Robert Reich’s film, Inequality For All, spotlights a problem that’s real. But it’s very complex, with no simple answers (“tax the rich;” raise minimum wages).

Robert Reich’s film, Inequality For All, spotlights a problem that’s real. But it’s very complex, with no simple answers (“tax the rich;” raise minimum wages).

I’ll start with some points of agreement. Moneyed interests, because their money inevitably confers political power, corruptly milk the government teat to extract still more wealth from the economy. But the answer is not to restrict political participation (via campaign money). That would be incompatible with our free democratic society. Instead we must broaden participation, with a campaign finance reform like a tax credit for small political contributions, so they’ll proliferate and counter the impact of big donors.

And I agree that the rich should pay their fair share of taxes — though it’s far from clear they don’t already. The top 5% of taxpayers pay half of all income tax; the top 1% pay over 30% of it.

Now, Reich maintains (like several recent books, e.g., The Spirit Level) that rising inequality is bad not just for the losers but for everyone. An oft-heard theme is that it tears society apart; however, in America at least, resentment against the rich is uncommon. Most still believe the American dream of upward mobility, and (rightly) don’t buy the left’s idea that the rich get wealth at others’ expense. Reich does make a fair point that the rich spend less of their income on consumer goods (you only need one car, even if a Porsche), so wealth concentrated in fewer hands means less consumer spending, hurting the economy. However, the rich do invest their money (economically beneficial; though not necessarily in the U.S.), and ultimately give away gobs of it. And it’s a dubious assumption that if the rich had less money, others would have more.

This is important. The left thinks there is a lump of wealth to be (more fairly) divided up. Not so; wealth is created by productive effort. Steve Jobs’s wealth essentially represented the difference between what his products cost to make and the prices people gladly paid for them. That added value made everyone richer. Had Jobs never existed, his wealth would not have been spread among the rest of us; it would never have existed either!

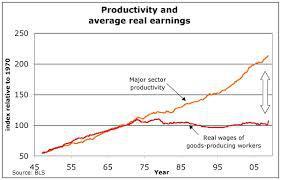

It’s not exactly true. One problem is that wages are only part of employee compensation. “Fringe” benefits are ignored, the biggie being health care. What’s happened is that a major part of earnings has taken the form of increasingly costly and valuable health benefits. If those are counted, incomes have not stagnated.

Secondly, the graph shows inflation-adjusted wages. As it should – except that economists know standard government indices tend to overstate the true inflation rate. (This is behind current battles over how to calculate cost-of-living adjustments.) Those indices don’t keep up with the changing mix of what people buy and, importantly, ignore changing quality. For example, the inflation rate might reflect rising car prices, but not improved safety, fuel efficiency, and durability, over the decades. A truer (and smaller) inflation adjustment would show real-dollar wages rising more than on Reich’s chart.

Another way to see it is even if wages haven’t risen, average living standards have: all that health care translates into a better quality (and length!) of life; cars are better as noted; and just look at the explosion in what people do with rising computer power and other communications and technological advances. All this amounts to a very real wealth gain, missed by a simple graph of wages.

A further element missing from Reich’s picture is pensions and related benefits. He suggests that in the postwar decades, strong labor unions were able to capture for workers a fair share of productivity gains; but then union power waned. However, during that period of labor strength, not only fat pay packets were negotiated, but fat pensions too. With rising longevity, we’re still paying for them.

This is relevant to a further aspect of Reich’s presentation. He stresses that in the halcyon period, government invested heavily in infrastructure and, particularly, education; with positive economic benefits, raising incomes, and hence tax takes, to be used for more investment: a virtuous circle. Now he sees a vicious circle of declining investments of that kind. But a huge reason why governments at all levels can’t do what they used to is pensions and health benefits and so forth soaking up all the available money (in fact, more than that). It’s exemplified by Detroit’s bankruptcy.

Reich thinks the problem is working people not earning enough. I think it’s not enough people working.

But he’s right about this: education is crucial. A major factor (if not the major factor) in rising inequality is that the rewards for high education and skill levels are growing, as are the penalties for low levels. While the rap is that corporations fatten profits by keeping pay down, they can’t be expected to pay anyone more than they have to. Hot-shots with valuable skills command high pay, but for low-skilled work it’s a buyer’s market. There are more such workers than are needed; they bring nothing to the table to make businesses compete for their labor. Raising minimum wages is not some magic wand that will change this economic reality. Making low-skill labor more costly would only hasten the trend to substitute technology for it.