$1 Million is a special milestone for retirement, advocated by many financial practitioners too. Why is $1 Million important for retirement? To lay out the context, $1 Million actually isn't really a lot of money for retirement. Assuming you have $1 Million dollars at the age of 55 and retire and live till 85 years old, you can spend about $33,333 every year from age 55 onward. This is about $2777 per month for expenses which really is just enough factoring inflation in the future.

$1 Million on the other hand is a good base for creating a steady stream of income for retirement. If we can generate 4% annual interest/dividend on the $1 Million, it is $40,000 which translates to $3333 per month. This is quite a good income for retirement.

In this post, I'll provide some realistic scenarios on what a typical average income earner's savings will turn out in his/her lifetime. This will allow us to see how $1 Million can be achieved realistically in our life.

Pure Savings without investment

If a person just saves money but does not invest, this is how much savings he or she will achieve assuming a savings of about $18,000 to $20,000 annually:

I have added in a $60,000 expense at the age of 30 assuming the expenses is for marriage, house etc, the first milestone of a typical person's life.

As we can see, just savings alone will not get us anywhere near $1 Million at all even at the age of 60. Now, let's add in investment to see how it will turn out.

Savings with 8% investment

Using the same scenario and adding 8% investment return, this is how much savings we will have:

With 8% investment return, this person can achieve $1 Million at the age of 50 with the same savings rate of $18,000 annually. Saving $18,000 a year from the age of 30 shouldn't be too difficult for many of us. Assuming a person earns $4000, he can spend $2500 a month and just save $1500 a month to reach the target.

If you think 8% investment return is too high to achieve, let's bring it down to 5% investment return

Using the same scenario and changing it to 5% investment return, this is how much savings we will have:

With 5% investment return, $1 Million can be achieved at the age of 55. Still not too bad.

As we can see, achieving $1 Million is not too difficult in our lifetime with an achievable savings rate. However, the scenarios above assume that our savings is always 100% invested which is rarely the case since we will always have some cash on hand. There should be some buffer when using the above scenarios as a guideline.

Key to a financial free life - ESI

The key to having a financially free life is in our earnings, savings and investing (ESI). If we do not earn enough, we can always try to increase our income. If we spend too much, we can try to reduce expenses to have more savings. The last part is on investing and learning how to invest wisely.

For my life, I've focused on increasing my income for the past 2 years. Increasing income is much harder than reducing expenses as there are a lot of things not in my control. Increasing income is all about creating value in our workplace as well as out of our workplace. Skills learnt will always be valuable which people will be willing to pay us for.

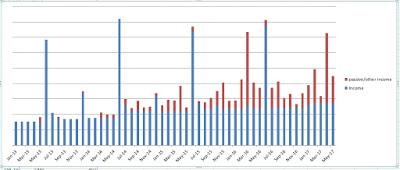

This is how my income has evolved over the years:

As you can see, my income has essentially doubled on some months as compared to the past. Over the years, I've managed to create other streams of income through writing, consulting and investing. These income did not happen in an instant. It took a few years to build it up. I've also changed job for better career progression. There are a lot of things that needs to be balanced to make sure time is allocated efficiently. I've also had to, on some instances, reject additional earnings opportunities because I feel it would be too much for me to handle.

What are your plans for retirement? Do you think $1 Million is an achievable target?

or follow me on my Facebook page and get notified about new posts.