The Republicans claim that their tax plan will spur economic growth, and therefore, be good for all Americans. But we already have a vast inequality in wealth and income between the richest Americans and the rest of the country (as big as it was just prior to the Great Depression), and their plan will make that inequality grow significantly larger. This is a serious problem, because wealth and income inequality stunts economic growth -- it doesn't increase that growth.

Josh Bivens has written a great (and lengthy) article about those at the Economic Policy Institute. Here is just a part of his article:

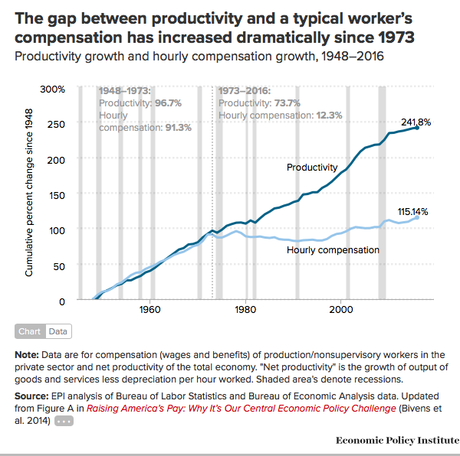

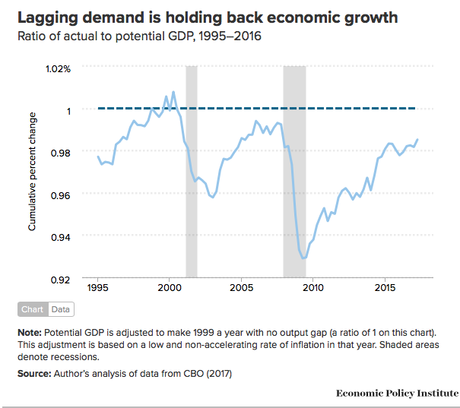

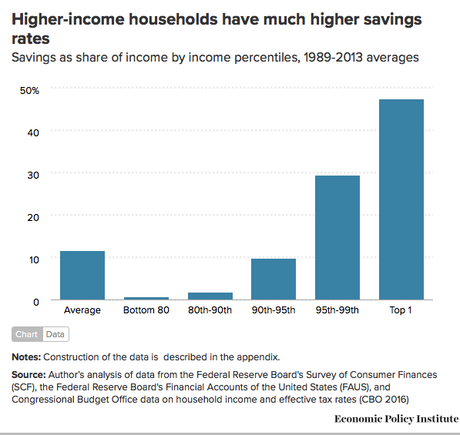

The problem of anemic wage growth—recognized for decades by American workers wishing for higher paychecks—has finally reached the front-burner of American politics. Angst over the stagnant pay of low-wage workers has for example, sparked recent movements to raise minimum federal, state, and local minimum wages far above levels that have characterized the recent past, and often even to levels that would constitute historical highs.2 This new attention to the crisis of American pay is totally proper. The failure of wages of the vast majority of Americans to benefit from economy-wide growth in productivity (or income generated in an average hour of work) has been the root cause of the stratospheric rise in inequality and the concentration of economic growth at the very top of the income distribution. Had this upward redistribution not happened, incomes for the bottom 90 percent of Americans would be roughly 20 percent higher today.3In short, the rise in inequality driven by anemic wage growth has imposed an “inequality tax” on American households that has robbed them of a fifth of their potential income. There would be huge benefits to American well-being from blocking or reversing this upward redistribution. This welfare gain stemming from blocking upward redistribution is the primary reason to champion policy measures to boost wage growth and lead to a more equal distribution of income gains. Put simply, a dollar is worth more to a family living paycheck to paycheck than it is to families comfortably in the top 1 percent of the income distribution. Proponents of increases in the minimum wage and other measures to boost American wages have often argued that there are benefits to these policies besides the welfare gains stemming from pure redistribution. These proponents have often argued that boosting wages would even benefit aggregate economic outcomes, like growth in gross domestic product (GDP) or employment. Recent evidence about developments in the American and global economies strongly indicate that these arguments are correct: boosting wages of the bottom 90 percent would not just raise these households’ incomes and welfare (a more-than-sufficient reason to do so), it would also boost overall growth. For the past decade (and maybe even longer), the primary constraint on American economic growth has been too-slow spending by households, businesses, and governments. In economists’ jargon, the constraint has been growth in aggregate demand lagging behind growth in the economy’s productive capacity (including growth of the labor force and the stock of productive capital, such as plants and equipment). Much research indicates that this shortfall of demand could become a chronic problem in the future, constantly pulling down growth unless macroeconomic policy changes dramatically. . . . Recent work has highlighted the possibility that rising inequality constitutes an exogenous shock to aggregate demand growth in the American economy. For years, this negative shock could largely be ameliorated by declining interest rates set by the Federal Reserve. But since 2000, the American economy has often found itself with a shortfall of aggregate demand even with short-term interest rates essentially at zero. This means that further increases in inequality will be damaging indeed to prospects of economic growth over the short and medium term unless some other lever of policy fills in the demand shortfall caused by the upward redistribution of income to high-saving households. Further, there is growing evidence that prolonged periods of too-low aggregate demand can damage the economy’s productive capacity. Policymakers need to get much more serious about avoiding this vicious spiral of chronic demand shortages caused in part by rising inequality degrading productive capacity. Getting serious would mean adopting a more expansionary monetary and fiscal policy portfolio (public investments and expansions to social insurance programs) than has been pursued in recent decades. But, as Taylor et al. (2015) highlight, the scale of upward redistribution of income in recent years would require historically unprecedented changes in taxes and transfers to reverse. They also note that to move the dial on aggregate demand, policy efforts to spur wage increases will have to be much more ambitious than the adjustments to the federal minimum wage in recent decades. We need to enact a much larger raise in the minimum wage and advance policies to boost wage growth for workers making substantially more than the minimum wage. This makes the EPI’s Raising America’s Pay agenda so vital. It proposes a series of policies that, together, could raise wages for American workers. Pay increases for the bottom 80 percent of households would not just raise the welfare and living standards of these families. Pay increases would also substantially loosen a binding constraint on economic growth: the chronic shortfall in aggregate demand. In short, boosting pay for America’s workers will indeed not only be good for their living standards, it would create a healthier economy overall.