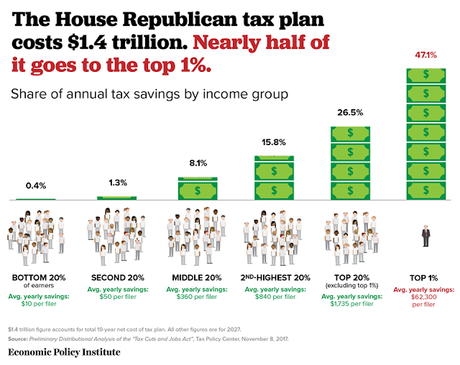

The graphic above shows who would benefit the most from the tax plan recently passed by the Republicans in the House of Representatives. Note that the top 20% would get 73.6% (about 3 out of every 4 dollars cut) of all the cuts, and the top 1% would get 47.1% (or nearly half of all the cuts).

How can this be called a middle class tax cut, when 80% of Americans get only 26.4% of the cuts? The truth is that this is a cut for the wealthy and the corporations -- not the middle or working classes. It once again highlights who the Republicans care about -- and that's not most Americans. Their true constituency is the wealthy and the corporations, and their economic agenda (i.e., trickle-down) is always geared toward helping those groups.

Here are the quintile yearly income levels:

Lowest 20% -- under $15,010

20-40% -- $15,010 to $30,000

40-60% -- $30,000 to $46,126

60-80% -- $46,126 to $75,067

Top 20% -- over $75,067

Top 1% -- over $300,800

That means 47.1% of the tax cuts go to those making over $300,800 a year -- and 73.6% of the cuts go to those making more than $75,067 a year.

If this was really a tax cut for the middle class, then the middle quintile (those making between $30,000 and $46,126 a year) should be getting the bulk of the cuts. But that middle group gets only 8.1% of the cuts. And those making less than $30,000, the ones needing relief the most, get only 1.7% of the cuts.

This isn't a middle class tax cut, and it's not a plan that's fair for most Americans. It's a travesty, and another giveaway to the rich -- and it must be stopped.