We are undoubtedly seeing a financial crisis unfolding before our eyes due to the COVID-19. Because of the lockdown of many countries around the world, governments have effectively created bigger problems to solve moving forward. Many investors have been preparing to take the opportunity of a lifetime to invest during a crisis. There was excitement at first when stock prices drop drastically and many investors started to buy stocks. The only past similar pandemic which we thought we have seen before is the SARS crisis back in 2003. No one would have imagined that the COVID-19 turned out much worse than the SARS crisis and now we are preparing for an even unpredictable future ahead.

There is no doubt many stocks are at attractive valuations now including blue chips and REITS. The problem now is many valuation methods are forward looking but there is no way we can analyse how the future will be and how a company will perform in the future. If we use macroeconomic factors to analyse sectors and industries to buy stocks, it is also very difficult now because many economists will not even know how the future will be. In the end, how the financial future will look like will depend on government policies and regulations.

Welcome to investing in a crisis

Many of us have been preparing for a crisis to happen so we can buy stocks at great prices. This has happen over and over again in the past such as the GFC, AFC and other crisis. The stocks market always goes back up isn't it?

Yes, indeed the stock market always goes back up after a crisis. However, what was not told to us is many companies also don't survive a crisis. It is therefore of utmost importance that we focus on whether a company can survive when investing during a crisis.

I myself am investing during this crisis and it has been a roller coaster ride. I know that losing money is part of investing during a crisis but the psychologically effects of losing money is still hard to stomach. My greatest worry nowadays is whether the companies I invest in will survive this downturn. It is really hard to predict but we definitely can use some financial knowledge to reduce the risk of losing our money entirely. I shall explain some of the things I look into for my investments now.

Focus on the balance sheet and cashflow statement

During a crisis, most companies earnings will take a hit. Many companies will report drop in revenue and profits. Without the revenue to pay their staff salaries, rental, loans and other business expenses, many companies will have to dig into their pockets. If they have no cash in their pockets, they may have to close down entirely and file for bankruptcy. This is how a company will not survive a crisis. We must remember cashflow is the life of a business especially during a crisis.

With lockdown in Singapore, many companies are suffering. Tourism is the worse hit as there are no more tourists in Singapore and places such as hotels, tourists attractions and other businesses which depend on tourists for revenue will be greatly impacted. Let's look at a company Genting Singapore which is no doubt the worse hit company during this COVID-19 pandemic. The resorts world Sentosa is totally closed down during the circuit breaker period in Singapore. In the near future, tourists arrivals to Singapore will probably still be low so their revenue will definitely be affected. Can this company survive?

Genting Singapore has initiated cost cutting measures and cut their staff pay by 9-18%. The good thing is the Singapore government is also paying 75% of staff salaries for Genting Singapore employees. Staff cost came up to about 448M in FY2019 for them. Looking at their balance sheet, they have 3.9 Billion in cash which can pay for about 8 years of staff salaries even if they don't make any money. This is really a huge sum of cash they have. Their current liabilities which includes borrowings is at 703M. With their cash, they can also pay of their current liabilities if needed. If you're confused on current assets and current liabilities at this point in time, you might want to read my post on the balance sheet to understand more.

We can use the current ratio to determine if a company is in good financial standing. A current ratio of more than 1 generally means they are able to meet short term obligations if they were to be due all at once. For Genting Singapore, their current ratio is a healthy 5.87. On the other hand, if we look at another company, Singapore Airlines (SIA), their current ratio is a low 0.44. This means they are not able to meet its short term obligations such as repayment of loans in the next 1 year. This is the greatest red flag but nevertheless, the Singapore government has pledged to make SIA survive at all cost. However, this will definitely not be good for shareholders as their share value get diluted. At the time of writing, SIA shares have fallen to below $4 from a high of $9 at the beginning of the year.

How to analyse REITs and Trusts during a crisis

Another ratio we can look at is the interest coverage ratio. It is used to determine how easily a company can pay their interest expenses on outstanding debt. The ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) or Net Property Income (NPI) by the company's interest expenses for the same period. This ratio is often used for REITs. When a company's interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable. The ability the pay interest expense is important for REITs as majority of them are financed by debt. If they are unable to meet their debt obligations, the REIT will just collapse as what we have seen recently for one company, Eagle Hospitality Trust.

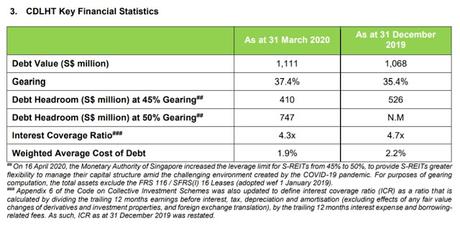

Let's look at a company in the hospitality industry, CDL Htrust. Its interest coverage ratio was 4.7x as at 31 Dec 2019. Of course this would have changed now and also in future as CDL Htrust income would have reduced and thus the interest coverage ratio will be lower. They had provided an operational update as of 31st March 2020 and indeed their interest coverage ratio dropped to 4.3x. This is after factoring the first 3 months of COVID-19 impact only. I suppose the next quarter will be worse.

Another important ratio to look at is the gearing ratio. This is the debt of a company relative to its equity or other financial metrics. For REITs, the gearing limit is 45% but now MAS has increased it to 50% to allow REITs to have more flexibility to get more borrowings if they need to survive. MAS has also relaxed the rule that mandates REITs to pay out 90% of their income to shareholders. This means REITs can now retain more of their income to strengthen their financial position.

Emerging out stronger from the crisis

If we invest in the right companies and they survive this crisis, we will definitely emerge out stronger from this crisis. Many have made their money through past financial crisis where at that time many people feared the markets. It is therefore not easy to invest during a crisis as most people would succumb to the psychological effects of losing money before the crisis is over.

Many of us have prepared for many years waiting for a crisis to happen before investing and now a crisis has happened. However, I suppose many of the same people who were waiting all their lives have trouble putting their money into the markets now out of fear of losing money. I would think this crisis will be a long drawn one and it will take time for the markets to recover. It won't be easy investing during these times as anytime the companies can go bankrupt and we will then surely lose money.

I have diversified all my investments to invest in different sectors and industries and I'm cautious not to put too much money into a single company. Focusing on whether a company will survive is of utmost importance during times like this. If a company has strong financial standing, they are able to take advantage of opportunities during a crisis and emerge out stronger. This is like us who have savings and we are able to look for opportunities to put our money in the right investments and emerge out stronger after this crisis. Without savings, we can't do anything in the first place and may lose our jobs (revenue) and end up worse. This goes the same for companies in the corporate world.