Want to get caught up? Check out my previous posts on Craft Brew Alliance.

This all started because of a tweet:

The yr in beer stocks: Craft Brew Alliance $BREW (+154%); Boston Beer $SAM (+80%); Molson Coors $TAP (+31%) Anheuser-Busch Inbev $BUD (+22%)

— CNBCBeerNews (@CNBCBeerNews) December 31, 2013

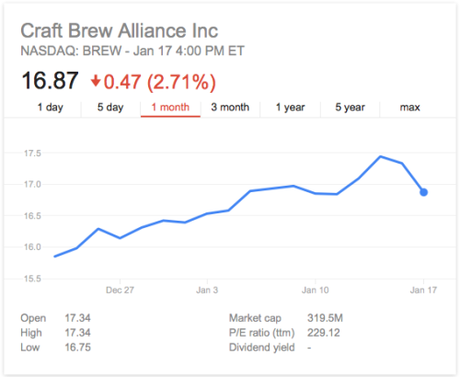

I’m glad someone was paying attention, because Craft Brew Alliance had a great 2013 and for the start of 2014, it’s going pretty good, too. Their brands are selling well and even though they’re receiving something of mixed messages from stock research firms, their share prices continue to grow.

The past month has been kind, despite a dip in stock price the last couple days that mirrored the NASDAQ Composite:

There’s a lot that goes into running a company, but for now it seems Craft Brew Alliance has a decent grasp on the beer market. In reviewing its core three bands, Widmer, Redhook and Kona, Craft Brew has set each up to succeed in something of a niche market, attracting different groups of beer drinkers.

In each case, it seems Craft Brew Alliance’s brands structure themselves to straddle a careful line:

- Kona stands to make big gains against companies producing that yellow fizz, with increased advertising and pushing its exotic feel of relatively unexciting brews. Moderate flavor and fun names stand a chance to bring drinkers into the fold.

- Redhook focuses on niche beer styles that also produce more flavor than generic lager, but ideal for “crossover” drinkers who want more than yellow fizz. It’s a perfect combination to slowly shift drinkers from bland beer to something that has a little more flavor.

- Widmer offers a variety of flavorful and sometimes high-octane brews that caters to real beer geeks, but knows where the money is these days: hops. That appeals to craft brew fans, but it’s a good gateway for casual drinkers.

It might not sound like a lot, but out together, it all adds up.

The more I thought about Craft Brew’s movements with these brands, the more I was reminded of this post from November. With the help of a (sort of) handy chart, I ponder the future of American beer interest and what that means for the general consumer. In the case of Craft Brew Alliance, they seem to be finding the right space to work in as we move from “before,” or start of the craft beer boom, to the “after” time we are moving toward, when craft and its variations are exponentially growing in popularity:

Click to enlarge

In building these core brands, Craft Brew Alliance [CBA] has structured themselves in a perfect way for beer drinkers. Each brand introduces the next step in a craft fan’s journey – from sipping that first non-BMC beer all the way to a strong ale brewed with chiles, cinnamon, pecans and chocolate.

Even more so, CBA brands do a great job at mixing attractiveness through label art (Kona), novelty (Redhook) or flavor intensity (Widmer) with price point. Beer nerds are willing to spend more to find something ideal to drink, but CBA affiliate beers do a good job at staying affordable across the board.

This type of approach is how any individual brewery would create their lineup, but by specifying identities for each brand and finding the right market, CBA has set themselves up nicely. This doesn’t even consider CBA’s Omission line of gluten-free beers, which accounts for 3 percent of the company’s output in a market that is constantly growing. Right now, the gluten-free market includes 21 million households in the U.S.

The only problem – according to those with a better understanding of stock market jargon than I – is that Craft brew needs to keep growing at its recent, rapid pace in order to see its stock hold steady. If all goes according to plan, that shouldn’t be a problem:

Craft Brew, especially with its Kona and Redhook brands, isn’t trying to go too big or too bold. It’s delivering beers that are more interesting than the Bud-Miller-Coors pilsner-style lagers, but are still approachable to people who are used to the old American standards. That helps explain why Kona grew by 26% over last year, and Redhook, by 20%.

There may not be a definitive conclusion on Craft Brew Alliance quite yet, but I think it’s evident we should still keep paying them as much attention as a beer behemoth as much as AB InBev, MillerCoors or Boston Beer.

Now I turn it to you … what do you think of CBA? Are they making the right choices? Are they a company you care about?

Craft Brew Alliance profile:

- Part 1: Widmer Brothers

- Part 2: Redhook Brewery

- Part 3: Kona Brewing

- Part 4: Don’t Forget About Craft Brew Alliance

+Bryan Roth

“Don’t drink to get drunk. Drink to enjoy life.” — Jack Kerouac