%%bloglink%%

This meant if your target return for your account was 8.00% and you maintained a balanced portfolio that was 60% “risky” and 40% “risk-free” your “risky” investments had generate returns of 11.3% or 3.7 times the risk free rate of return in order for you to reach your total return goal of 8%.

(60% of the portfolio invested in risky assets times annual return of 11.3% = 6.78%) +

(40% of the portfolio invested in risky free assets earning average of 3.00% = 1.2%)

6.78% + 1.2% = 7.98%

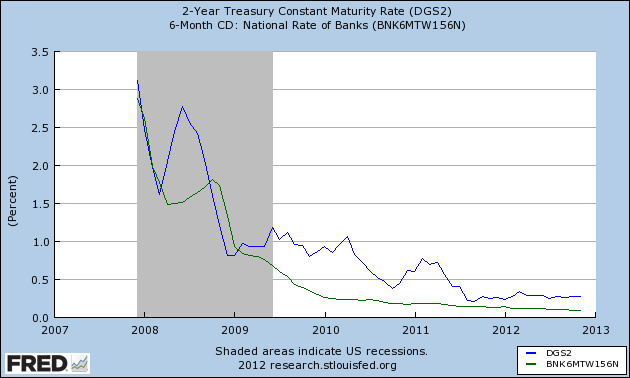

As of November, the “risk-free” rate of return was 0.27% for 2-Year Treasury Bonds and 0.09% for the average 6-Month CD.

This meant if your target return for your account was 8.00% and you maintained a balanced portfolio that was 60% “risky” and 40% “risk-free” your “risky” investments had generate returns of 13.21% or 73.4 times the risk free rate of return in order for you to reach your total return goal of 8%.

(60% of the portfolio invested in risky assets times annual return of 13.21% = 7.93%) +

(40% of the portfolio invested in risky free assets earning average of 0.18% = 0.07%)

7.93% + 0.07% = 7.99%

Here are my questions:

- Do you believe your investments will earn 73 times the risk free rate of return?

- Are you willing to accept the price swings of an investment that is expected to earn 73 times the risk free rate of return?

- If you do not believe your investments will earn 73 times the risk free rate of return, are you willing to either A) lower your target return or B) increase the portion of your account that is allocated to “risky” assets?