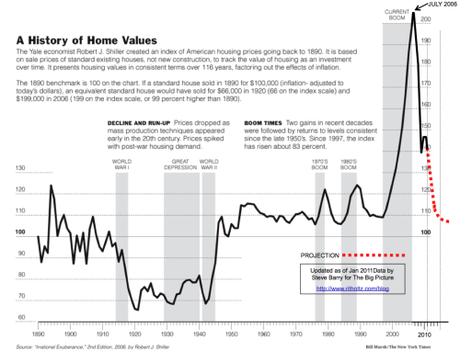

From 2000 to 2006, American home values nearly doubled.

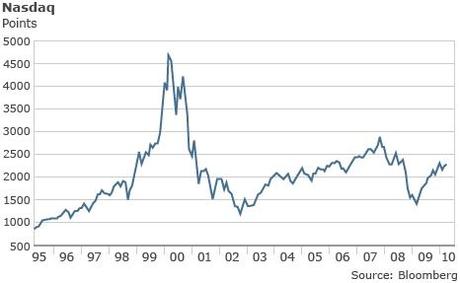

From 1995 to 2001, the Nasdaq Composite, driven by the massive dot-com growth of that time, more than quadrupled.

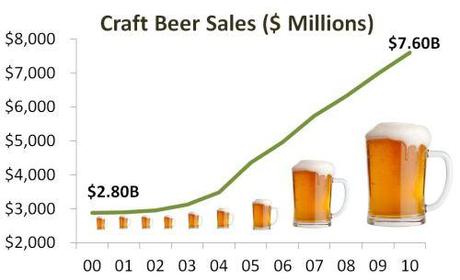

Between 2007 and 2017, craft beer sales are expected to triple. (Or is that tripel? Nailed it.)

One of these things is not like the others … yet.

As history tells us, when the bubbles of the real estate market and dot-com era burst, it took some time to regain traction. As sales of craft beer continue to increase and the number of breweries around the country grows to new historical highs, what’s in store for the world of beer?

Obviously, there are great differences in the realities of real estate, dot-com businesses and beer. However, there are some similarities between the rapid expansion.

First, here’s a look at the housing buildup, which saw values almost double from 2000 to 2006 (courtesy of the NY Times)…

… and a peak at how the Nasdaq Composite was impacted by dot-com companies, seeing exponential increases leading up to 2000…

… and finally charts showcasing the increase in craft beer sales (courtesy of somethingsbrewing.com)…

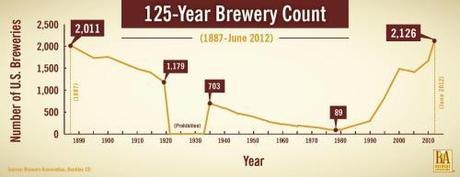

… and growth of breweries…

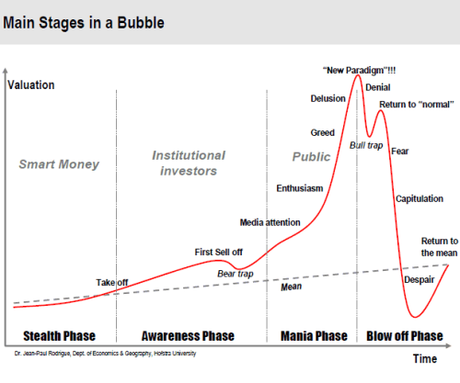

There are lots of varying opinions on the legitimacy of the craft beer bubble. While we don’t know for sure what will happen, there does seem to be hints that we’re in the “Mania Phase” of an economic bubble which comes just before the “Blow off” crash.

Charlie Papazian, one of the godfathers of craft beer, doesn’t believe in the threat of the bubble:

We are knee-deep in foam (laughing) and it’s rising all around us. By 2017, [the Brewers Association] anticipates pretty confidently that we’ll have 10 percent of the volume, and at that point, the momentum will take us pass that.

The 10 percent volume refers to craft beer’s overall market share, which stood at 5.7 percent in 2011. In all fariness, not all industry insiders believe that such fast growth is a sure-fire, good thing. Jim Koch, another early pioneer for the craft movement, is a bit weary:

He thinks the market share could grow to 10 percent by the end of the decade, but he thinks that most stores have reached their limit for all the new breweries. He said there are too many breweries brewing similar beers without adding anything to the market.

Everyone’s got an IPA now and everyone’s trying to hop the living crap out of it. Why? Because novelty accounts for something in the current state of our market. With so many options – and often somewhat similar options – brewers have to find a way to stand out.

That doesn’t mean everyone is doomed. It just means at a time when competition is fierce, shelf space is limited and livers bellies are full, can all this growth sustain itself?

As Papazian points out, the beer industry saw a boon in the late 1990s because “investment people got involved and people were getting into the business for the wrong reasons.” Are we terribly far away from this now? Lots of people are getting into the industry today because of its monumental growth and there’s money to be made. But they’re also getting into the industry because of their genuine love of beer.

No matter how big the threat of a bubble may be, there seems to be no question that one exists. It’s just a matter of how big and strong it can get and its risk for bursting. In the meantime, craft beer is growing, we’re enjoying tasty brews and people are loving it. That’s a good thing.

But maybe it’s also a good thing to pay just a little attention to that voice in the back of our heads…

And while we’re excited by all this growth and activity – there’s a small voice in the back of our head advising caution. Some of us watched our portfolios multiply madly before the Tech boom went bust. Many of us saw our homes’ values go through the roof until everything eventually collapsed.

Some food beer for thought.