Definitely, people who buy and sell mutual funds based on reading their annual returns will lag the market. People buy funds that have done great and sell those that lag – the very definition of buying high and selling low.

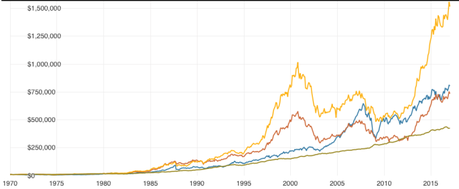

Performance of US Shares (S&P500; yellow), Australian Shares (blue), International Shares (orange) and Australian Bonds (brown) since 1970. Source: Vanguard Investments Australia.

Performance of US Shares (S&P500; yellow), Australian Shares (blue), International Shares (orange) and Australian Bonds (brown) since 1970. Source: Vanguard Investments Australia.

As a bit of light reading this week, I perused an investor newsletter by Mike Taylor, CEO & CIO of Pie Funds (Pie Funds is a small New Zealand funds management firm). Mike recalled the story of how Peter Lynch wondered what return investors in the fund which he managed – Fidelity Magellan – were getting versus the fund’s actual return. During the period 1981-1990, the fund returned a very decent 21.8% p.a. The average individual investor however, actually achieved an annual return of 13.4%.

How can an investment in such a stellar fund perform so poorly on a relative basis?

Lynch noted that due to their buying after a period of strong performance and selling after relative poor performance, investors were doomed to substantially lag behind the fund.

Taylor…

View original post 158 more words