Most of the Republican candidates for the presidential nomination have released tax plans. They tell us that these plans will cut taxes for everyone and give the economy a jump start. That is simply not true.

Most of the Republican candidates for the presidential nomination have released tax plans. They tell us that these plans will cut taxes for everyone and give the economy a jump start. That is simply not true.The truth is that all of their tax plans will give much more to the rich than to anyone else. These plans cling to the failed "trickle-down" economic policy -- the idea that giving more to the rich will help all Americans. That hasn't worked in the past, and there is no reason to believe it will in the future.

Nobel Prize winning economist Paul Krugman (caricatured at left by DonkeyHotey) calls it "Pandering To Plutocrats". Here is what he had to say recently in his New York Times column:

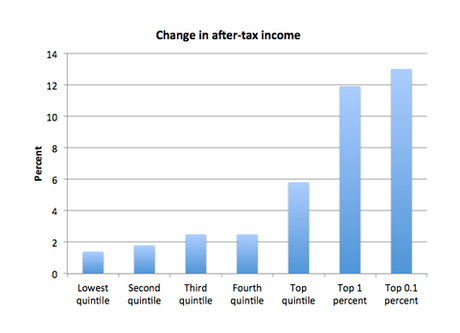

Jeb Bush is not going to be the Republican nominee, so it’s somewhat unfortunate that the invaluable Tax Policy Center chose to make his proposals the subject of its first analysis of candidate tax plans. Still, it’s useful, if only as an indicator of what passes for responsible, establishment policy in today’s GOP. Most of the headlines I’ve seen focus on the amazing price tag: $6.8 trillion of unfunded tax cuts in the first decade. Even deep voodoo isn’t enough to turn that number positive; so much for any notion that Republicans cared about fiscal responsibility. But it’s also important to realize the extent to which this is tax-cutting on the rich, by the rich, for the rich. Here’s the change in after-tax income resulting from the plan:

Huge benefits for the super-elite. And if you are tempted to say that the middle class gets at least some tax cut, remember that the budget hole would force sharp cuts in spending; and since the federal government is a giant insurance company with an army, this means sharp cuts in programs that benefit ordinary Americans, probably swamping any tax cuts. So, huge tax cuts that would massively increase debt, with the benefits going to the very highest-income Americans. And this is the “responsible”, moderate candidate.