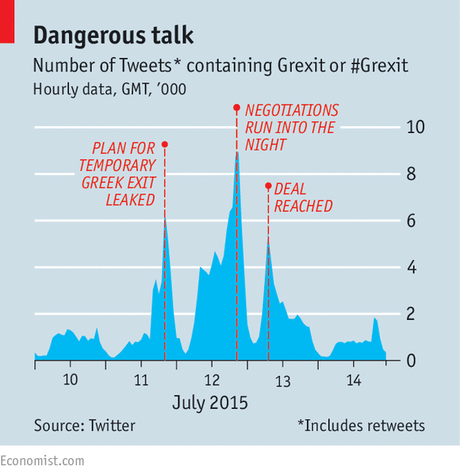

THE risk of a chaotic Grexit was averted by the morning of July 13th. But the rest of Europe exacted a price from Alexis Tsipras, the Greek prime minister. To have a chance of a third bail-out, Greece must meet strict terms. And, even if it does, and a three-year programme providing financing of as much as €86 billion ($ 94 billion) is concluded this summer, many wonder if the deal will really help the country stand on its own feet.

Much depends upon how resilient Greece is after the turmoil of the past month, and the self-harm of early 2015. It has slipped back to a mostly cash economy, with capital controls and shuttered banks. Even before these setbacks, a recovery in the first nine months of 2014 had turned to recession in the final quarter of 2014 and first quarter of 2015. Credit to the private sector dried up as banks faced a drain of deposits, forcing them to rely on “emergency liquidity assistance” (ELA), nominally from the Bank of Greece but controlled by the European Central Bank (ECB).

To jump-start any growth, banks must reopen and start offering trade credits, needed for vital imports. That will require…

The Economist: Europe