Do you want to know how to choose a payment processor? Then, keep reading this article if you are interested in it!

If you need to accept payments online, you must rely on a payment processor. PayPal and Stripe are two giants in payment processing. But, well, there are more available.

When picking a payment processor, there are many things to consider. Factors such as brand recognition, ease of integration, customer service come into play, how flexible the company is, whether they provide reporting, and room for growth.

If you are confused between payment processors, we have this guide.

This article will show you how to choose a payment processor for your online shop.

How to Choose a Payment ProcessorHow to Choose a Payment Processor

If you are ready to choose a payment processor, keep these 8 things in mind. We will give you a short summary of why these matter while picking a payment processor.

1) Define Your Minimum Requirements1) Define Your Minimum Requirements

The first step is to define your business strategy and define your needs.

What does your business need to run efficiently?

Do you want to accept international payments?

Do you want access to sales reports?

Do you want to accept credit card payments?

What about gift cards or loyalty rewards programs?

Think of each requirement separately and determine what service you need. For example, most popular payments will give you access to credit card payments, simple setup, sales reports, reward programs, and so on.

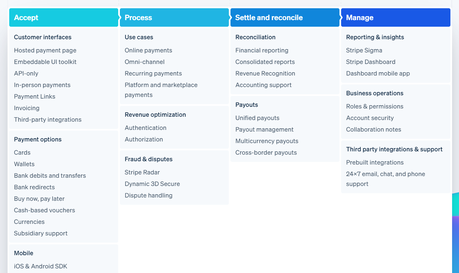

If you are unsure, you can check out the features page inside the payment processor’s official website. In most cases, they will list all the features inside that section. For example, here are some of the Stripe payment features.

You can also contact the pre-sales team regarding your requirements and see if it suits your needs.

2) Narrow down Your Options2) Narrow down Your Options

Once you’ve defined what you need, narrow down your options. Narrowing it down means you don’t want to think about payment processors as a single entity but a group of smaller entities, each with a few different features.

For example, if you need a reporting platform, one provider might offer it free while another requires an additional monthly fee. Find out how flexible each provider is and if they have anything going for them that the others don’t.

3) Think About Your Product or Service3) Think About Your Product or Service

High transaction costs are probably worth it if you sell a high-end product or service because you are probably making higher profits. But, if your margins are low, you need to think about the extra 2-5% in costs.

As an example, let’s take Stripe.

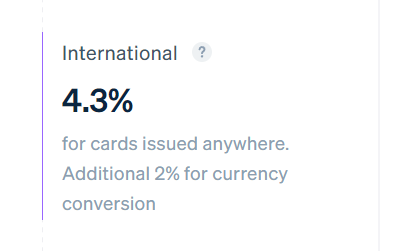

If you want to international cards through the Stripe payment gateway, the fee is 4.3%. Therefore, when someone purchases your digital or physical product through an international card, you must spend a 4.3% fee on Stripe.

On top of that, they will also charge you 2% for currency conversion.

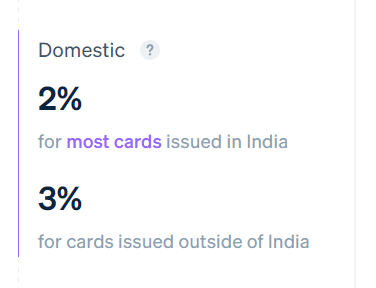

For domestic payments, the fee will be low.

And there will be no currency conversion fee since you accept the same currency.

So, while selecting a payment processor for your business, you must check their fee structure.

4) Look at Recurring Versus Non-Recurring Sales4) Look at Recurring Versus Non-Recurring Sales

If you are selling expensive and only sold once, you want to be paid upfront. However, if you are selling something that people will come back to buy again and again (like a subscription), you want to be paid monthly or yearly.

So, you have to choose a payment processor that accepts recurring payments.

If the payment processor can automatically charge the amount every week/month, that would be a helpful feature. Once you have enabled this feature, your subscriber does not need to use the credit/debit card whenever the subscription ends.

5) Consider What Your Customers Want5) Consider What Your Customers Want

Many sellers get hung up on one payment processor and don’t realize what their customers want. Some businesses can get away with charging more for their product and taking less payment processing fees, while others need the payment processor to make money too.

If possible, you need to take care of the payment processing fee. However, charging the user is not a wise choice. You will probably lose some conversion rates if you charge the user the payment processing fee.

6) Make Sure You Can Get Paid for Everything6) Make Sure You Can Get Paid for Everything

Cash out your sales no matter what! Your payment processor should help you with whatever you need, whether getting paid in cash, check, or whatever else. Most popular payment processors offer a wide range of options for accepting payments.

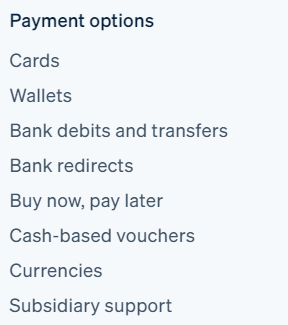

Here’s another example of Stripe.

As you can see, through Stripe, you can accept

- Cards

- Wallets

- Bank debits and transfers

- Bank redirects

- Buy now, pay later

- Cash-based vouchers

- Currencies

and so on.

It is a complete solution. Offering multiple payment options is a great idea. This way, your visitors will be able to choose their preferred payment method and complete it with ease.

7) Research Payment Processors7) Research Payment Processors

Next, research as many processors as possible, focusing on those that best match your needs and comparing them. Some of the popular ones are:

- PayPal

- Stripe

- Amazon Pay

- Skrill

- 2Checkout

- Authorize.net

- Payza

- Braintree

Once you have found the best ones you can afford, start comparing the fee structure, features, support available, and so on.

At last, you will probably land on a payment processor.

8) Check Features That Will Help Your Business Grow8) Check Features That Will Help Your Business Grow

Each payment processor comes with unique features.

For example, does the provider offer invoicing and other useful features? If you’re a retailer or other business that needs to keep track of inventory and shipping, consider whether the provider offers those services as well.

This way, you can make your work easier. On top of that, if you have an accountant, the accounting process will become so simple.

ConslusionConslusion

Finally, think about ease of use. Choose a provider that offers an easy-to-use website and app and plenty of technical support over the phone. Ensure that all of your questions are answered promptly and that there is no extra charge for help.

We hope you have found this article helpful and learned how to choose a payment processor for your small business. Please consider sharing this post with your friends and fellow bloggers on social media if you did.

For more related posts, you need to check out the blog archive.