I've got a running joke on Twitter, in which I tease news of all things IPA by "shouting" in all caps, calling beer drinkers INSATIABLE ANIMALS for their unrelenting assault on taste buds with lupulin-laced brews.

But there shouldn't really be any surprise. IPA is the top-selling craft beer style. The top-100 craft brewers are selling an average of three IPA brands each.

From Jan. 1 to May 17, market research company IRI counted 888 IPA brands in U.S. supermarkets, a 20 percent increase in just five months over the 741 from 2014. Here's a look at the past six years and 2015:

Over that timespan, supermarkets - which typically get increased beer shelf space and new brands at a slower pace then specialty stores like bottle shops - saw an average of 112 new IPA brands a year, or an average increase of 27 percent year-to-year.

That's a lot of IPA, but most important, that's a lot of hops for INSATIABLE ANIMALS.

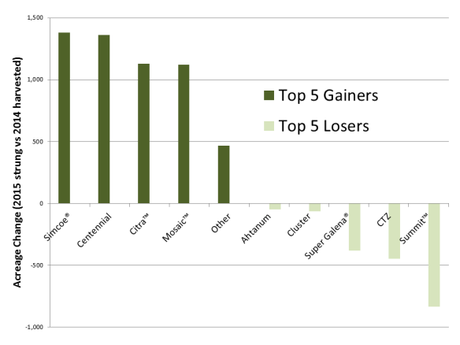

Naturally, there's a strong connection between what drinkers prefer and what brewers are putting into their beer, as evidenced by the shift in hop plantings over recent years. That's most commonly seen in changes of alpha (bitterness) and aroma hops grown by farmers.

According to a recent update from the Hop Growers of America and analysis by the Brewers Association, aroma hop acreage grew by 25.8 percent from 2014 to the 2015 acreages strung for harvest. Meanwhile, alpha acreage decreased by 11.5 percent:

Assuming similar alpha and aroma yields as recent years, this year's crop will be 77% aroma acres and an incredible 69% aroma pounds. To underline how big a shift that is, as recently as 2009, the U.S. crop was 69% alpha acres, and an even higher percentage of pounds.

What are these hops taking over the fields? Here's a breakdown from the Brewers Association:

If you're a fan of IPAs, names like Simcoe, Centennial and Citra shouldn't be a big surprise, especially considering the prominence of of these hops in top-ranked beers.

In 2013, Derek Dellinger did a quick and dirty look at what kind of hop varieties were used in the top-20 ranked IPAs on beer rating sites Beer Advocate and Rate Beer. Here are the number of beers in which these three hops appeared, but please note Derek couldn't find hops used in every single beer, so these figures are most likely lower than what they really were:

So we've got the expectation that brewers - and most important, drinkers - love beers that include these hops.

Even though this list is almost two years old, it's worth noting that today's beers continue to seek out these varieties. Stone Ruination Double IPA 2.0, a reimagining of the original that was released this spring, features all three of Centennial, Citra and Simcoe.

It's no surprise then that the latest hop acreage report shows increases in plantings of these types hops in the Pacific Northwest, where nearly all US-grown hops are farmed.

Here's a look at two major states that handle hop farming for Centennial, Citra and Simcoe hops, with two new, favorite varieties thrown in for good measure:

In Oregon, the third prominent hop-growing state, the Hop Growers of America listed Citra and Simcoe with zero acres in 2014 but had 235 and 189 acres strung for harvest in 2015, respectively. Why the lag for those varieties? Contracts, stock and rights to grow them, especially careful attention to geography of where the crops will perform well.

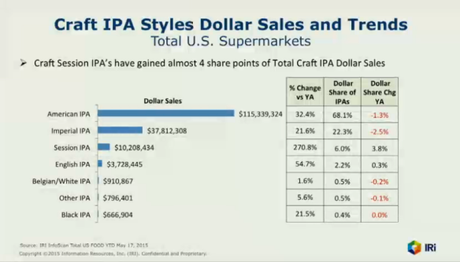

As the top-selling craft brand, people love their IPAs and that shows up in hop use, especially these very popular aroma varieties. By one estimate, craft brewers use about 1.4 pounds of hops per barrel as opposed to "traditional beers" (read: BMC) that use a quarter to a fifth of a pound, which explains the importance of increased planting for these hops. Craft brewers love making IPAs because people love drinking (and spending money) on them:

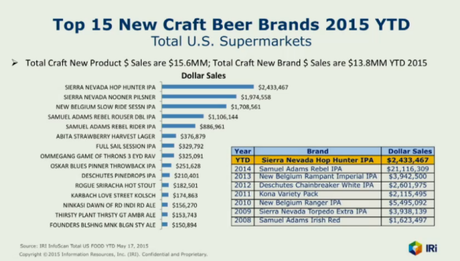

As you'd expect, this is an ongoing trend. In the last seven years, five of the top-selling new craft beer brands in supermarkets have been IPA, with 2015 on track to be the sixth time in eight years:

The incentive is there, the consumer dollars are there, so why not keep pumping this well? It's just a matter of finding the available ingredients.

For the big craft brewers selling successful IPAs, that doesn't seem to be a problem, especially when considering hop usage of 2015's hottest-selling IPAs:

- New Belgium Slow Ride - Amarillo, Citra, Mosaic, Simcoe, Nelson Sauvin, Nugget, Centennial, Cascade

- Oskar Blues Pinner - Boil hops not available, but dry hops include Mosaic, Citra, El Dorado and Azzaca.

- Deschutes Pinedrops - Nugget, Northern Brewer, Chinook, Centennial, Equinox

Then there's No. 1 Sierra Nevada Hop Hunter, which features Bravo, Cascade, Crystal and Simcoe, before adding farm distilled hop oil of Cascade, Centennial and CTZ. That portion fascinates me because it could essentially be (uneducated comment) taking lower-price, "traditional/older" hops and using their oil for strictly aromatic purposes, like these newer, popular varieties.

Let's not forget Sam Adams' Rebel family of beers, which includes last year's release of Rebel - the biggest new craft brand debut of all-time - and Rider (session IPA) and Rouser (double IPA), which were both in 2015's top five new brands in mid-May. All of these beers feature some combination Centennial, Citra and Simcoe, along with other popular aroma varieties like Amarillo:

- Rebel - Cascade, Simcoe, Chinook, Centennial and Amarillo

- Rider - Citra, Topaz, Cascade, Centennial and Simcoe

- Rouser - Bravo, Galaxy, Zeus, Simcoe, Centennial, Cascade and Amarillo

Are these hops a road map to creating a perfect beer for today's consumer? Probably not as good as this one, that's for sure.

But at least we can get some additional context to highlight why, where and how these hops are becoming a big deal, if only beyond the fact that brewers might like to play around with new ingredients as they become available, just like any good chef. Because from farm to glass, it's clear there are a few good ways to appease you INSATIABLE ANIMALS.

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac