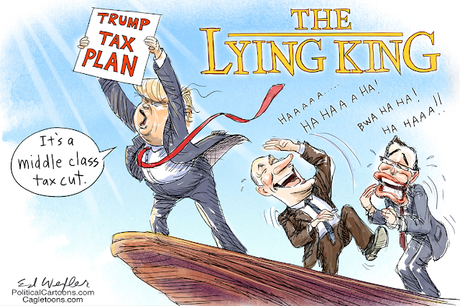

Trump was bragging again yesterday about how much the huge tax cuts given to corporations is helping American workers (through bonuses and higher wages). That was either a sick joke or an outrageous lie -- probably both. The truth is far different.

Here's just part of an article by Nicole Goodkind in Newsweek:

President Donald Trump’s corporate tax cuts might not have trickled down to American workers in the way that he suggested they would. Trump and Republican leadership have long touted their tax cuts as a massive boon to America’s working class, if not through direct tax reductions or refunds, then through the trickle-down effect of bonuses and wage increases from their employers who receive massive corporate cuts. “Tax reform is working,” Republican House Speaker Paul Ryan said in January, mentioning Apple’s decision to reward a bonus of $2,500 in stock grants to some Apple employees. “Workers are coming home and telling their families they got a bonus, or they got a raise or they got better benefits.” But a new analysis of all Fortune 500 companies found only 4.3 percent of workers will receive a one-time bonus or wage increase tied to the business tax cuts, while businesses received nine times more in cuts than what they passed on to their workers, according to Americans for Tax Fairness, a political advocacy group devoted to tax reform. The analysis also found that companies spent 37 times as much on stock buybacks than they did on bonuses and increased wages for workers. The study looked at corporate data, news reports and independent analyses of the top companies in the United States, which represent more than two-thirds of the gross domestic product, and analyzed changes in wages and share buybacks since the announcement of the Republican tax plan in December.