The Pound to US Dollar exchange rate has been extremely volatile this week.

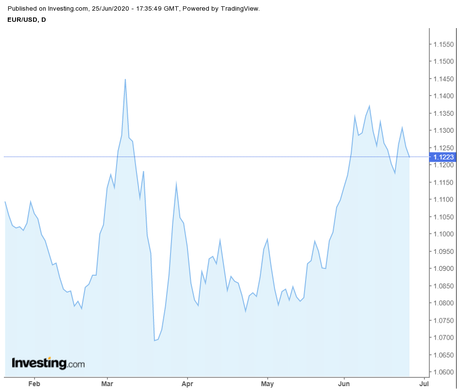

EUR/USD is trading at crucial levels, just above 1.12 . It faces renewed support at 1.117- and if the pair breaks below these levels, it may witness a slide.

The euro has gone down to $1.1226 levels. The British pound has retreated to $1.2423.

The USD/JPY continues to stay above crucial levels of 107.00. The pair reached a fresh weekly top at 107.46 on Thursday. After touching a seven-week low on Tuesday, it has gained traction for the second time this session. The U.S. dollar meanwhile is seeing fresh interest.

Coronavirus Fears Pushes Greenback UpNew daily cases in the U.S. have touched 36,188 on Wednesday, which is approaching the all-time high set on April 24 in New York. The virus is sending shivers down the stock market and the currency market. The greenback is gaining demand on Thursday after market worries about the fresh surge in coronavirus cases and mounting fear of fresh lockdown measures in the country. The dollar is gaining strength from the risk-averse mood.

Meanwhile, in the United States, the initial jobless claims are expected to be around 1.3 million for the week ending June 21. Though the data shows some improvement, unemployment continues to remain high.

The Fibonacci level for EUR/USD with 38.2 percent retracement comes at 1.1170 and the pair may turn bearish if this level is broken.

In Canada, the CAD has been downgraded by Fitch from AAA to AA+. USD/CAD rose to 1.3649, an increase of 0.1 percent. The rating agency has stated that Canada may face a high public debt ratio when it emerges from the contraction in the economy. Output has contracted with the rising virus attack.

Brexit Concerns Adds Risk-SentimentBrexit concerns continue and this risk-sentiment is attacking the economy. Unless a reliable vaccine comes into the market, the effects of Covid-19 will continue and cause pain to the economy. Despite the quarantine conditions, some industries have been doing well. Polls suggest that there is a 10 percent chance that trade talks may extend beyond 2020. 30 percent suggests that there is no chance of a trade deal soon. This may bring down sterling by 5.6 percent, bringing the currency to $1.18 percent. But a survey in August 2019 states that the pound may slump to 2016 lows of $1.10.

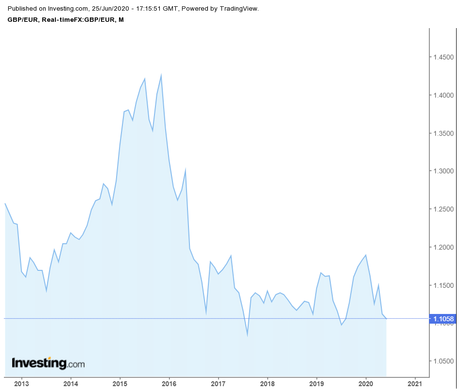

The recent announcement in the UK about holidays to begin from July 4 has brought in optimism for the tourism industry. Director-General John Lally at the National Caravan Council (NCC) says that is "great news" for caravan owners and parks industry in England. Parks follow safety protocols and this will be safe for visitors and staff, says Lally. Experts feel that the Sterling continues to remain jittery against the euro. It touched lows of €1059 and struggles to move out of the trading band.

The United Kingdom has been battered by the coronavirus. There is raising concern with the virus affecting the common man. Investors are wary about putting their money in the currency as it is considered a risky buy in today's environment.

Best InvestmentsThe coronavirus fear is rising again and investors are running to safe-haven assets to secure their investments. The GBP/USD exchange rate has been fluctuating wildly, whenever the pandemic raises its head. With the recent downtrend in the economy, some investments continue to outshine others in the market. Bitcoin and gold are considered as safe-haven assets as they outperform others in the market.

Trade Tensions Dominate GBR/EUR Exchange RatesThe Pound Sterling Euro exchange rate (GBP/EUR) was trading at around €1.1070 on Thursday. Though German data has improved, the currency continues to struggle. Consumer confidence has improved according to data released by a survey from GfK.

The Euro dropped against the Pound, despite good data. The US dollar has gained strength and this has brought a fall in the Euro against the Pound.

Tariff Fears Rise AgainWashington has threatened Brussels with a $3.1 billion tariff on European products. These tariffs are "very damaging" says the bloc and would harm the already downhill economy say, experts. US-EU tensions continue to remain high as the U.S. has stated that it would raise tariffs further on Tuesday. The European Union has criticized the U.S. saying that companies that are already battered by the pandemic will grow worse.

After lockdown restrictions have eased, situations have improved and consumer optimism which was at -18.6 has improved to -9.6 for the month. Experts say that the temporary reduction in VAT payment has contributed to the improved consumer sentiment and the economic stimulus package has improved the economy.

Bank of Mexico is expected to cut interest rates by 50 bps, after its policy meeting to be held on Thursday.

The central bank of Turkey is expected to bring down its one-week repo rate again from 8.25 percent to 8.0 percent. The interest rate in Turkey which was at 24 percent last year has seen nine straight decreases in rates later. USD/TRY at 6.8587 is away from its high of 7.27 that it saw in May.