So you’ve pulled together a few thousand dollars, opened a brokerage account, and done some research to find the stock that you wish to purchase. (If you don’t know how to find the kind of stocks you want to invest in, please pick up a copy of The SmallIvy Book of Investing, which includes gobs of information on all sorts of investing options, what kinds of companies to look for, and investing strategies that will put the odds way in your favor.) In this article, we’ll go through the mechanics of how you actually enter an order and what the different types of orders are. Using the right kind of order can make a big difference in your results, so a little knowledge can go a long way.

(Note, while you’re reading this for free, it is not “free” to put all of this great information together for you. Hundreds of hours, an average of two to three hours per article, have been spent researching and writing these articles for you to use and hopefully better your life. One way that you could pay back and keep me writing more great articles like this one, while getting a lot of great information, is by purchasing one of the books, The SmallIvy Book of Investing or FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early. Reading these books will make you very knowledgeable in money management and investing and give you the secret to reaching financial independence. Buying a book and writing an honest review in Amazon would be even more helpful.

Another way that you can support The Small Investor is to buy something through one of the links on this page, or just by going to Amazon through one of the links and then buying something you were going to buy anyway. This page uses affiliate links, which is a way for you to get all of this great content while paying nothing more than you would otherwise. As an Amazon Associate I earn a small fee, paid by Amazon, from qualifying purchases. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase, so you get something you would purchase anyway and The Small Investor gets a few dimes. This helps keep The Small Investor going and free. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link and buy whatever you wish.)

Where you place orders

In ye olden days of last century, stock orders were placed over the phone or occasionally in person at a brokerage office. Some people would even sit in the brokerage all day, watching the screens and buying and selling stocks. (These people didn’t tend to make money.) Today you may still be able to place orders by phone with your broker if you’re using a full-service brokerage like Merrill Lynch, but more and more often people are entering orders through websites and apps. Regardless of how you enter the order, however, the terminology is the same.

(Want to become an expert in single stock investing, plus learn what you need to be doing at each stage of life to grow wealthy? Get a copy of The SmallIvy Book of Investing.)

Parts of an order

When placing an order you need to indicate:

- What you want to do (buy or sell)

- How many shares

- The stock or security involved

- Whether it is a market or a limit order

- Special instructions

Hopefully the first three items are self-explanatory. For example, if you wanted to buy 10 shares of Amazon, you would say “Buy 10 shares of Amazon, symbol AMZN” or enter the information under order type, quantity, and security fields in the app. Note that in the past it was common to buy in equal increments of 100 shares at a time since it would cost less to buy and sell this way. Today you may not even pay a commission (a fee to the broker) when you buy and sell, or the commission may be a flat rate regardless of what quantity you buy, so this is less important. You might check with your brokerage if you’re not sure, however, and see if buying in 100-share increments (called “round lots”) has an advantage for you.

The other parts of the order are a bit more complicated. Let’s go through each of these parts in detail.

What is a market order?

When placing a trade, you need to specify whether it is a market or limit order. If you are buying a stock and you place a market order, it means that you are willing to pay the lowest price that someone else is willing to sell the shares for right now. That price is called the ask price because it is what someone else is asking for the shares. This price is normally higher than the price at which the shares traded at last, which is the price you’ll see when you look at a simple quote for the stock in your phone, which is called the last price. With most stocks the ask price will only be a few cents above the last price, so if the stock last traded at $25.25 and you put in a market order to buy, you may end up paying $25.35 per share.

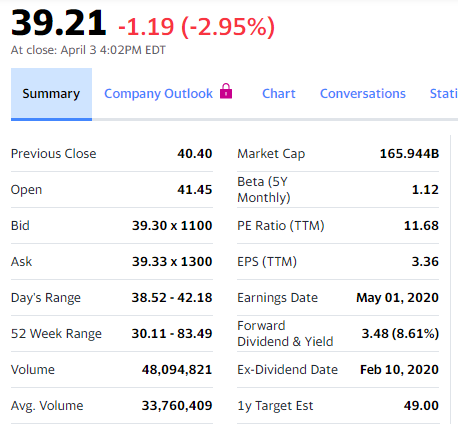

You can see the ask price (and the equivalent on the sell side of the trade, the bid price) for a stock by getting a detailed quote. For example, here’s a detailed quote for Exxon from Yahoo Finance that shows the bid and the ask price (the last price, which is where the shares traded last, is shown at the top):

Note that the number after the “x” is the number of shares that are offered or being sought at that price. For example, I could buy up to 1300 shares of Exxon at $39.33 if I put in a market order to buy when this quote was active. If I wanted to buy 1500 shares, I’d get 1300 at $39.33 and then the rest of the shares at whatever the next higher price was. For example, maybe there was someone wanting to sell 1000 shares at $39.35 at the time when I put in my buy order, I’d get $1300 at $39.33 and the other 200 shares at $39.35. Note that you are not the only one in the market, so there could be orders ahead of you that get some of the shares you’re trying to buy, so you might get fewer shares than shown in the quote when you put your order in.

Sometimes the ask price can be significantly higher than the last price (or the bid price can be significantly lower than the last price). This happens when some news breaks about a stock, like for instance if earnings are released and they are a lot better than expected. It also happens frequently when a stock is thinly traded. For example, a microcap stock that very few people trade. If you’re trading a household name, however, like Apple or Home Depot, or you’re trading ETFs like the S&P 500 SPiDeRs, there will be lots of people on both sides of the trade at any given time. If you are buying or selling a stock that is thinly traded, you will want to use a limit order.

If you were selling shares and put in a market order, the sale would be executed at whatever the bid price was right now. Again, if all of the shares at the current bid price were sold, you would sell your shares at the next lower bid price, continuing in this manner until all of your shares were sold. What if you didn’t want to sell the shares unless you got a certain price? Again, in that case, you might enter a limit order.

What is a limit order

If you put in a limit order, you’re saying that you will not buy (or sell) the shares unless they are at or below (above) a certain price you set called the limit. For example, you could tell your broker that you want to sell 100 shares of Amazon with a limit of $1882. This would guarantee that you would get at least $1882 per share if and when they sold.

So, what would cause these shares to sell if you put in such an order? The bid price would need to be at $1882 per share or above and there would need to be enough shares available at that price to fill your order. For example, if someone came in and put in a bid to buy shares at $1882.50, you would sell your shares (up to the number the other person was wanting to buy) at $1882.50. Again, this assumes that you are the first person in line with a limit order at or below that price.

When, and when not, to put in a market order

There are good and bad times to use both market and limit orders. It might seem odd to place a market order since you don’t know the price you’ll pay (or get), but it is actually perfectly safe a lot of the time. Normally, you’ll get something close to the price at which the stock traded last. This is because there are lots of individuals in the market, throwing out bids and offers, plus people buying and selling their shares look at those prices and set their offers accordingly. Just like you would probably set the price of a used car you were trying to sell near the price for which someone else sold theirs, people trading stocks set limits near previous prices since they figure others would expect to trade near the same prices. The only times prices change rapidly is if there is some news that comes out, causing people to change the price they are willing to pay or sell their shares for. If great news comes out, people instantly raise the price, trying to figure out how much people will pay. If bad news comes out, holders of the stock may want to get out as fast as they can and drop the price quickly just to sell their shares. You can get an even better idea of what you’ll pay (or get) by looking at the current bid and ask prices just before you place the trade.

Good times to put in a market order are:

- The stock you’re trading always has lots of volume, meaning there are lots of people buying and selling shares every day.

- You think that the price is cheap (if you’re buying) or high (if you’re selling), such that you really want to get in or out before people come to their senses and move to a more reasonable price.

- You want to be sure to get in or out. You may want to be sure to get in if you think shares are cheap or you want to invest some money quickly to make sure you don’t get left behind. You may want to get out quickly if you’ve made a good profit and don’t want to see the share price go back down before you sell.

- You don’t want to waste time adjusting your order. You just want to get it done and get on with other things, so you’ll give up an extra $25 or $50 on a $2000 trade.

Bad times to use a market order are when:

- The stock does not have a lot of volume, meaning there are only a few buyers and sellers. In this case, the stock can change in price drastically, particularly if you’re buying or selling a lot of shares.

- The size of your buy or sale is large compared to the trading volume of the stock. In this case the trade you are making will make the share price change significantly, making you get a bad price. All or none is also important in these situations (more to come on this).

When to put in a limit order

Limit orders also have their uses and can help you make a little more on each trade. If you’re investing long-term, as suggested in FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early , it really won’t make much of a difference and it is dangerous to miss getting in or out, making it worth it to just enter market orders and perhaps pay an extra quarter point for a stock. I put in market orders most of the time when I’m buying shares so that I know I’ll get the shares. But there are situations where you can really get hurt if you use a market order and a limit is more appropriate.

FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early

Times where a limit order makes sense:

- You’re buying or selling a stock that does not have a lot of volume, meaning the price you pay or get could change rapidly and even your order could move the price of the stock.

- You’re buying a stock and you only have a certain amount to invest. For example, you have $2000 in an IRA to invest and can’t add more until next year, so you need to make sure you don’t pay more than $2000.

- You’re accumulating shares of a stock over time and want to buy more if it drops below a certain price.

- You’re selling shares to trim your position and want to sell if it goes above a certain price, but are happy to hold it if not.

Note in these last two cases especially, you’ll want to tell your broker that the order is Good ’til cancelled or GTC. Otherwise it will be considered a day order and you’ll need to enter it again tomorrow if the order doesn’t execute today. GTC orders stay active for a period of months.

Times when you don’t want to use a limit order:

- You’ve made a good profit and want to take money off of the table to protect yourself. You might save a hundred dollars with a limit order, but you could lose thousands if the stock doesn’t reach your limit and falls precipitously.

- A stock is at a good price and you want to get in.

- You’re doing a stop loss order.

In this last case, a stop loss order, you are creating an order to protect yourself should a stock drop below a certain price. For example, if stock XYZ drops to $20 or below, you want to create an automatic order to sell the shares. You can create both stop loss limit and market orders. If you set a stop loss limit order, you’ll create a limit order at $20 if the stop price is hit, meaning that if it fell to $19 and triggered your stop loss, you would create a limit order to sell at $20. If the stock continued to fall and never hit $20 again, you’d keep losing money. You thought you were protected, but you really weren’t!

To prevent this, you should use market orders with stop loss orders. If you set a stop loss market order, it would sell at whatever price it was at after reaching $20 per share or lower. This could still bite you in the case of flash crashes where stocks drop quickly due to a computerized trade for a few seconds or minutes and then bounce right back, but these are extremely rare and measures have been put in place to make these less likely than they were ten or twenty years ago.

Tips on setting limits

A good way to determine where to set a limit is to go back to the bid/ask spread. If you’re buying, for example, and kind of want to buy in but wouldn’t mind it if you missed out, you might set a limit at the current bid price. If you are more eager to buy, you might set it right between the bid and the ask price. If you really want to get in but don’t want to see the stock jump in price when you do, you might set it at or slightly above the ask price.

If you are accumulating shares, you might set a limit order a few dollars or maybe 10% down from the price at which you first bought in to add more shares if the stock drops. For example, if you’re buying XYZ, which is trading at $20 per share, and want to accumulate 1000 shares, you might first buy 200 shares at $20 with a market order and then set a limit to buy 200 more shares at $18 per share. If you get that order executed, you might then set another order to buy 200 more at $17 per share, and so on. If the stock keeps retreating, you’ll keep getting more shares. If it goes up, you might just sit tight and let it go or you might set a higher limit still below the current price and wait for a dip in price.

Actually, I would set the first limit order at $18.07 or something like that in the above example. Why? I would think that there would probably be other people with limit orders in and they would probably set them at even dollar amounts since that is human nature. If someone else had an order in at $18 and I had one in at $18.07, I would get the shares. If I put it in at $18 and she were there first, she might get the shares instead of me before the stock bounced back up. So, instead of setting a limit at 418 or $18.25 or something, set it at $18.06 or $18.31.

Special Instructions

The two special instructions that you may use are Good ’til Cancelled, or GTC, and All or None. Let’s look at each of these.

Good ’til Cancelled

When you put in an order and don’t specify, the order will automatically be a day order, meaning that if it is not executed by the end of the day, it will be cancelled and you’d need to put it in the next day again if you still wanted to do the trade. If you put in a market order, it will normally be executed within seconds of your placing it, so this will not matter. If you place a limit order, however, it will not execute until the bid or ask price hits your sell or buy limit price, respectively.

If you give the special instructions that the order is GTC, the order will remain in effect for a couple of months. This way, you don’t need to place the order again each day. If you decide that you no longer want to execute the trade and it has not occurred yet, you can call your broker or go in through the app and cancel the order.

All or None

All or none is useful when you’re trading stocks that are thinly traded and/or you’re buying or selling a whole bunch of shares at once. Let’s say that you’ve placed an order to buy 10,000 shares of a microcap stock at $20 per share. If there are not enough shares available for sale to fill your order, your broker will normally fill as much of your order as she can. This may not be what you want, especially if you get charged a flat commission whether you buy 10 shares or 100 shares.

You can prevent this by putting in an all or none order. If you specify all or none, the trade will only execute if you can get all of the shares. If you place a limit order as all or none, you won’t buy any unless there are enough shares available at the price you set as your limit. A market order all or none is a little more complicated. If you place an all or none order on a market order, it will execute if you can get all of the shares, but the price you pay may go up (if you’re buying) above the current ask price if there are not enough shares at the current ask price.

If you’re placing a large order on an active stock, all or none would usually only be useful for limit orders since there may not be enough shares available at the limit price and you don’t want to get a partial order filled. It would make no sense on a market order because there will be plenty of shares available, just maybe at a slightly higher price than the current ask price. If you’re buying or selling a microcap stock, it would be suicide to not place a limit order. If very few people are trading and you place a market order, the price you pay (or get) might be tens or hundreds of dollars above (or below) the last price.

(If you enjoy The Small Investor and want to support the cause, or you just want to learn how to become financially independent, please consider picking up a copy of my new book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early This is the instruction manual on how to become financially independent.)

Have a burning investing question you’d like answered? Please send to [email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.