It's a tough time to be a "big" brewer.

AB InBev and MillerCoors continue to watch as flagship brands slowly decline in sales, but some legacy craft breweries are suffering as well. Sales of Sierra Nevada's Pale Ale (2.8 percent) and Torpedo IPA (2.3 percent) are down. Sam Adams continues to face a free fall for Boston Lager, declining nearly 12 percent in 2016.

Diagnosing the problem points to a host of symptoms, from longtime brands going stale among consumers who always want something new to the rise in importance of what's "local."

"If [consumers] have two [beers] they feel are equal, and one's local and one's not local, that's an important part to the decision for two-thirds of craft purchasers," Brewers Association economist Bart Watson recently mentioned at a Brewbound Session in San Diego.

So what are these Big Boys of beer to do? Follow the lead of their smaller, more nimble competition.

For some breweries, we're seeing a balance of tried and true brands and creating something new, as heritage breweries extend flagships as a means to get another mile out of a beloved, singular beer.

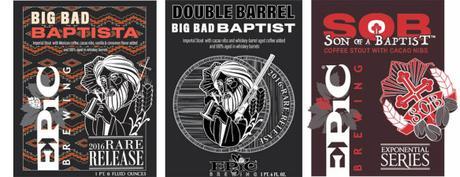

Epic Brewing, which has long caught the eye of drinkers with Big Bad Baptist imperial stout, has given new life to the brand with its barrel-aged, Mexican-coffee and " session" versions of the beer. Great Divide, which has brewed variations of its Yeti imperial stout for years, is set to release two new versions: a chai-themed and nitro Yeti, the latter appropriately named "Velvet."

The decision behind these moves is simple: you take a brand that drinkers already like, and through seasonal or specialty release, remind them to come back to you. Building that kind of connection and expectation has proven to be an effective form of marketing.

However, what makes the situation unique to the beer industry is the fact that we're dealing with an experiential good. You have to drink the beer to understand whether you like it or not and form your subjective opinion. By starting with an experience a consumer already knows, these companies are, presumably, already getting a head start. If you buy a Big Bad Baptist or Yeti variant because you've already enjoyed the original, chances are the psychological effects at play will work in the favor of the brand, toward which you already have an affinity.

Using that tactic may prove pivotal in the coming year.

With Sierra Nevada, we see an attempt to expand on its iconic Pale Ale and Torpedo beers with extensions Sidecar Orange Pale Ale and Tropical Torpedo. Given an overall sales decline of more than 4 percent in 2016, the company needs these brands to be a hit:

Nick Lundquist, Sierra's director of national accounts, asked wholesalers to achieve "50 percent or higher" distribution of Sidecar and Tropical Torpedo, relative to their flagship counterparts, by June 1, 2017. And by our math, that would be around $20 million of combined sales in IRI-tracked food stores.

On the flip side, Founders, which continues to grow its national footprint led by All Day IPA, is doubling down on favorite brands. The brewery will discontinue its Pale Ale and Devil Dancer in 2017, presumably to shift capacity for other, hotter sellers. All Day, which saw an 80 percent volume increase in 2016 over the previous year, is expanding into 19.2-ounce cans. Seasonals that include an IPA, pilsner and a Mosaic-focused pale ale ( HOT HOP ALERT) are getting double packaging to be available in bottles and cans. More barrel-aged beer is on the way, too.

For a company that is growing fast, all these moves come across as ideal moves to capitalize on what's working best in terms of national trends and interest.

Dogfish Head is also hoping for a similar reaction by extending their Flesh & Blood IPA ( FRUITED IPA ALERT) and SeaQuench Ale while also returning Burton Baton and Palo Santo to full year-round status. Trendy changes to their seasonal lineup are worth noting, which includes:

- Spring: A rotating version of the Beer to Drink Music To series (a fruited blonde ale)

- Summer: Shifting Romantic Chemistry (fruited IPA) to the warmest months

- Fall: Like Punkin is going anywhere

- Winter: Post-Boil IPA, a new IPA that exclusively utilizes the now common and wildly popular method of whirlpool addition to extract the most aromatics and least bitterness.

That last brand really interests me, because in a way it highlights Dogfish Head's acknowledgment of where sales stand today. Their balanced collection of 60/90/120 Minute IPAs, highlighting malt alongside hops, are at the core of the brewery's ethos, but you gotta give those INSATIABLE ANIMALS what they want.

According to Eric Schmidt, director of alcohol research for Beverage Marketing Corporation New York, the best course of action to stand out as the volume of available beers continues to grow is to lower prices. We know that price definitely plays a role in selection, but the continued diversification of brand portfolios suggest the latter is another avenue to explore, too. Just consider what New Belgium is doing: three rebrandings and four new releases.

"This is our most ambitious portfolio re-imagining since our beginnings," New Belgium spokesperson Bryan Simpson said in a release.

Among the new releases are some check-the-boxes moves that have benefited breweries in recent years, including all four new beers clocking in at 5.5 percent ABV or below ( SESSIONABLE STYLES ALERT) and including a hop-forward pale ale, a fruited sour ale and an extension of their Citradelic Tangerine IPA, the best-selling new craft brand in 2016, with Citradelic Exotic Lime Ale.

The creation/rebranding of New Belgium's IPA lineup is particularly noteworthy, as the brewery has seen its Ranger (2010), Rampant (2013) and Citradelic (2016) IPAs become the best-selling new craft brands each year of their releases. Even Slow Ride Session IPA, debuting in 2015, was a top-five new craft release that year. It's now being discontinued to allow for the new brands to breathe, but the moral of the story is clear: New Belgium knows what it's doing when it comes to IPA.

Despite all of these changes, it's not as if New Belgium is struggling. The brewery saw a 44 percent increase in dollar sales from 2013 to 2016. That's higher than Sierra Nevada, which is at about 37 percent.

Which leaves questions about where one biggest craft breweries sees itself going in 2017.

Along with a dip in Boston Lager, Sam Adams has seen volume of its seasonal lineup of beers fall nearly 20 percent in 2016. In the same 2013 to 2016 timeframe mentioned above for New Belgium and Sierra Nevada, the Samuel Adams family of brands has grown just over 3 percent in dollar sales. As noted on this blog on several occasions, it's been rough going for Boston Beer, especially among beer enthusiasts.

Despite all that, new releases have been working out for Sam Adams. Grapefruit Rebel IPA is the second best-selling new craft brand in 2016 and its Nitro White Ale and Nitro Coffee Stout are also among the top 10. Sam Adams' national distribution certainly helps, but it's also worth considering name recognition, which is obviously associated with quality, otherwise these brands wouldn't be selling at such high volumes.

Ultimately, there's little we'll know about the outlook of 2017 until we get there - aside from the fact that rare beer will continue to dominate the minds of beer geeks, at least. Until then, these ideas are merely a case of Schrodinger's beer - a brand that exists, but its own survival is yet to be determined.

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac