Buying a car in Singapore is a dream for many. The problem is cars are getting more expensive in Singapore with the cheapest new car at around $75,000 now. Recently, I've been pondering on the idea to own a car and still meet my financial targets for retirement. Can this be done?

Its a fine line between planning for retirement and owning a car. It took me awhile to finally pend down my thoughts and perhaps finally be able to plan to own a car while still achieving my financial goals. In this post, I will list down the cost of owning a car and how it is still possible to plan for retirement.

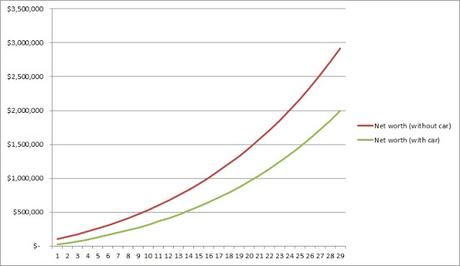

My initial financial target was that by the age of 48, I will be able to save up a million dollars in cash excluding CPF. With owning a car, the financial target will be pushed back by about 5 years to 53 years old. Doesn't sound that bad isn't it? Let's get straight to the numbers.

The first thing is the cost of the car itself. Looking through several websites, the few lowest price cars you can get are probably the Mitsubishi Attrage at $74,000 and Honda Fit at about $75,000. These prices are inclusive of COE. If you look at other models such as Hyundai Avante, Honda Vezel or Toyota Vios, these will cost about $85,000 to $95,000. Any other higher end models will cost you close to or above $100,000 easily.

If you have the cash to pay for it, then it will decrease your savings by one lump sum but you don't have to incur a monthly instalment cost. Let's say you don't have the cash and have to take a loan:

Loan amount: $63,699 (70% max loan)

Monthly loan installment: $906

If you decide to buy a lower price car at $74,000, the monthly loan installment will then be $737.

Monthly loan installment for car: $737-$906 per monthThe next cost is the cost of road tax. For a car with 1500cc and age of car is less than 10 years, the road tax is $686 per year. If the car is 1600cc, the road tax will be $744 per year.

Road Tax: $686-$744 per year

Insurance is important for a car to protect you against liability for any accidents. If you've not met any accidents before and never claimed from any car insurance and have more than 3 years of driving experience, insurance cost will be lower at $800+. It can go up to $1600 if you're a young driver with less than 3 years of experience or have claimed from car insurance before.

Insurance cost: $800-$1600 per yearThe daily running cost will include petrol, parking and ERP. For HDB season parking, it is priced at $110. If you go to your parents or in laws house often, you might have to buy another family season parking at $55 x 2. Total cost of season parking will be about $220. Other miscellaneous parking cost such as when you drive out for meals or outings will probably cost another $50 per month. For petrol, let's say your car fuel efficiency is about 20km/litre and you drive about 40km/day, with average pump price at $2.40/litre, petrol cost will be about $144. For ERP, let's put it at around $40 per month.

The general recommendation is to send your car for servicing every 10,000km driven or every 6 months which every is early. This will set you up for a cost of about $600 per year.

Maintenance cost: $600 per year

Summary of cost to own a car in Singapore

After listing out all the different cost, we are now finally able to add it all up.

If the car is paid in full without any loan, then the monthly cost for car will be about $628/month.

Now, we come to the tough question of can we afford to own a car? If owning a car causes you to have little to no monthly savings from your income, then its definitely a no. If after deducting the expenses to own a car and you still have savings, then it may be a yes. Question is, how much savings you should have in order to retire in Singapore?

The amount required for retirement in Singapore is always increasing. Some say its $1 million, some say its $2 million, others can afford to retire with just a few hundred thousand or some just totally give up and rely on their kids in the future to give them allowance. Let me put this forward, retirement planning is hard. I've struggled through it a lot the past few years finding a balance towards spending and planning for retirement to the extend I can be pretty stressed up. Its no wonder people do give up planning for retirement.

To make things easier, let's set the retirement amount to be $1 million. We have the below profile of person to see if he can afford to own a car:

Salary increment: 3% annually

Monthly expenses: $2500 (without car), $3100 (with car)

Monthly expenses increase: 3% per year

For person A with $5000 monthly salary and the above expenses, he still can save up $1 Million in 16 years without a car, 21 years with a car. Owning a car pushes back retirement by 5 years so it doesn't seem that bad. This is assuming the person does not buy another car after 10 years which is the end of life for cars in Singapore.

Using the same parameters, if we bring down the salary to $4000 per month, this person will take 21 years to save up $1 Million without a car and 26 years with a car. Do take note the above parameters assumes the monthly expenses per household member and probably will be for a person without kids. For a couple, the expenses will be higher but if your spouse is also working and contributing to household expenses, then its still affordable. In the 2018 household expenditure survey, it was stated that Singaporeans with a family of 4 spends an average of $4906 per month. This may have included owning a car but the figures here are still quite high.

If you're a single income earner supporting a family of 4, you definitely need to earn above $7000 to afford a car and still have enough for retirement.

Can you afford to own a car in Singapore? Its better to work out your own financial plan before committing to buying a car. If your income is relatively high above $5000 and don't have much other commitments, you might be able own a car without affecting your future retirement plan.