Managing ecommerce accounting can be a tricky task, especially when you're selling on multiple channels like Shopify, Amazon, and your own website. You need to accurately track all income and expenses, keep the data organized, and run regular reports.

Optimizing these processes helps you to save time and money and to make the right decisions about inventory, suppliers, and shipping carriers. In this post, we'll show you the best ways to optimize ecommerce accounting (hint: using the right software is the key theme).

Why ecommerce bookkeeping & accounting is important

Accounting and bookkeeping are important for all types of businesses. So, why is ecommerce accounting different? It's because you're dealing with multiple sales channels and payment sources, not to mention aspects like shipping costs, warehousing, selling fees, and returns.

Ecommerce accounting includes traditional bookkeeping functions like managing invoicing, payroll, and balance sheets, as well as preparing financial statements. However, the complex nature of an ecommerce business requires specific processes for:

- Inventory

- Sales tax

- Transactional data

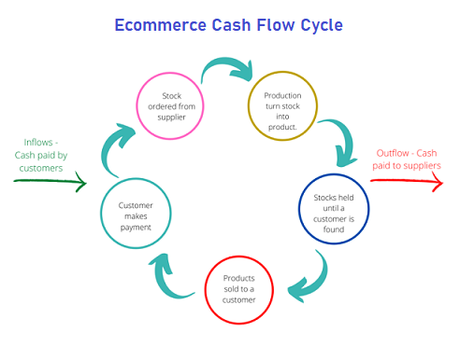

The purchase, sale, and movement of inventory has a huge effect on your cash flow. Sales tax is more complicated for online sales, as it varies depending on your location and where you sell your goods. What's more, you need data that shows details of transactions, not just net deposits.

As the business expands, your accounts become more complicated. Ecommerce accounting and bookkeeping are essential for staying organized and gaining insights into performance, as well as making smart decisions on how much inventory to buy or how to price your best-sellers.

How to optimize ecommerce accounting

Let's take a look at the best accounting practices for online businesses.

1. Choose the right accounting software

One of the key ways to optimize ecommerce accounting is to use software, which is far more efficient than using spreadsheets or paper ledgers. Software saves time and money by streamlining processes such as invoicing and billing, reconciliation, reporting, and expense management.

Cloud-based accounting software also makes your data and accounting tools more accessible. For example, a mobile bookkeeping app lets you log in from anywhere and manage your ecommerce business on the go.

It's important to choose software that's designed to meet the needs of ecommerce firms, with features to help you process returns and collect the right taxes. The software should integrate smoothly with your ecommerce platform, inventory management system, bank account, and CRM.

2. Be on top of cash flow management

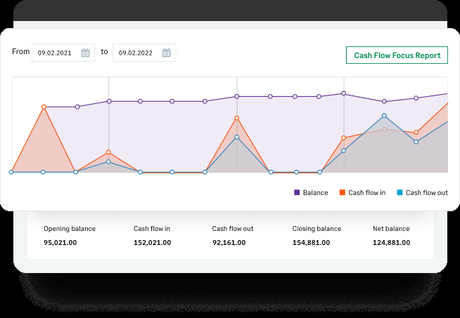

Managing your cash flow is vital for all businesses. You need a clear picture of what you're earning and what you're spending to make sure you have enough to meet your obligations and to predict your incomings and outgoings for the coming weeks and months.

For example, in ecommerce, you need to know how much cash is available for purchasing inventory, especially if there's a sudden rush for a certain product or a supply chain issue that leaves you scrambling to avoid a stockout. A key part of cash flow management is keeping cash on hand for emergencies.

3. Explore automation

We already discussed using software to streamline your ecommerce processes, but automation makes life even simpler. It avoids time-consuming manual data entry, which is prone to errors and additional costs. The best software also gives you options for designing your own workflows.

Automated tools will automatically track and manage returns, as well as scheduling bank payments and generating reports. Advanced systems can pull in data from each channel and calculate sales taxes and merchant fees. They'll even catch any errors and send a notification.

4. Keep taxes up-to-date

As an ecommerce business, you need to file quarterly estimated taxes and year-end accounts. It's wise to calculate as you go along and set money aside, rather than leaving things to the last minute. If you're in the UK, take the time to learn more about HMRC's plan to digitize the tax system and find out what you need to do.

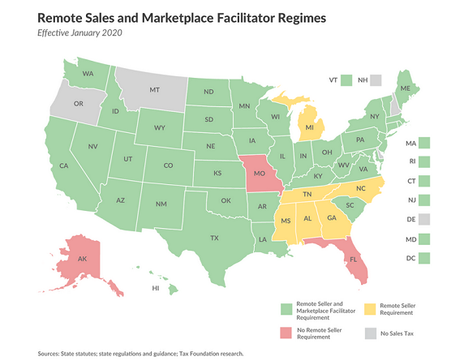

Ecommerce sellers in the US also have to figure out the sales tax nexus regulations. In essence, if you do significant business in a particular state, you're responsible for collecting and remitting state taxes for any purchase made from that state. Since most ecommerce merchants sell nationwide, things can get complicated.

5. Reconcile your accounts regularly

Reconciliation is the process of comparing your own accounting records with bank statements in order to highlight any discrepancies (and make adjustments if needed). You're ensuring that all transactions are accounted for and that the money leaving an account matches the sum that was spent.

In ecommerce, transactions take place on multiple channels, and you must factor in platform fees and customer refunds. Again, software can help by connecting the various platforms and data. Reconciliation needs to be done regularly-enterprise companies may even do it on a daily basis.

6. Track your inventory in real time

Ecommerce accounting and inventory management are tightly linked. Understanding your finances helps you figure out how much inventory you can afford and when to buy it. What's more, by keeping a close eye on your inventory, you'll have more data to feed into the accounts.

Tracking inventory in real-time is vital. You'll get early warnings of too much or too little stock, learn which products sell well on which channels, and monitor returns. By syncing this information with your accounting system, you can set up automatic reorders and payments to suppliers and carriers.

7. Make scheduled reports

Another important aspect of ecommerce accounting is reporting. Your financial statements show valuable insights into your company's performance, enabling you to analyze the data and make the right decisions on pricing and suppliers. Essential reports include:

- Balance sheet (assets vs. liabilities and the overall value of the business)

- Profit and loss statements (showing sales channel performance, trends, expenses)

- Cash flow forecast

- Tax report (identify how much you collected in taxes so that you can put it aside)

Most accounting software comes with reporting capabilities, automatically generating reports that you can easily share with your accountant or stakeholders.

Bottom Line

Optimizing your ecommerce accounting processes gives you a great foundation for success, no matter how big your business grows and how many channels you sell on. Using dedicated software will help you to follow the tips in this post, from cash flow management to keeping on top of taxes.

Automated accounting provides an instant overview of income and expenses, while the software integrates with other systems such as inventory tracking and customer management. This makes it easier to identify best-sellers, set price points, and find opportunities for savings.

accountingecommerce strategy