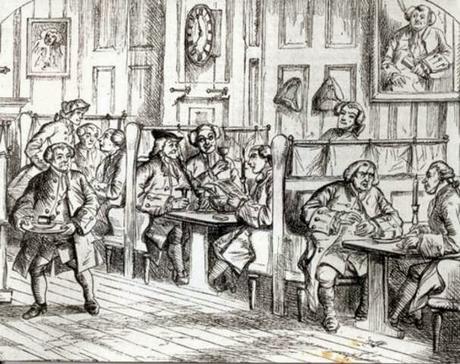

Lloyds

Coffee House

This

is a post about ‘ Lloyd’s Brokers’ …. Lloyd's of London, simply ‘Lloyd's’, is an

insurance market located in London. Unlike most of its competitors in the

industry, it is not a company but instead a corporate body governed by the

Lloyd's Act of 1871 and subsequent Acts of Parliament. Lloyd’s insurance market consists of members, both corporate and

individual. Lloyd's members conduct their insurance business in syndicates,

each of which is run by a managing agent. Thus there are multiple Underwriters

coming together to pool and spread the risk.

The insurance

business underwritten at Lloyd's is predominantly general insurance and

reinsurance, although in 2013 there were five syndicates writing term life

assurance. The market has its roots in marine insurance and was founded by

Edward Lloyd at his coffee house on Tower Street in the 17th century. Business

is conducted face-to-face between brokers and underwriters in the Underwriting

Room. When we talk of Lloyd’s, we’re

really referring to two distinct parts. The market, which is made up of many

independent businesses, and the Corporation of Lloyd’s, which is there –

broadly speaking – to oversee that market. These parts are distinct, but far

from independent. Both work closely to maintain high standards of performance

across the market.

Outsiders, whether

individuals or other insurance companies, cannot do business directly with

Lloyd's syndicates. They must hire Lloyd's brokers, who are the only

customer-facing companies at Lloyd's. They are therefore often referred to as

intermediaries. Lloyd's brokers shop customers' policies among the syndicates,

trying to obtain the best prices and terms.

Lloyds

Coffee House

This

is a post about ‘ Lloyd’s Brokers’ …. Lloyd's of London, simply ‘Lloyd's’, is an

insurance market located in London. Unlike most of its competitors in the

industry, it is not a company but instead a corporate body governed by the

Lloyd's Act of 1871 and subsequent Acts of Parliament. Lloyd’s insurance market consists of members, both corporate and

individual. Lloyd's members conduct their insurance business in syndicates,

each of which is run by a managing agent. Thus there are multiple Underwriters

coming together to pool and spread the risk.

The insurance

business underwritten at Lloyd's is predominantly general insurance and

reinsurance, although in 2013 there were five syndicates writing term life

assurance. The market has its roots in marine insurance and was founded by

Edward Lloyd at his coffee house on Tower Street in the 17th century. Business

is conducted face-to-face between brokers and underwriters in the Underwriting

Room. When we talk of Lloyd’s, we’re

really referring to two distinct parts. The market, which is made up of many

independent businesses, and the Corporation of Lloyd’s, which is there –

broadly speaking – to oversee that market. These parts are distinct, but far

from independent. Both work closely to maintain high standards of performance

across the market.

Outsiders, whether

individuals or other insurance companies, cannot do business directly with

Lloyd's syndicates. They must hire Lloyd's brokers, who are the only

customer-facing companies at Lloyd's. They are therefore often referred to as

intermediaries. Lloyd's brokers shop customers' policies among the syndicates,

trying to obtain the best prices and terms.

Façade

of Lloyds now.

A

Lloyd’s registered broker is a broker who has applied and been approved by

Lloyd's, having met certain minimum standards and is able

to place business directly with any Lloyd’s managing agent subject to a terms

of business agreement. This is the predominant route to place business into the

market. There are non-Lloyd's registered

brokers too doing business.

The Registered broker will have the advantage of

: being able to place business with any Lloyd's managing agent; market

themselves as a registered "Lloyd's broker". In a larger way, the directors of such

registered brokers will be able to take part in the governance of Lloyd's (eg

by becoming members of Lloyd's who can stand for election to Council and so

take a role in shaping Lloyd's future strategic direction).

With regards – S.

Sampathkumar

Façade

of Lloyds now.

A

Lloyd’s registered broker is a broker who has applied and been approved by

Lloyd's, having met certain minimum standards and is able

to place business directly with any Lloyd’s managing agent subject to a terms

of business agreement. This is the predominant route to place business into the

market. There are non-Lloyd's registered

brokers too doing business.

The Registered broker will have the advantage of

: being able to place business with any Lloyd's managing agent; market

themselves as a registered "Lloyd's broker". In a larger way, the directors of such

registered brokers will be able to take part in the governance of Lloyd's (eg

by becoming members of Lloyd's who can stand for election to Council and so

take a role in shaping Lloyd's future strategic direction).

With regards – S.

Sampathkumar

4th Feb 2015.