This morning, Good Beer Hunting published a Sightlines piece I wrote examining the essential forfeiture of the Brewers Association's goal of 20 percent market share by 2020.

At the end of 2016, BA-defined market share stood at 12.3 percent. Nothing to scoff at, considering how the industry continued to grow last year. But the truth of the matter is the goal of "20 by 20" is based on a self-prescribed definition of what "craft" is and isn't. So I was intrigued by this question I got after the story went live:

@BryanDRoth absolutely. Do you know the craft share using IRI's definition instead of the BA's?

- Mike Francis (@PayetteBrewMike) March 29, 2017

What was once an idea of gaining 20 percent market share - something actually written into the organization's mission statement in 2014 - has now more or less faded into the stark contrast of a reality where merger and acquisition activity can easily strip millions of barrels away from "craft" defined beer.

But instead of adhering to the artificial placement of the word "craft," what if we rearranged what is allowed to be included in this equation? Is the goal of 20 percent then attainable?

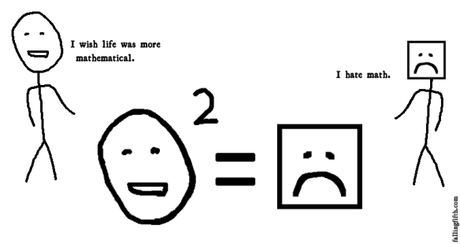

To explore this idea, I'm doing some really rough, probably bad, hopefully not inaccurate, back of the napkin-type math. I am a writer. Numbers - despite what I'm able to showcase on this blog - are not my thing. But that never stopped me from trying.

Instead of playing by what the Brewers Association says is "craft," I'm going to include breweries and brands that according to Beer Geekery are decidedly not craft. Businesses like Blue Moon, Shock Top, Leinenkugel's, etc. While these don't fit the BA definition, they do count as craft for market services like IRI and Nielsen - and most important: consumers. Because no matter how many loud voices come from the tippy-top of enlightened beer drinkers, the honest-to-god truth is that we are a small percentage. Blue Moon is "craft" to millions of others. So there.

... and away we go.

We are starting with the Brewers Association's reported "craft" production volume of 24,570,469 barrels produced in 2016. If that accounts for 12.3 percent of the 2016 market, that puts us a touch below 200 million barrels overall. (FWIW, the National Beer Wholesalers Association estimated 206.7 million barrels in 2015)

From there, we start adding.

There are more than 1.5 million barrels from brands caught by IRI's "craft" definition, including an estimated 1.2 million that were reported to Brewbound.

Then we can add breweries from AB InBev's High End unit, which includes Blue Point, Elysian, 10 Barrel, Golden Road, Four Peaks and Breckenridge. Combined, based on press reports of the latest available production numbers (many old), they made what we'll conservatively call 375,000 barrels in 2016.

Let's not forget about MillerCoors' contingent (Hop Valley, Revolver, Saint Archer, Terrapin) that was around 180,000 barrels, too, based on what public data I could find.

Adding all those together came out to something a little over 29 million barrels, or roughly 14.6 percent of the total market. Then I started filling in the blanks for additional capacity for brands like Shock Top, Blue Moon, Goose Island and others.

After all these hurried additions, which I hope are sane and accurate, the total, as best as I could find, was nearly 31 million barrels of "craft" beer (whatever and however you'd like to call it) out of the roughly 200 million total barrels produced. In a very crude sense, that leaves us at 15.5 percent market share.

That means, by pulling production data from the last five years, many of which is old and doesn't reflect up-to-date growth by some of the fastest, largest breweries in the country, the sort of, Real World "craft" beer market share is maybe about 4.5 percent away from a 20 by 20 goal with three years to go. And that's not too bad, considering the continued addition of new breweries and growth of larger ones (even if some are having difficulties).

So what the hell was the point of all this, aside to steal my attention from my wife and cats?

Focusing on definitions, and what we want to manipulate them to be, seems kind of silly. So often, card-carrying beer enthusiasts talk about "gateway beers" like Blue Moon, but now won't acknowledge that brand unless it's in a joke that only a dozen friends will understand when told at a bottle share. The reality is many of these "crafty" brands are, in fact, just as "craft" to millions of consumers who pass by them every day in beer aisles.

No matter how long ago we left behind our enjoyment of a Blue Moon or Summer Shandy, there have been plenty of people to take our place who find those flavors and tastes just as experimental as we once did.

Despite facing pressures from wine and spirits and other drugs of choice (cough-wheeze- pot-cough-choke), beer is putting up a hell of a fight. And while Bud, Miller and Coors may be working hard to try and recapture your attention, overall, shoppers continue to show interest in more full-flavored beers. So let's relax for a second and realize that those kinds of decisions have strong potential to bring people over to whatever you want Real Craft Status to be.

That mom buying Blue Moon may be the next Allagash brand ambassador.

So yeah. "Craft," whatever it is, is doing pretty good. Maybe that goal for 2020 isn't so crazy after all.

Now only if it means I'll finally get that jet pack I was promised as "the future" so long ago...

(no but for real go read what I wrote for Good Beer Hunting)

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac