Back before about 1930, most children were educated at home. Many families used the bible as a reader since that was one of the few books families had, Mom would teach lessons for an hour or two a day between wash loads, cooking, and cleaning.

Children who were lucky would get to go to a school. This would typically be a school building that their parents built and maintained. Their parents were the school board and would hire the teacher. One family might even provide a room for the teacher who was typically a young, unwed woman between the ages of fourteen and twenty. These children were lucky because going to school meant that they got to take a little time off from doing work around the home. If they misbehaved, they would be thrown out of the school and be sent back to their chores. Getting to go to school was a privilege and kids knew that they were lucky to have the honor.

At this time students would typically graduate and start their adult lives at fourteen. Despite what would be considered a limited education today, in truth, the education they received is probably better than today’s education that extends four more years through high school. In fact, it was better than some of today’s college educations. This probably seems odd to most people today. After all, they were in school for fewer years, taught by someone who had just graduated from school herself and who didn’t even have a high school education, let alone a bachelor’s degree or a master’s in education.

But parents who choose to homeschool their children will not be that surprised by the results. While most homeschool students are only in school for a few hours per day, and do all of their work then with no homework later on, homeschool students tend to learn more, do better in testing, and end up better prepared for college at age 18 than their public schooled peers. So apparently lots of hours in school, going between classrooms, professional teachers, and hours of homework are not necessary for a good education. The secret lies in individual teaching (where the work progresses at the rate at which the student can learn); motivation to finish early (since the sooner you’re done, the sooner you can go play); a lack of time wasted on preparing for standardized tests, calling role, and other activities; a motivated teacher; and the ability to concentrate in an environment free from distractions by other kids.

Public schools are declining as we see a generation of parents preoccupied with themselves and forgetting about their children. This has caused teachers to need to spend their time disciplining students, when they aren’t busy teaching their students how to fill in bubbles for the standardized tests. New events such as school shootings, sexual assaults by teens and preteens probably encouraged by easy access to pornography, and various stupid “challenges” launched by YouTube videos that sometimes end up killing children are also a concern. I predict that as public schools continue to deteriorate due to a lack of parenting by some of those sending their kids to these schools, more and more parents will choose to homeschool their children. I also predict that some parents will band together and set up coops. Parents will initially teach the classes in these schools, but eventually many will hire teachers. We’ll essentially be going back to where we were back in the 1800’s with the one-room schoolhouses.

So what if you want to have one parent stay home and become a homeschool teacher, but worry about losing the extra income that having two working parents provides? Passive income, along with careful budgeting, may provide the solution. Here is one path to set yourself up for homeschooling.

(Note, this site contains affiliate links. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase. This helps keep The Small Investor going and free. I don’t recommend any products I do not fully support. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link

1. Start early

Creating passive income takes some time. Ideally, you’ll start getting ready when you first get married and have two incomes and no childcare costs. You might also consider working an extra job or two and/or working overtime at one or both of your current jobs to generate extra cash. Keeping expenses low by doing things like limiting vacations (or taking cheap vacations alike road trips and going camping) and eating in most of the time will also free up cash flow for investing. For more suggestions on cutting expenses, plus how to determine your cash flow and develop a plan to build your wealth, check out FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early

2. Find a teacher

The next step would be to determine which of you will become the homeschool teacher. Traditionally this has been a woman’s role, but there is certainly no reason that the father couldn’t take it on. Certain individuals may be more suitable for working and other may be better at childcare (the harder of the two jobs by far). The teacher should be a good communicator, excited to share knowledge with his/her kids, and probably have the patience of a saint. This doesn’t mean that the non-teacher gets off completely. That parent should help with homework where needed and spend time interacting with the kids after work to give the primary parent a break.

Obviously, financial situation also plays a role in the decision of who should teach as well. Normally the individual with the higher income would continue to work and the other would drop out to become the teacher, primary caregiver, and home executive. Consider potential future income, not only current income, when weighing income. Some careers start at a low salary but increase in salary with time and promotions. Also, think about certifications and training that the working parent can receive/take that will boost income. 48 Days to the Work You Love: Preparing for the New Normal

3. Determine your income change

While it may seem that you take a huge cut when one spouse stops working, the actual difference may actually be fairly minimal, especially when child care costs are included. If you’re spending $1200 per month on daycare, that’s $14,400 per year that must be paid, perhaps after taxes have already been taken out. Add to that extra costs for clothing, insurance, meals on-the-go, and hiring jobs out due to lack of time to do them yourselves, and you can easily wipe out the $30,000 a second job may provide. You might therefore really only need to replace $10,000 in employment income with passive income instead of the $40,000 in take-home pay a job provides.

If you’re considering having one spouse leave the workforce, sit down and figure out what savings could be had by reducing these costs and by purchasing things more cheaply with a little extra time researching choices. Subtract this savings from the after-tax income their job provides. The net income is what you need to replace to enjoy the same standard of living that you hade with both spouses working. This is the amount of passive income that you would need to generate, assuming that the other spouse couldn’t increase their income by working extra hours with the first spouse at home.

4. Creating Passive Income

Passive income comes from investments that pay out money periodically. These should be things that require very little work on your end to maintain since the idea is to create income that you don’t need to work to achieve, not start another job. The two most commonly used passive income generators are income stock/bond investing and rental real estate.

a. Income stock/bond investing

Income stock and bond investing would normally be done through the purchase of income mutual funds. With a mutual fund, you purchase shares in the fund along with other people, then the fund manager invests the money for you, following an investment style as described in the description of the fund called prospectus. In this case, you’d want to find funds that invest in income-producing securities such as stocks that pay large dividends and bonds since you want them to be paying out cash on a regular basis that you can use for expenses.

An example of a bond fund is the Vanguard Long-Term Bond Index. This fund is currently paying out 4.19% annually, meaning that for every $10,000 you invested, you’d receive $419 per year in income. The fund has a risk level of 3 on a 1 to 5 scale, so it would fluctuate in value far less than something like a growth stock fund, which would have a 4 or a 5 for risk. It would still decrease in price if interest rates went up or people became worried about the economy, meaning that the $10,000 you invested might decline to $8000 or even $7000 if interest rates rose, or it might increase to $12,000 or more if interest rates dropped again. The pay-outs should remain about the same, however, so the price of the fund could just be ignored. You could simply wait for favorable interest rates to cause the price to go up before selling the fund in the future.

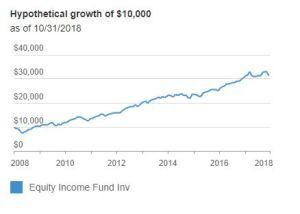

An example income stock fund is the Vanguard Equity Income Fund, which currently pays 2.94% or $294 per year for every $10,000 invested. Obviously, this fund pays out less than the bond fund referenced, but because the fund invests in stocks, their value would tend to increase with inflation and as the underlying companies become more profitable. This means that the shares will also increase in value over time, so you can sell off shares periodically to raise additional income. As can be seen in the graph below, including reinvestment of dividends, the fund would have turned $10,000 into about $32,000 over the last ten years. This means that a $10,000 investment has actually returned about $2200 per year, but there are some periods like 2014 to 2016 where there was virtually no return.

Another popular way to generate income is to become a landlord and rent apartments. This option is more hands-on than stock and bond investing. For example, if you’re renting apartments, you’ll need to find renters, do a background check on them and research references, find insurance and learn landlord laws, fix things when they break, pay property taxes, and take care of cleaning and refurbishment when renters move out. Much of this work can be hired out, but you’re reducing your income when you do. If you are lucky you’ll find longterm renters who don’t cause any problems and there won’t be too many late-night phone calls when the heater breaks. There are nightmare scenarios, however, where you’ll need to evict people who don’t pay rent or face lawsuits from renters who claim some sort of injury or damages. Most people probably end up with fairly good renters with a few issues along the way.

If you don’t want to deal with apartment tenants, another possibility is to buy and rent retail storefront locations. The nice thing about this option is that when a business fails, they’ll normally move out on their own so the need to evict people is probably less frequent. You might lose rent payments for the last few months before a business fails or have damage for which payment is difficult to collect. In some cases, equipment may be left behind that can be sold to make up for some of these losses.

If you’re thinking about renting, it would be wise to talk to others who rent and learn from them. Books such as The Complete Guide to Buying and Selling Apartment Buildings, Second Edition

Investing isn’t a one-time thing. You would typically start buying shares of mutual funds or apartment buildings until

Please contact me via [email protected] or leave a comment.

Follow me on Twitter to get news about new articles and find out what I’m investing in. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.