Here's Why The First $100K Savings Is Very Important:

"The first $100,000 is a bitch, but you gotta do it. I don't care what you have to do-if it means walking everywhere and not eating anything that wasn't purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit" - Charlie Munger

The above quote is adapted from Charlie Munger who's a popular name in the investing world. He is vice chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett. There is much truth in his words as I personally experienced it myself saving the first $100,000. It was real hard, very hard at the start. After that, its true that it gets easier.

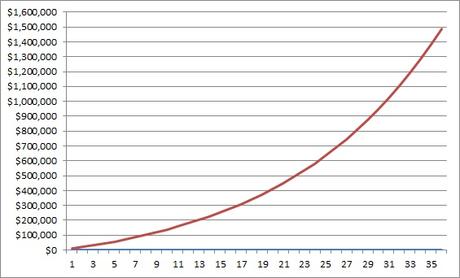

To illustrate the point why saving the first $100K is very important, I've put the numbers into various charts to visualise how life actually pans out after we have saved the first $100,000. The scenarios are based on saving just $10,000 annual and investing at a 7% investment return.

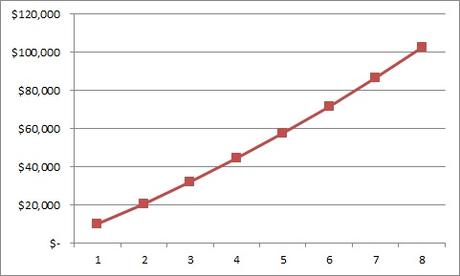

How long does it take to save the first $100K?

The first $100K is the hardest. If we only save $10,000 annually and invest at 7% return, it takes about 8 years to reach the first $100K.

The journey beyond $100K

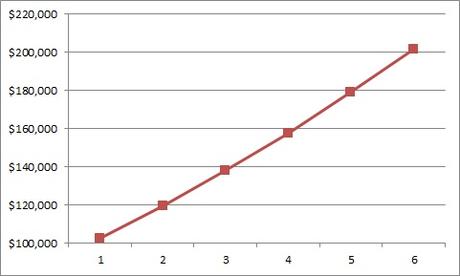

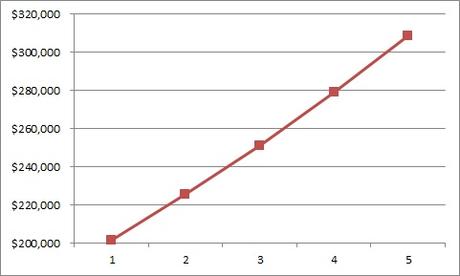

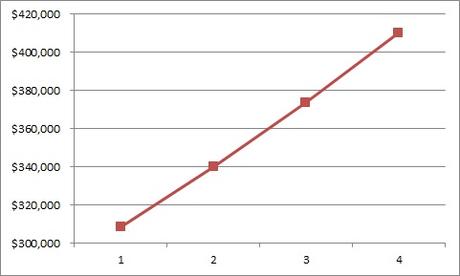

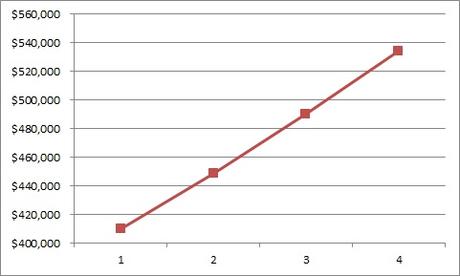

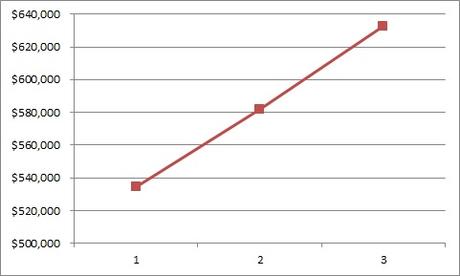

Let's look at what happens after we have saved the first $100K assuming we continue tosave only $10,000 annually and invest at 7% interest rate.

From $100K to $200K, it takes about 6 years

From $200K to $300K, it takes less than 5 years

From $300K to $400K, it takes less than 4 years

And from $500K to $600K, it takes only less than 3 years

This is the summary of how our money compounds after the first $100K. As we can see, the line gets steeper indicating the the power of compound interest and also the importance of saving the first $100K.

There is another interesting fact we can see through the charts. The fact is investing is less important when we have less money as even if we can get 10% on just $10,000 savings, it is only $1000 returns. This doesn't add much to our wealth. But if we have $100K savings, the same 10% will increase our wealth by $10,000.

For my own financial journey, I set out a goal to save $100K when I started my blog back in 2013. I saved aggressively and managed to achieve it in less than 5 years. Did it get easier after that? Yes it did and I really can ease off a little bit and spend more without hurting too much.

For those who are still on your way to the first $100K, get it as early as you can. For those who have already got your first $100K, you can actually relax a bit.