An unexpected fall in German industrial output in December ensured any hopes of a bounce post late 2018 bear market were stifled. It was only a matter weeks ago that we had more data out that was placing Germany in to a recession and this week, the death blow was finally dealt. Importantly, it acts as a strong indicator to a slowdown in Europe’s strongest economy.

The Dax in Frankfurt ended 2.6% lower on Thursday, with private companies such as Deutsche Bank plunging 6% with Daimler and the steel group ThyssenKrupp both down 5%.

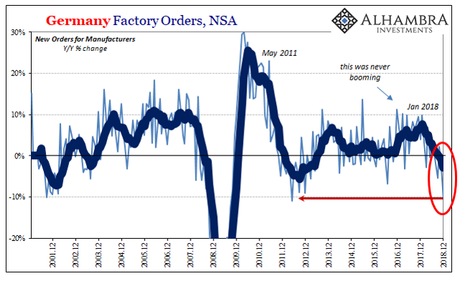

German factory orders dropped by 10.8% year-over-year (unadjusted) in the final month of 2018. The graph below shows the decline before a relative boom.

Source: Alhambra

Output was down 0.4% in November going against the Reuters forecast of a 0.7% increase.

Last week, the manufacturing sector contracted dropping to 49.7 points in January from 51.1 in December, according to the latest figures from IHS Markit. The economy also shrunk by 0.2% in the third quarter, this is due to a continued fall in the lucrative German car sector. Deutsche Bank expects the same contraction for the start of 2019. Investment bank Citigroup has predicted a “technical recession”, putting fuel on the fire that numerous factors could trigger a further slump in confidence.

These “factors” include global trade tensions, particularly between the US and China, uncertainty around Brexit, and the Italian debt crisis all significant problems for the German economy.

Deutsche Bank economists said in a report: “The start of the German economy into 2019 has been a major disappointment so far. “The development of several key cyclical indicators is telling us that the German economy is drifting towards recession right now.”

Christian Schulz from Citigroup said the German finance ministry was looking at tax cuts to ease the pain and help the economy for a July start valued at 0.5%of GDP. The German economic minister warned there was “muted momentum at the start of the year” unless demand for numerous core goods picks up.

Away and in the private sector, in a further problem for German industry, the EU has blocked a merger between Siemens and Alstom (based in France.) The EU is becoming increasing anxious to protect itself against the threat of China with larger mergers and acquisitions to become economically efficient against their cost of production.

The main issues causing the problems

Talking of China, there has been a downward shock from foreign trade, triggered by many economies and larger institutions rapidly winding down or deleveraging their positions on the Chinese economy paired with the well documented widespread effects of US-China trade wars on business confidence.

The central Bank of Germany has been very clear that the catalyst for pulling the German economy back since has come from foreign shores. One of many factors has been the tightening in global financial conditions such as the Q3 2018 financial market sell off which meant increases in US policy rates. Every central bank (including the Bank of England covered this week) has a dovish policy to future growth. The ECB’s latest tone has been to expect a downtrend in global growth.

However, the downturn in the German economy has been considerably greater than placing all the blame on China. Germany, being Europe’s largest and most robust economy, is more sensitive to the economic cycle in China than other European countries. German activity growth is one percentage point lower than it “should” be, if normal conditions with China were to be resumed. Germany’s retraction is down to a several of one-off shocks that have occurred in important industrial sectors. Industry victims include the automotive industry with motor vehicle output collapsing in 2018 Q3 because of the slow implementation of new regulatory checks on auto emissions, and has not yet fully recovered. Chemicals output fell sharply in 2018 Q4 because of water shortages in the Rhine following the dry summer, making shipping transportation on the river extremely difficult. Factories have subsequently seen less water provision. Pharmaceuticals output suddenly collapsed in 2018 Q4, probably due to hoarding due to Brexit uncertainty (Britain is doing the same) and a reversal in production by a company now under investigation.

It’s thought that the macro issues of Brexit, wider EU depressed growth and China-US in conjunction with these three separate shocks have probably depressed German annualised growth rates by 1.4% in the back end of 2018. It is expected a recovery to take place over the first half of 2019 but subject to market conditions it could well be a lot longer than that.

After all this, the pound traded at 1.1434 against the euro more on the German weakness than pound strength. Then, the bank of England delivered its dovish outlook of downgraded UK 2019 growth to 1.2% down from 1.7% and the pound crashed back down to a low of 1.1352.