We're shaking things up this weekend in the newsletter, focusing on a number of broader themes and news instead of having a few separate sections. Because? Because there was too much to fit into our usual format. If you were a fan of the original layout, we'll be back next week.

Today we talk about Coinbase's growth, how Juked.gg exploited the equity crowdfunding market, a spaghetti or two on the a16z multimedia game, the predictions of SPAC, VC and founder of Talkspace for 2021 and where is the right place to found a company.

Sounds good? Let's go inside!

Coinbase deposits climb before the IPO

Thanks to Kazim Rizvi of Drop, Cardify's parent company providing data on consumer spending, let's take a look at how quickly deposits have grown on the American cryptocurrency platform Coinbase. As Coinbase has filed to go public and we are eagerly awaiting its eventual S-1 deposit, we've been thrilled to take a directional look at the rapidly growing consumer interest in the assets it helps people buy.

They are shrinking rapidly. Using the first week of January 2019 as a reference, in the last week of December 2020 the deposits and withdrawals from Coinbase had grown by more than 12 times each. This is staggering growth, and while the data is somewhat volatile - and we would consider it directional rather than accurate - on a weekly basis, it underscores how well companies like Coinbase can perform as Bitcoin explodes once again, leading to greater commercial interest and consumer demand.

Cardify data also indicates a multiplication of the acquisition of new customers on Coinbase over the same period of time and of deposits that are scaling down along with the price of Bitcoin. Given that Bitcoin recently crossed the $ 30,000 mark, much higher than in recent quarters, the price gains may have helped Coinbase not only to a solid Q4 2020, but perhaps also set it on track for a crazy Q1 2021.

If we were 10 out of 10 enthusiastic about Coinbase S-1 prior to this dataset, we're now a 12/10 heck.

Seven-figure equity crowdfunding for eSports content

Esports are great and if you disagree, you're wrong. But it doesn't matter if you or I are right on the matter, as did the market largely decided that competitive play is worth investors' time, attention and money.

The proliferation of esports leagues and games and the like has led to a decidedly fragmented universe, yet lacking a central hub similar to what ESPN provides to the world of traditional sports.

But don't worry, Juked.gg has just raised capital to build an esports content hub. This means old folks like me can still find out when tournaments are running and enjoy some League of Legends or Starcraft 2 pro play whenever possible, without searching the internet for dates and times.

Juked.gg surveyed 500 startups (more on its class here), catching our eye at the time as an accurate nexus for esports-related content. Now with just over $ 1 million he has raised on the Republic platform, he has big plans.

The Exchange spoke to Juked.gg co-founder and CEO Ben Goldhaber on his company's performance to date. According to Goldhaber, Juked has grown from 500 users when it launched in late 2019, to 50,000 in December 2020. In the future, Juked could invest more in journalism, more in social features and more in user-generated content. We'll have more on Juked as it realizes its vision, now fueled by over $ 1 million from 2,524 investors, each betting the startup is building the right product to help unify a growing entertainment category, if deployed.

The push of the a16z media

To preserve our collective sanity, I won't elaborate here, but building content in a VC company is nothing new. Hell, how long ago was the first round review launched? What a16z seems to have in mind is different in scale, not in substance. We talked about it on Equity this week, in case you need more on the matter.

Maybe not stupid SPAC from Talkspace

While it is enjoyable for mock SPAC, with so many fledgling companies to say the least, not all SPAC-led debuts are as silly as the rest. This is the case with the upcoming Talkspace deal, the deck you can read about here.

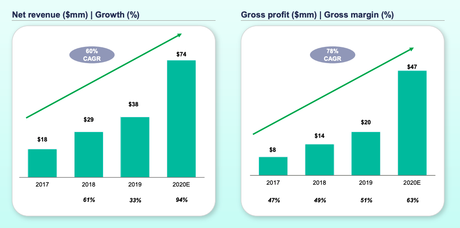

What matters is this set of charts:

Look that! Historic revenue growth! Gross margin improvement! Gross profit on the rise!

It could be argued that the company isn't really worth the $ 1.4 billion corporate worth it will flaunt after its combination with Hudson Executive Investment Corp., but hey, at least it's a real business.

How VCs and founders see 2021 differently

- VCs are more optimistic about the economy than founders, with about 30% of founders expecting consumer spending to remain stable or declining, positions that only about 17% of VCs agree.

- And when it comes to leaving the Bay Area - yes, that chestnut again - 35% of founders have itchy feet, while only 20% of investors are similarly prone. I think this is because the latter have houses in the Bay Area while most of the founders don't. But it should mitigate the idea that all the money and talent go away. They are not.

The other day Seed VC NFX released a VC and Founder survey that I was planning to share with you. You can read it all here if you want.

I have two drawers for you this morning:

There is no place like no place

Initialized Capital has put together some data on where founders think it is best to start a company. In 2020, nearly 42% of founders surveyed said the Bay Area. By 2021 that number has dropped to just over 28%, with a plurality of 42% indicating that a distributed business is the best way to go.

I've heard a lot about it from novice founders. They often build what I call micro-multinationals, small companies that have few employees in one country and then a handful in others. Making this configuration work will be a hot spot for HR software, I think.

Regardless, the requirement for founding companies in the Bay Area is kaput. The benefits of founding there will last much longer.

Arriving!

Coming to The Exchange next week: the first entries from our new $ 50 million ARR series, featuring interviews with Assembly, SimpleNexus, Picsart, OwnBackup and more. And we also have $ 100 million canned ARR interviews.

Finally, to keep The Powers That Be happy, The Exchange covered some interesting things this week, including American VC results, fintech and unicorn venture capital, European and Asian venture capital results, such as the IPO market. it's even crazier than I thought, and notes on how much Qualtrics is worth when it goes public.

Hug and take a nap on everyone