In the UK, the MM is 5.1. So this roughly breaks down to median household income of £28,000 and house prices £143,000.

The trouble with this is, it doesn't really tell us about how affordable housing is once we've stripped out taxes and mortgage repayments. That's what is felt in peoples pockets at the end of the day.

So if we do that, we take off about £6,000 for net tax ( benefits netted off) and mortgage repayments £8,000, which leaves us with £14,000 per year to pay all the other bills and expenditures of life.

Which is a pretty small amount. If we use this as our measurement of affordability we get a ratio of 10.2 We'll call this the True Affordability ratio.

Now, what happens under LVT? Well simplistically you might say because the mean house prices will half, we'll end up with a Median Multiple of 2.5. So twice as affordable.

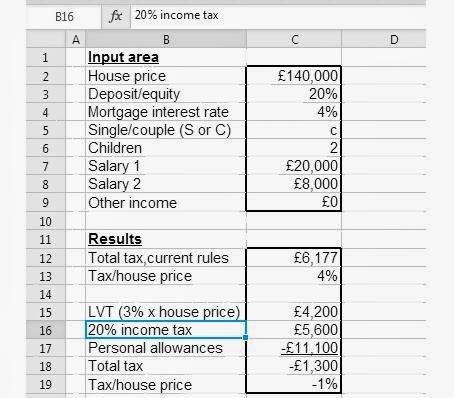

Pretty good, but that doesn't tell us the true picture of how LVT will affect True Affordability. Taken from the KAALTVN LTV net liability calculator here, we get the following.

So after-tax income becomes £29,300 minus £4,000 in mortgage repayments equals £25,300 to pay all the rest of life's expenditures.

To get the True Affordability Ratio we divide £70,000 by £24,300, which gives us 2.8.

So under LVT true affordability improves from 10.2 to 2.8, which results in housing being four times more affordable.

Now, I wonder what Policy Exchange et al would have to say about that?

Also it's worth noting the above assumptions were calculated on Mark Wadsworth's half way house LVT/CI formula with 20% Income Tax and 5% deadweight losses.

In reality the deadweight losses from taxation and the land monopoly are likely to be much bigger(Prof Nic Tideman states 48%GDP).

So 10 years down the line after a change to full on LVT, a) GDP would have grown quite a bit larger than today b) the top 1% would be pay 50% of all expenditure instead of 20% now, or 35% under the half way house c) the housing mis-allocations would have straightened themselves out d) there would be a generally higher re-cycling rate of existing property assets.

In other words, housing affordability for a median household wouldn't be only 4 times better, but likely double that.