the first $50,000 in the bank account but this has been revised to $100,000. However, there are certain conditions and it may be a little complicated for those who are new to this account.

Getting higher interest on the first $50,000 is easy as we just have to have our salary credited and have another category such as credit card spend. This will earn us at least 1.55% on the first $50,000 only. For the next $50,000 to earn higher interest, we'll have to have our salary credited plus additional 3 or more categories such as credit card spend, home loan installment, investment or insurance. You can get a minimum of 2% interest on $100,000 in your bank account if you meet the above salary credit + 3 or more other categories. Otherwise, in my opinion, the OCBC 360 still works better to get higher interest for the first $75,000 without having to meet so many categories.

Best Cashback Credit Card

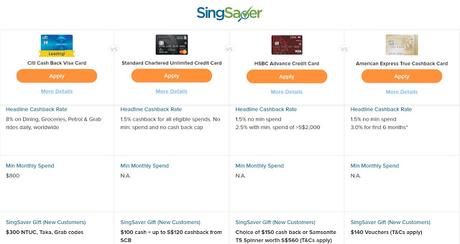

Apart from getting higher interest on our savings in our bank accounts, we can also get cashback for our spending with cashback credit cards. I saw this promo by Singsaver on the Citi Cash Back card which they aregiving out $300 NTUC, Taka or Grab codes for new customers. This is surprisingly quite a generous offer to give out $300 worth of vouchers.

Citi cashback credit card offers 8% cashback on Dining, Groceries, Petrol & Grab rides daily, worldwide with a min. spend of S$888 per statement month. You can apply for the Citi cashback card here to claim your offer or view other cashback cards available here.

Click on the above image to find out more!

Let your money roll!

I've always try to make the best out of my money with all the deals out there. The interest which I get on a high interest bank account such as the OCBC 360 is far better than what I would get in a normal savings account. It just takes the initial setup to open the bank account and thereafter the interest will be credited to my savings account on a monthly basis. I can get more than $100 in interest per month just like that.

Pairing the high interest savings account with cash back credit cards is a smart way to make our money work harder for us. Hope this article helped you in searching for the best savings account and cashback credit cards out there with the deals you can get at this moment.